Introduction:

In today’s volatile market environment, identifying stocks with the potential for exponential growth is paramount for investors seeking substantial returns.Moreover,the semiconductor industry, driven by technological innovation and strategic investments, offers fertile ground for such opportunities. In this blog post, we delve into 3 semiconductor companies poised to 5X your investment by 2030.

Follow us on Linkedin for everything around Semiconductors & AI

3 Lesser Known Semiconductor Stocks Which Can 5X Your Investment by 2030

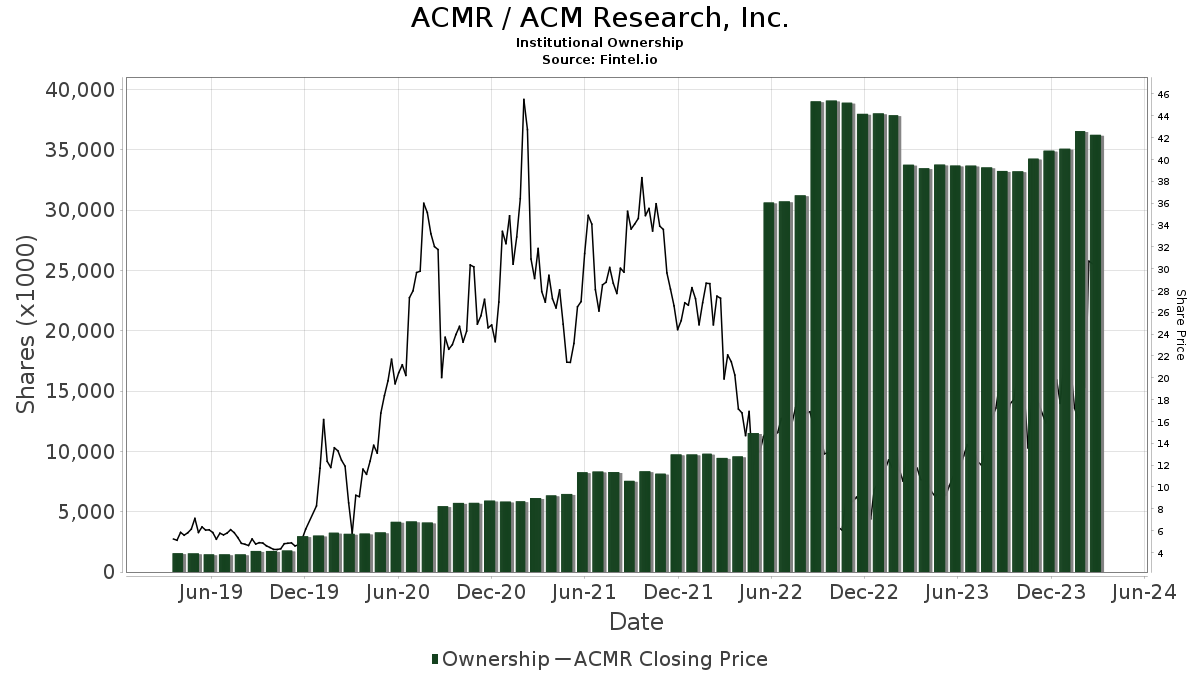

Semiconductor Stocks #1: ACM Research (ACMR):

ACM Research (ACMR) is a company that makes equipment used in the semiconductor industry . They specialize in wet processing technology, which is a type of cleaning system used in the manufacturing of computer chips. They target their products at companies that make integrated circuits (ICs) and other types of semiconductors.

The company’s tailored portfolio for the Chinese market has been instrumental in its impressive growth trajectory. ACM Research experienced a remarkable 43% growth rate in 2023, outpacing the overall mainland China wafer fab equipment (WFE) market.

Key to ACM Research’s success is its focus on providing high-quality products and superior service, solidifying relationships with clients and attracting new business opportunities. Additionally, the company’s commitment to continuous R&D ensures sustainable development and technological innovation, essential for long-term growth.

ACM Research aims to raise up to RMB 4.5 billion ($625 million) through a private offering. This reflects their commitment to fueling future growth by investing in R&D, capex, and working capital. They align with the growing semiconductor market in China and prioritize technological advancement, offering investors potential exponential returns.

Read More:How AMD MI300X is A Game-Changer in the AI Hardware Landscape – techovedas

Semiconductor Stocks #2:Navitas (NVTS):

Navitas is a global education provider that offers a wide range of educational services to students around the world . They operate through a network of colleges and campuses, partnering with universities, governments, and industry to help people achieve their educational goals

Navitas exhibits remarkable top-line growth and technological advancement efforts. In Q4 2023, the company experienced a significant 111% year-over-year revenue increase, showcasing rapid expansion and market penetration. Anticipating further growth, Navitas expects a 40% to 50% revenue increase in 2024, propelled by innovative products and widespread customer adoption.

A key driver of Navitas’s growth is its pioneering GaNSafe and Generation 3 Fast silicon carbide technologies, catering to the burgeoning demand for high-performance power semiconductors in electric vehicles, data centers, and renewable energy systems.

Additionally, Navitas’s GaN-based chargers address the growing need for fast and ultrafast charging solutions in the mobile industry, further solidifying its position as a leader in semiconductor innovation.

With a robust pipeline of advanced technologies and a focus on addressing evolving market demands, Navitas is well-positioned to capitalize on future growth opportunities and deliver substantial returns for investors.

Read More: Elon Musk Announces Open-Source Release of Grok – techovedas

Semiconductor Stocks #3: Photronics (PLAB)

Photronics (PLAB) is a leading manufacturer of photomasks, which are essentially high-precision stencils used in the creation of electronic components like semiconductors and flat panel displays

The company’s strong presence in the advanced Active-Matrix Organic Light-Emitting Diode (AMOLED) display market positions it for sustained growth in the coming years.

Photronics prioritizes organic growth through investments in high-end and mainstream IC segments, showcasing a commitment to innovation and market expansion. With a full-year capital expenditure guidance of $140 million, the company aims to boost future demand and technological capabilities, solidifying its competitive position.

Despite challenges such as increased operating expenses, Photronics maintains a solid operating margin, reflecting the efficiency of its operations. By prioritizing technological advancements and market expansion efforts, Photronics is poised to deliver significant value for investors in the semiconductor space.

Conclusion:

In conclusion, ACM Research, Navitas, and Photronics represent compelling investment opportunities in the semiconductor industry as stocks.

As always, investors should conduct thorough due diligence and consult with financial advisors before making investment decisions.