Introduction

Nvidia, known for its cutting-edge graphics processing units (GPUs) and AI technology, has made headlines by surpassing Apple in market value. This achievement underscores the growing importance of AI and semiconductor technology in the global market. With a valuation of $3 trillion, Nvidia’s rise is a testament to its strategic innovations and market adaptability.

In a landmark shift within the tech industry, Nvidia has overtaken Apple to become the world’s second most valuable company. Nvidia’s market valuation has soared to an impressive $3 trillion, fueled by its advancements in AI and graphics processing technology. This significant milestone reflects the evolving dynamics of the technology sector and Nvidia’s strategic positioning.

Background

Founded in 1993 by Jensen Huang, Chris Malachowsky, and Curtis Priem, Nvidia initially focused on developing graphics processing units (GPUs) for the gaming industry.

Over the years, the company has diversified its portfolio to include AI, data centers, and autonomous vehicles, transforming into a leader in high-performance computing. Nvidia’s ability to innovate and adapt has been a key driver of its success, culminating in its recent market valuation milestone.

Follow us on Linkedin for everything around Semiconductors & AI

1. Surging Demand for AI Technology

Nvidia’s advanced GPUs are at the heart of the AI revolution. These GPUs are essential for AI applications, machine learning, and high-performance computing. The company’s stock has skyrocketed by 147% in 2024, reflecting its critical role in the AI sector. Major tech firms like Microsoft, Meta Platforms, and Alphabet depend heavily on Nvidia’s GPUs to enhance their AI capabilities. This dependency underscores Nvidia’s pivotal position in the industry and has significantly boosted its market value.

Read More: 8 Companies Poised to Benefit Significantly from the AI Boom

2. Strategic Stock Split

Nvidia’s decision to implement a ten-for-one stock split on June 7 has played a crucial role in its recent stock surge.

By lowering the price of individual shares, Nvidia aims to attract a broader range of investors. This move is anticipated to drive increased trading volume and investment interest, as lower-priced shares are more accessible to individual investors.

The announcement of this stock split has already generated substantial market excitement, contributing to the recent spike in Nvidia’s stock price.

3. Strong Financial Performance

Nvidia’s financial performance has been nothing short of stellar. On May 22, the company issued an optimistic revenue forecast, predicting sustained high demand for its AI chips.

This announcement bolstered investor confidence, leading to a nearly 30% increase in Nvidia’s stock value in a short period.

The company’s ability to consistently exceed market expectations has cemented its reputation as a strong performer, further driving its market capitalization to record levels.

4. Visionary Leadership and Innovation

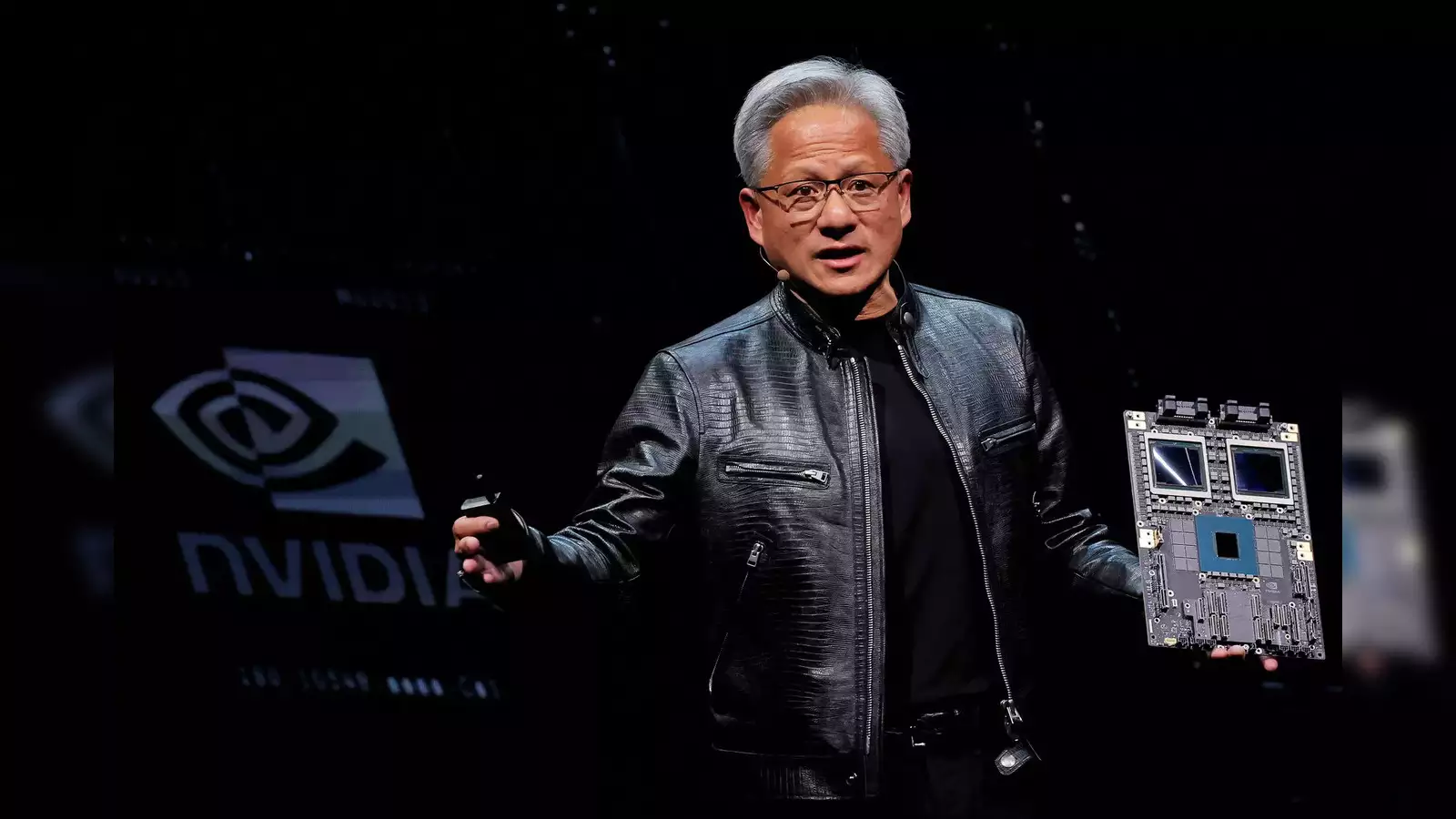

Under the leadership of CEO Jensen Huang, Nvidia has evolved from a company known primarily for gaming graphics cards to a leader in AI and data center technologies.

Huang’s strategic vision and commitment to innovation have been key to Nvidia’s growth. His recent appearance at the Computex tech trade fair in Taipei garnered significant media attention and highlighted his influence in the tech industry.

Nvidia’s continuous focus on innovation and its ability to adapt to emerging market trends have been instrumental in its success.

5. Apple’s Comparative Challenges

While Nvidia has been on the rise, Apple has faced a series of challenges that have hindered its growth. The tech giant is contending with declining demand for iPhones and intense competition in China, the world’s largest smartphone market. Local manufacturers like Huawei and Xiaomi are gaining ground, putting additional pressure on Apple. Moreover, some investors believe Apple is lagging behind other tech giants in integrating AI features into its products and services. These challenges have affected Apple’s market performance, allowing Nvidia to overtake it in market value.

6. Shifting Industry Dynamics

Nvidia’s ascension to the position of the world’s second most valuable company signals a significant shift in the tech industry. Since the launch of the iPhone in 2007, Apple has dominated the market. However, Nvidia’s recent performance underscores the growing importance of AI and semiconductor technology in the industry’s future. This shift reflects broader trends and the increasing significance of AI and machine learning technologies in driving tech innovation and growth.

Follow us on Twitter: https://x.com/TechoVedas

Conclusion

Nvidia achievement in surpassing Apple highlights the dynamic nature of the tech industry and the critical role of innovation. With its focus on AI and semiconductor technologies, Nvidia is poised to continue shaping the future of computing. As the industry evolves, Apple will need to address its challenges and adapt to maintain its competitive edge. Nvidia’s rise emphasizes the growing importance of AI technology and the pivotal role it plays in the tech sector’s ongoing transformation.