Introduction:

Apple Inc. has just released its financial results for the Q3 of 2023, and the tech giant continues to demonstrate its financial prowess.

Despite a few areas falling short of analysts’ expectations, Apple’s overall performance remained robust, with impressive figures in terms of revenue and earnings per share (EPS).

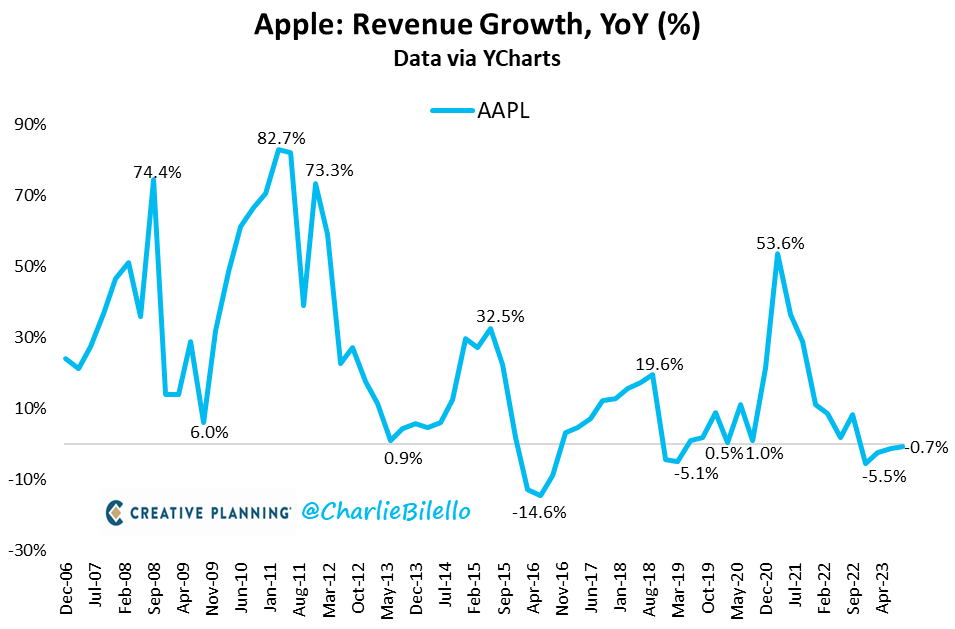

However, it’s important to note that this quarter marked the fourth consecutive quarter of negative year-over-year (YoY) revenue growth.

In this blog post, we’ll dive into the details of Apple’s Q3 2023 earnings report, examining key metrics and highlighting the company’s performance in different segments.

Apple Revenue Highlights for Q3 :

Total Revenue:

Apple reported quarterly revenue of $89.50 billion, representing a 0.7% decline over the same quarter last year. This marks the fourth consecutive quarter of negative YoY revenue growth.

However, it’s worth noting that this decline was relatively modest, and Apple’s overall financial health remains strong.

Image Credits: Charlie Bilello On X

Greater China Revenue:

One area of concern was Apple’s performance in Greater China, where revenue came in at $15.08 billion, falling short of the estimated $17.01 billion.

This decline may be attributed to various factors, including global economic uncertainties and increased competition in the region.

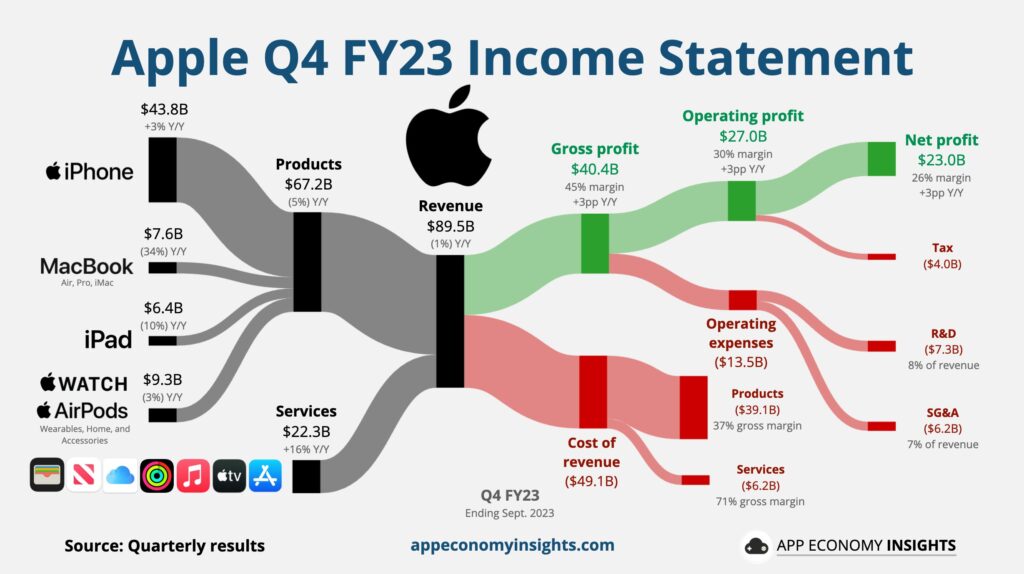

Services Revenue:

Apple’s services segment continues to be a growth driver, with revenue totaling $22.31 billion, exceeding the estimated $21.37 billion. This segment, which includes the App Store, Apple Music, and iCloud, saw impressive growth, reflecting Apple’s success in monetizing its vast user base.

Read More: What are the Top 5 Companies in Smartphone as per Q3 2023?

Apple Product Segment Performance for Q3:

iPhone Revenue:

Apple’s flagship product, the iPhone, generated $43.81 billion in revenue, slightly edging past the estimated $43.73 billion.

Despite increasing competition in the smartphone market, the iPhone remains a cornerstone of Apple’s success.

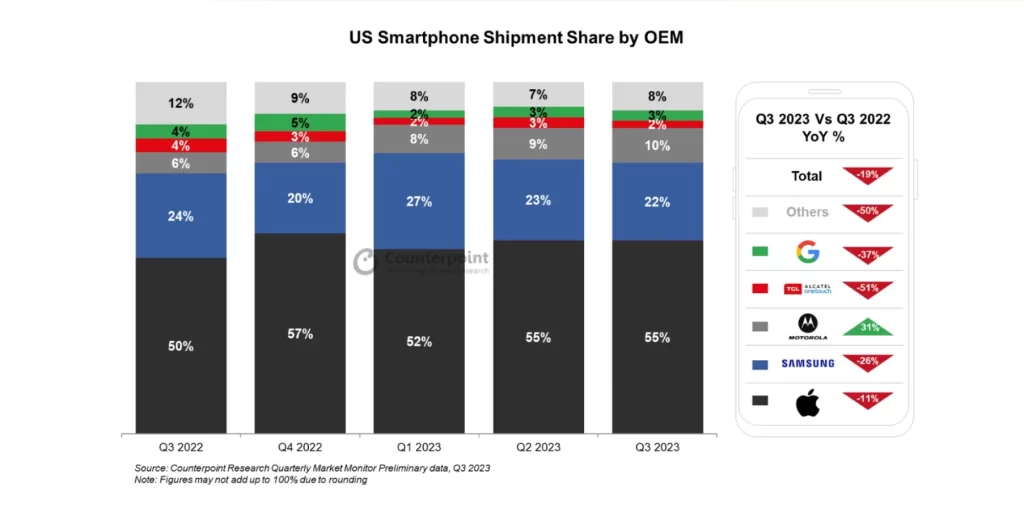

Image Credits: Counterpoint

According to Counterpoint Research, Apple experienced an 11% decrease in iPhone shipments in the United States during Q3 2023 compared to the previous year, despite its market share increasing from 50% to 55% year-over-year (YoY).

The primary reason cited by the publication for this decline is the delayed launch of the iPhone 15 series in comparison to the iPhone 14 series. This suggests the potential for improved results in Q4 2023.

In contrast to the previous year, where most of the iPhone 14 series was made available for sale on September 16, 2022, the iPhone 15 series was introduced on September 22, 2023.

The mere one-week difference in launch dates is believed to have contributed to the drop in shipments.

Notably, this delay was likely influenced by challenges Apple faced in manufacturing its previous phone models due to a COVID-19 outbreak and unrest in its largest Chinese factory.

Other Smartphone companies

Apart from Apple, several other smartphone manufacturers also witnessed a decline in their shipments in the U.S. during the last quarter. Samsung, Google, and TCL experienced substantial drops of 26%, 37%, and 51%, respectively, in their smartphone shipments.

On the flip side, Motorola managed to achieve a notable 31% increase in shipments compared to the previous year.

History of Apple’s iPhone revenue (Fiscal Year) with a column for the year-over-year (YOY) growth in the iPhone revenue:

| Fiscal Year | iPhone Revenue (in billions of USD) | YOY Growth (%) |

|---|---|---|

| 2006 | $0 | – |

| 2007 | $0.123 (Launched in Q3) | – |

| 2008 | $1.8 | 1,365% |

| 2009 | $13 | 622% |

| 2010 | $25.2 | 94.2% |

| 2011 | $46 | 82.1% |

| 2012 | $78.7 | 71.1% |

| 2013 | $91.3 | 15.9% |

| 2014 | $102 | 11.7% |

| 2015 | $155 | 51.9% |

| 2016 | $136.7 | -11.8% |

| 2017 | $139.3 | 1.9% |

| 2018 | $164.9 | 18.4% |

| 2019 | $142.4 | -13.6% |

| 2020 | $137.8 | -3.2% |

| 2021 | $192 | 39.4% |

| 2022 | $205.5 | 7% |

| 2023 | $200.6 | -2.4% |

Read More: iPhone 15 Sales in China Fall 6%! Apple Loses Ground to Huawei

iPad Revenue:

The iPad segment demonstrated solid performance, with revenue reaching $6.44 billion, exceeding the estimated $6.12 billion.

Apple’s continued innovation in this product category, including the iPad Pro and iPad Air, has sustained consumer interest.

Read More: BMW Wireless Charger Can Destroy iPhone 15 NFC Chip, Apple Confirms

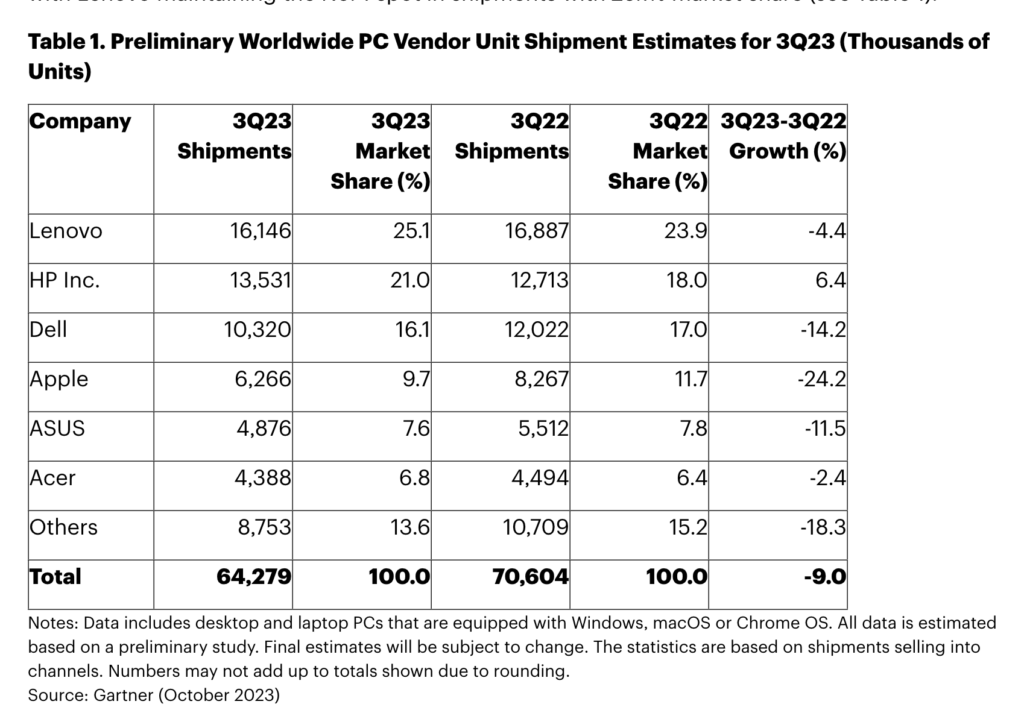

Mac Revenue:

Mac revenue was $7.61 billion, falling short of the estimated $8.76 billion. Supply chain challenges and chip shortages might have contributed to this dip in revenue, but Apple remains optimistic about its Mac product line.

This probably explains the M3 Release a few days ago.

Read More: Apple Announces M3 Chips: The Biggest Upgrade to the Mac Since M1

Wearables, Home & Accessories:

This segment, which includes products like the Apple Watch and AirPods, generated $9.32 billion in revenue, just slightly below the estimated $9.41 billion.

The wearables category remains a growth driver, with Apple dominating the market.

| Product Segment | Revenue (in billions) | Estimated Revenue (in billions) | Performance |

|---|---|---|---|

| iPhone | $43.81 | $43.73 | Exceeded |

| iPad | $6.44 | $6.12 | Exceeded |

| Mac | $7.61 | $8.76 | Below |

| Wearables, Home & Accessories | $9.32 | $9.41 | Slightly Below |

Read More: Apple TSMC Controversy Erupts with iPhone 15 Overheating

Image Credits: App economy Insights

Conclusion:

Apple’s Q3 2023 earnings report showcases the company’s remarkable ability to generate consistent revenue and profitability.

While some segments, like Greater China and Mac, faced challenges in meeting analysts’ expectations, the overall picture remains positive.

It’s important to note that this quarter marked the fourth consecutive quarter of negative YoY revenue growth, with a 0.7% decline over the previous year.

The strength of the iPhone, the continued growth of the services and wearables segments, and a 10.8% year-over-year increase in net income to $23 billion demonstrate Apple’s diversified revenue streams and its resilience in a competitive market.