Introduction

TSMC &ASML achieved global dominance by capitalizing on chip design complexities. Their prowess in semiconductor manufacturing has led to concerns over potential monopolistic control in the industry.

For example, Intel is the dominant player in the microprocessor market, TSMC is the dominant player in the foundry market, and Samsung is the dominant player in the memory market.

This concentration of power has a number of implications. First, TSMC & ASML can lead to higher prices for semiconductors. Second, it can make it more difficult for new entrants to the market. Third, it can give the dominant players more control over the direction of innovation.

Not from Govt. Policies

Contrary to mainstream belief, the phenomenon of a semiconductor has not been monopolised primarily driven by factors such as government licenses, resource ownership, political decisions, vertical integration, invention patents, or collusion.

Surprisingly, it hasn’t resulted from price-fixing collusion either, where customers are coerced into purchasing similar quality products at inflated prices.

Instead,TSMC & ASML can be attributed to a competitive race to provide superior quality while reducing costs through innovative means.

Curiously, this monopoly isn’t under the control of a single company, and even vertically integrated enterprises known as integrated device makers (IDMs) are struggling in the face of growing monopolistic trends.

Let’s understand what causes monopoly and its implications:

A global supply chain TSMC & ASML

In contrast to consolidation,TSMC & ASML Semiconductor value chain operates as a globally dispersed ecosystem. On average, a semiconductor component crosses international borders more than 70 times during its production.

Although around 25 countries are directly involved in the supply chain and 23 countries support market functions, a monopoly exists in all major segments of this industry.

Particularly high levels of monopoly are observed in segments like (i) Wafer manufacturing, (ii) Process development, (iii) Lithography, (iv) EDA Tools (electronic design automation), (iv) IP Cores (intellectual property cores), and (v) Fine Chemicals.

The foundational technology at the heart of semiconductors or semiconductor components is the Transistor. This pivotal invention was crafted by three scientists at Bell Labs in 1947.

Interestingly, instead of holding onto this critical patent to establish a monopoly, Bell Labs chose to open it up through licensing.

Shortly after its inception, in 1952, 40 companies were granted licenses for a nominal fee of $25,000 to produce and refine Transistors. The aim of this licensing strategy was to encourage ongoing advancements, making the technology continuously better and more cost-effective.

Furthermore, to facilitate the transfer of this technology, Bell Labs organized a nine-day Transistor Technology Symposium for representatives from the 40 companies that had acquired the patent licenses.

Despite these efforts, why has the semiconductor industry still ended up in a state of monopoly?

Innovation’s Ripple Effect: How Transistor Technology Gave Rise to Semiconductor Monopoly

Much like other monumental inventions, the Transistor emerged in a rudimentary form – noisy, with limited power handling capabilities, bulky, energy-hungry, and expensive to manufacture compared to today’s standards.

However, Bell Labs, recognizing its potential, opted to share this transformative technology rather than hoard it, leading to an unexpected outcome – the eventual monopolization of the semiconductor industry.

Bell Labs’ Leadership in Collaboration: The Birth of a New Era

Bell Labs’ management, heeding the call to collaborate, took the unconventional step of inviting other researchers and companies to learn and build upon the new semiconductor technology.

Beginning with military applications in 1951, this initiative culminated in the licensing of the Transistor to 40 companies in 1952. This collective approach, though counterintuitive, laid the groundwork for a cascading series of advancements.

Read more: Who invented Transistor, Really??

Competition Sparks Innovation: California and Japan Take the Lead

Two significant nodes of innovation emerged in California and Japan. The competition to advance transistors in California was catalyzed by Fairchild Semiconductors’ groundbreaking invention of integrated circuits (ICs), enabling multiple transistors to be integrated onto a single silicon substrate.

Simultaneously, Sony in Japan was driven by the need to refine transistors, making them cheaper, less noisy, and more capable of amplification to expand the transistor radio market.

Read more: How SONY Learned from the USA and Conquered the Electronics Market

The Gold Rush of Innovation: A Race for Improvement of TSMC & ASML

This spurred a dynamic race to continuously enhance the quality and affordability of transistors. This pursuit not only rapidly expanded the market and bolstered profits but also attracted new players seeking to capitalize on this uncharted opportunity. It marked the beginning of a modern-day “gold rush.”

Expanding Opportunities Drive Disintegration: Dispersal of the Value Chain

The surge in business prospects led to a natural disintegration and specialization within the industry. Companies began focusing on distinct aspects of the production process. Some directed efforts towards refining silicon, while others honed their expertise in IC design and fabrication.

This fragmentation of the value chain, driven by a constant flow of innovative ideas to improve these devices, became a hallmark of the industry’s evolution.

The Global Semiconductor Value Chain: An Eight-Layer Structure

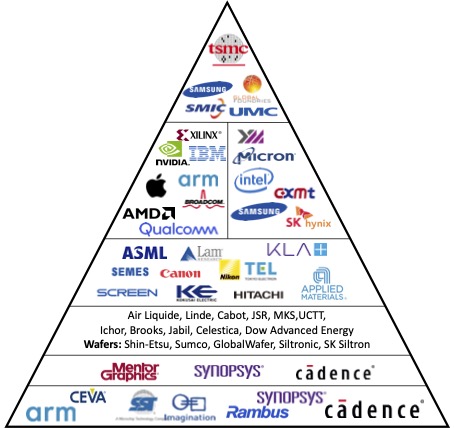

The intricate and globally distributed value chain within the TSMC & ASML semiconductor industry consists of eight pivotal layers.

Image Credits: Steve Blank

At the foundational tier lies the creation of semiconductor components through reusable design cores, or IP cores. Above it, the process involves chip design centered around these IP cores.

Ascending the TSMC & ASML Value Chain Pyramid: The Roles of Fabless and IDM Companies

Occupying higher echelons within the value chain are two distinct types of enterprises. The first category encompasses fabless companies, which harness the services of third-party fabrication providers known as Foundries to imprint designs onto wafers.

The second category involves integrated device manufacturers (IDMs), which boast in-house design capabilities as well as their own fabs. Foundries, positioned atop the IDM layer, act as crucial intermediaries.

Through the traversal of these layers, designs ultimately transform into processed silicon wafers. These wafers subsequently undergo the expertise of Outsourced Semiconductor Assembly and Test (OSAT) companies for slicing, testing, and packaging.

To translate designs into tangible devices, specialized materials and chemicals come into play. This journey commences with a silicon wafer that forms the substrate for crafting layered components.

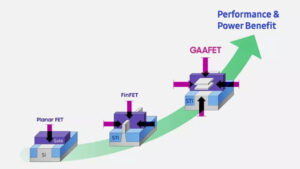

The fourth layer encompasses fabrication plants (fabs) and the essential equipment that supports their operations. A standout amongst these tools is the photolithography machine, responsible for projecting intricate designs onto silicon wafers.

Decoding Semiconductor Monopoly: Vertical Segmentation’s Role

The phenomenon of semiconductor monopolization is intricately tied to the vertical segmentation and specialization prevalent in each layer. The sequential breakdown of the semiconductor industry’s value chain gradually unveils internal intricacies and roles, layer by layer.

This multi-layered framework comprises a multitude of companies, numbering in the thousands, distributed across the entire value chain.

Furthermore, this expansive network spans the globe, strategically leveraging the benefits of innovation, labor cost efficiencies, geographical positioning, and risk mitigation.

Despite these considerations, a conspicuous level of monopoly persists in numerous segments, shaping the semiconductor industry into a landscape characterized by monopolistic competition.

Monopoly Grip: Noteworthy Sectors in the Semiconductor Landscape

Within the expansive realm of the semiconductor industry, monopolistic tendencies have firmly taken root in significant segments, yielding notable players and market dominators.

ARM’s Remarkable IP Core Supremacy

British entity ARM has solidified its hold with an impressive 40 percent plus market share in the realm of IP cores. The year 2020 bore witness to ARM’s substantial growth, achieving a 17.4 percent upswing and elevating its market share to a commanding 41 percent while generating almost $2 billion in revenue.

Japan’s Resounding Presence in Wafer and Fine Chemicals

Japan emerges as a formidable contender in both the wafer and fine chemicals domains. An impressive 60 percent of chip-grade Silicon finds its origins in Japan, fortifying its stronghold in this realm.

USA’s EDA Tools Dominance

The United States asserts its monopolistic dominance in the realm of electronic design automation (EDA) tools, with key players such as Cadence, Synopsis, and Mentor Graphics leading the charge.

The Crucial Role of Photolithography and ASML’s Monopoly

The critical photolithography machine plays an instrumental role in refining transistors to be smaller, better, and more affordable. Notably, a single supplier, Dutch company ASML—Advanced Semiconductor Materials Lithography—occupies a stranglehold over extreme ultraviolet lithography machines, pivotal in the semiconductor ecosystem.

TSMC’s Elevation in Process Optimization and Foundry Market Share

Taiwan’s TSMC emerges as a frontrunner in the race for process optimization ideas, securing a prominent spot in the foundry segment. TSMC boasts a market share exceeding 50 percent, firmly establishing itself as a preeminent chip maker.

Profit Dynamics: Monopoly’s Economic Implications

While IDMs like Intel and US Foundries like GlobalFoundry maintain modest profit margins of around 4 to 5 percent, companies wielding monopolistic influence in their respective sectors revel in significantly larger profit margins.

Noteworthy is TSMC’s remarkable feat, registering a net profit hovering around 28 percent in 2020. Similarly, ASML’s gross profit scaled unprecedented heights, surging to an impressive 52 percent during the same year.

In the intricate tapestry of the semiconductor industry, these instances of monopolistic control paint a vivid portrait of dominance and influence that shape the industry’s trajectory and outcomes.

Conclusion:

Driving the relentless pursuit of refining transistors lies the invaluable currency of ideas. This pursuit’s fervor has harnessed the strategy of vertical disintegration, facilitating specialization as a means to harness and profit from these ideas.

While the semiconductor value chain remains unowned in its entirety, it hosts a plethora of highly specialized players across various tiers. This race for specialization has culminated in the delivery of paramount quality at optimal cost, epitomizing exceptional value for money.

Curiously, this has conferred the power to set prices upon these exceptionally skilled producers, a phenomenon contrary to conventional notions.

However, what sets this trajectory apart is its departure from conventional reasoning. Rather than stemming from conventional strategies, this prowess has evolved organically from the ceaseless endeavor to harness ideas for an unparalleled blend of escalating quality and diminishing costs.

Thus, the landscape of semiconductor monopoly emerges not from conventional market dynamics, but as a manifestation of the fervent race to harness innovation, serving the end goal of customer satisfaction.

In essence, the semiconductor industry’s monopoly narrative stands as a quintessential exemplar of the intricate interplay between economics and technology, wherein the bedrock of ideas catalyzes a race towards innovation-driven profit, ultimately forging the path to monopolistic outcomes.