Introduction:

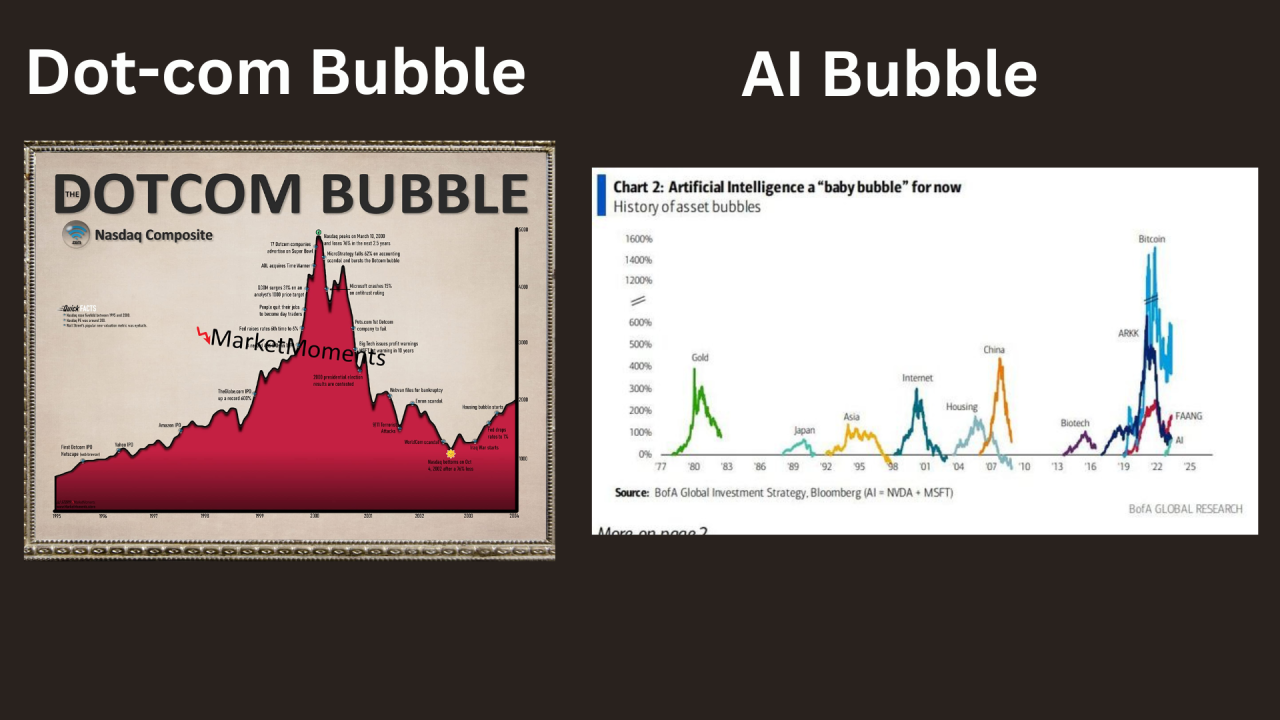

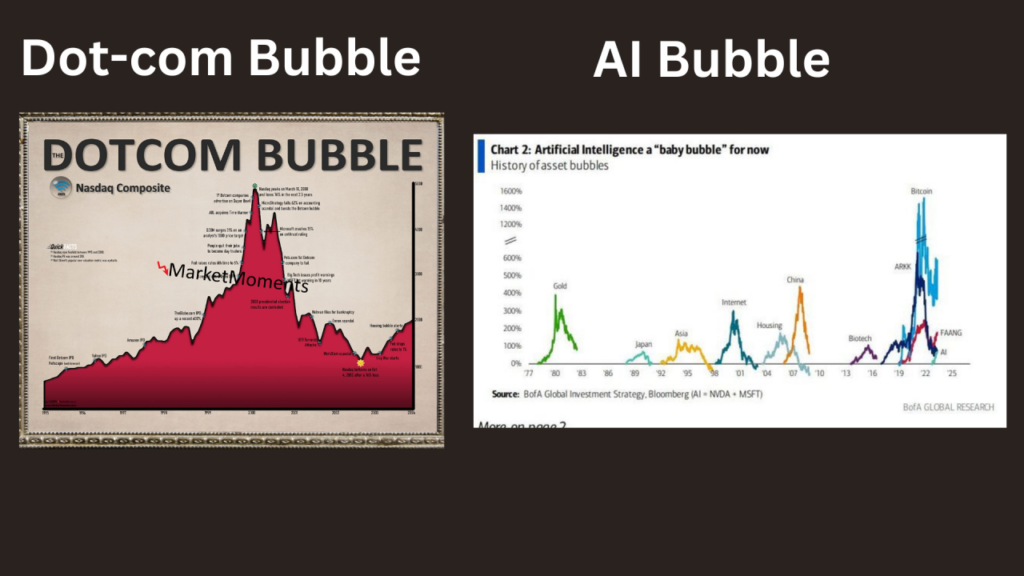

The comparison between the AI era and the Dot-com boom is multifaceted. Both periods are characterized by rapid innovation and an atmosphere of heightened excitement surrounding transformative technologies poised to revolutionize various industries.

This exuberance often leads to speculation akin to a contemporary “gold rush,” fueled by the promise of significant returns. Additionally, similarities emerge in the realm of uncertainty, where some AI startups, like their early internet counterparts, grapple with unproven business models and unclear paths to profitability.

Despite these challenges, investors remain drawn to the potential of AI, often placing bets on future prospects rather than existing revenue streams.

This emphasis on investment trends over foundational business principles reflects a broader tendency in both eras to prioritize innovation and potential over established fundamentals.

However, there are also key differences between the two eras:

Maturity of Technology: AI has already demonstrably improved various industries, unlike many Dot-com companies whose ideas were more theoretical.

Role of Established Players: Tech giants like Google and Amazon are leading the charge in AI, providing a level of stability and resources absent in the Dot-com era.

Funding Sources: Today’s AI boom relies less on risky public offerings and more on private investments and partnerships, potentially mitigating some of the financial bubbles seen in the Dot-com era.

Overall, the AI era shares some characteristics with the Dot-com boom, but the underlying dynamics are different. AI technology has more tangible applications, and the involvement of established players suggests a potentially more sustainable trajectory.

Follow us on LinkedIn for everything around Semiconductors & AI

Similarities with the Dot-com Era:

1. Mass Adoption Amid Infancy:

The current AI boom mirrors the Dot-com era’s mass adoption of transformative technologies during their nascent stages, fostering a gold-rush mentality and driving substantial investment.

Gen-AI has experienced widespread adoption but is still in its early stages, reminiscent of the emergence of email, search, e-commerce, and streaming in the past. This trend has sparked a fervent rush for investment and lofty predictions about the future, accompanied by a euphoric atmosphere among investors. Novel applications and services that generate considerable excitement are frequently entering the market.

Example: Self-driving car companies like Waymo receiving significant investments despite the technology being in its early stages and facing regulatory hurdles. This is similar to how many e-commerce startups gained traction in the late 90s before fully developed online shopping infrastructure existed.

2. Cycle of Hype:

The emergence of new AI applications and services perpetuates a cycle of hype, akin to the frenzy witnessed during the Dot-com era, fueling investor enthusiasm and exuberant forecasts.

Venture capitalists are heavily investing in startups, acknowledging that a significant percentage may not achieve success. AI model startups could play a similar role in the Gen-AI boom as e-commerce startups did in the Dot-com era.

The surge in spending coincides with a period of heightened interest rates, raising concerns about tighter financial conditions and macroeconomic pressures potentially dampening enthusiasm.

Example: A new AI-powered chat application explodes in popularity due to its ability to generate human-quality text, leading to inflated valuations based on potential future growth, similar to how many “.com” companies saw stock prices soar on speculative bets.pen_spark

3. Uncertainty in Identifying Industry Leaders:

In 1999/2000, numerous publicly-traded search companies commanded significant valuations, yet none attained the stature of $GOOG, which was privately held and in its nascent stages. Similarly, startups like $NFLX, $PYPL, and $MELI were emerging, while $META, $UBER, and $ABNB had yet to come into existence. Interestingly, during this period, $EBAY enjoyed a period where it surpassed $AMZN in both worth and profitability.

Example: Several AI startups(OpenAI leading) focusing on facial recognition vying for dominance, with no clear frontrunner yet established, mirroring the early days of internet search engines where companies like AltaVista and Lycos competed with the then-unknown Google.

4. Mismatch Between Revenue and Capex:

The disparity between revenue gains and capex spending, coupled with the influx of venture capital into AI startups, echoes the dynamics of the Dot-com bubble. Currently, Gen-AI revenue and productivity gains represent only a small fraction of the total capital expenditure. This mirrors the scenario during the Dot-com era when telco and startup Internet revenue constituted a minor portion of hardware expenditure.

Example: A young AI company focused on developing a healthcare diagnosis tool secures a massive round of funding despite having no current product or revenue stream, reminiscent of how many dot-com startups burned through venture capital without generating profits.

5. Enterprise Spending Without Clear ROI:

Enterprises, caught in the fervor of AI adoption, allocate funds to AI initiatives without a clear strategy for achieving a return on investment, reminiscent of the Dot-com era’s spending spree. The most challenging Gen-AI workloads are not yet economically viable for widespread consumer adoption, analogous to the quality streaming video and large-scale cloud storage challenges faced in the late 1990s and early 2000s.

Some enterprises are allocating funds to Gen-AI projects due to its current popularity, despite lacking a clear strategy for achieving a strong return on investment. This could result in budget cuts once initial projects conclude and executives scrutinize ROI.

Example: A large bank invests heavily in an AI platform for customer service automation without a well-defined strategy for measuring the return on investment, much like how some companies in the Dot-com era spent excessively on building websites with unclear goals for generating business value.

Read More: What Does Mark Zuckerberg Think about AI: 9 Key Takeaways You Should Know – techovedas

Differences from the Dot-com Era:

1. Dominance of Tech Giants:

A significant portion of Gen-AI investment is led by financially robust tech giants accustomed to undertaking billion-dollar losses annually for strategic initiatives, contingent upon perceiving long-term benefits.

These giants are unlikely to drastically reduce investment unless AI advancements disappoint or macroeconomic pressures compel them to do so, especially if they observe their counterparts maintaining aggressive investment strategies.

Additionally, many profitable tech firms, including ISVs, consumer Internet companies, and hardware OEMs, view Gen-AI as a strategic imperative and are unlikely to scale back spending unless they believe it would disadvantage them relative to competitors.

Example: Google investing heavily in AI research and development, creating products like LaMDA and DeepMind, which push the boundaries of language processing and artificial intelligence. This is a stark contrast to the Dot-com era where many startups lacked the resources and infrastructure of established players.

2. Financing Landscape:

Unlike the Dot-com era, where a substantial portion of investment was fueled by debt-financed telcos that subsequently faced insolvency, today’s Gen-AI investment landscape relies less on debt financing and more on venture capital funding.

The prevalence of dubious financing in public equity markets during the Dot-com era contrasts with the current environment, where such practices are less common, at least for the time being.

Example: Companies like OpenAI utilizing a combination of private investment and research partnerships with Microsoft, avoiding the need for risky public offerings like the common practice during the Dot-com bubble.pen_spark

3. Technological Constraints:

While chip and component shortages, along with other constraints like power and rack space, present risks of hoarding and double-ordering, they also mitigate the likelihood of a sudden demand downturn, provided companies remain eager to invest in Gen-AI in the coming years.

Example: The need for massive computing power for training complex AI models leading to a global shortage of specialized chips, impacting the pace of development for some AI companies. This is a constraint that wasn’t as prevalent during the Dot-com era.

4. Expansion of Spending Vectors:

The scope for spending growth extends beyond the tech sector, encompassing areas such as automated customer support, content creation, robotics, military R&D, and disease detection and drug discovery.

Example: Retail companies investing in AI-powered chatbots for automated customer service, providing 24/7 support and personalized experiences – a concept not widely explored during the Dot-com era.

5. Improved Distribution Channels:

Unlike the Dot-com era’s distribution bottlenecks, the current AI landscape benefits from improved broadband and mobile data penetration, facilitating widespread adoption.

Example: AI-powered language translation apps being readily available on smartphones due to high-speed mobile data networks, allowing for real-time communication across language barriers. This widespread accessibility wasn’t possible during the dial-up era of the Dot-com bubble.pen_spark

Furthermore, valuations for Gen-AI investment opportunities are comparatively rational, with triple-digit P/E ratios, prevalent in the Dot-com era, being less common.

Read More: 5 Most Useful and Important High-End Graphics Cards – techovedas

Conclusion:

In navigating the complexities of the AI capex boom, stakeholders must draw insights from historical precedents while remaining attuned to evolving dynamics. While acknowledging diverging viewpoints, the author aligns tactically with the bullish camp, advocating for continued engagement in the AI wave. However, vigilance and strategic foresight are paramount, ensuring prudent decision-making amidst the exuberance of AI investment.