Introduction

PCBs are thin boards containing electronic circuits that form the backbone of many electronic devices. From smartphones to laptops to medical equipment, PCBs are crucial components.

From smartphones to automotive systems, PCBs play a vital role in modern technology. Understanding the significance of PCBs underscores the importance of recent developments in the European market.

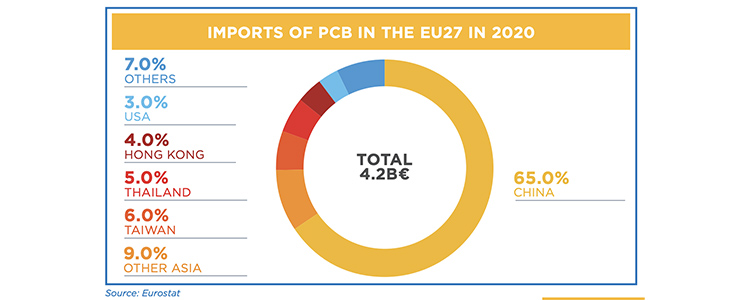

With 65% of Europe’s PCB imports coming from China, it indicates China is the primary supplier for Europe in this sector. This dominance could be due to factors like cost-effectiveness, established supply chains, or expertise in PCB manufacturing.

Follow us on Linkedin for everything around Semiconductors & AI

Why are PCBs Important?

PCBs (Printed Circuit Boards) are essential components in modern electronics for a few key reasons:

Miniaturization and Organization: They allow for complex electronic circuits to be miniaturized and organized efficiently. Instead of bulky wires connecting components all over a device, PCBs provide a flat platform with etched copper tracks that act as pathways for electrical signals. This miniaturization is crucial for making compact and portable devices like smartphones and laptops.

Reliability and Performance: PCBs offer a more reliable and higher-performing way to connect electronic components compared to traditional point-to-point wiring with wires and soldering. They’re less prone to errors in assembly and provide a more consistent electrical connection.

Mass Production: Mass production techniques are well-suited for PCBs. Manufacturers can produce them with precise specifications and consistent quality, which is necessary for efficiently creating large quantities of electronic devices.

Versatility: PCBs can be designed in various shapes, sizes, and layer configurations to accommodate the specific needs of a device. This allows for a high degree of customization depending on the functionality required.

Protection: The PCB itself serves as a physical base that holds electronic components together and protects them from physical damage, dust, and other environmental factors.

In simpler terms, PCBs are like the central nervous system of electronic devices. They enable all the different electronic parts to communicate and function together, making them fundamental building blocks for the vast array of electronic devices we rely on today.

Background

The global PCB industry has undergone significant transformations in recent years, driven by technological advancements, changing consumer preferences, and geopolitical dynamics.

China has emerged as a manufacturing powerhouse, leveraging its vast resources and infrastructure to dominate various sectors, including electronics manufacturing.

The EU only accounts for 2.3% of global PCB production and 11.5% of electronic assembly. Revitalizing and growing these segments is essential to building a robust European electronics manufacturing ecosystem to ensure industrial resiliency, advance the twin transitions, and promote European innovation,” the IPC writes in a recent report on EU industrial policy.

Read More: What is a Data Center And Why It’s Considered Backbone of 21st Century Digital Age – techovedas

Market Size and Growth:

According to The Observatory of Economic Complexity (OEC), China was the world’s leading exporter of PCBs in 2022, with a total value of $26 billion.

The global PCB market is expected to reach $85.4 billion by 2028, with a Compound Annual Growth Rate (CAGR) of 3.44%. This indicates a steady rise in demand for PCBs.

Reasons for China’s Dominance:

Cost-competitiveness: China has traditionally offered lower production costs due to factors like labor costs and economies of scale.

Established Infrastructure: China has a well-developed PCB manufacturing ecosystem with numerous factories and skilled workers.

Government Support: The Chinese government has provided significant support to the electronics industry, which may have fueled PCB production growth.

European Purchasing Managers’ Indices (PMI)

Despite global uncertainties, European Purchasing Managers’ Indices (PMI) have shown resilience, indicating steady growth in manufacturing activities.

This suggests a robust demand for electronic components, including PCBs, within the European market. The PMI serves as a reliable indicator of economic health and provides insights into the manufacturing sector’s performance.

Read More: What are 6 Types of Data Center: Difference & Similarities – techoveda

Market Trends

One of the prominent trends in the European PCB market is the growing demand for high-density interconnect (HDI) boards.

HDI boards offer greater circuit density, enabling smaller and more efficient electronic devices.

This trend aligns with the consumer preference for compact and portable gadgets. Additionally, there is a growing emphasis on sustainability and environmental compliance.

European regulations regarding hazardous substances in electronics are prompting manufacturers to adopt eco-friendly practices and materials in PCB production.

China’s Dominance

China’s dominance in the European PCB market can be attributed to several factors, including cost competitiveness, manufacturing capabilities, and established supply chains.

Chinese manufacturers benefit from economies of scale, allowing them to offer competitive pricing compared to their European counterparts.

| Market Players | Market Share |

|---|---|

| China | 65% |

| Europe (excluding China) | 35% |

Moreover, China’s robust infrastructure and skilled workforce enable efficient production and timely delivery of PCBs to European buyers.

This reliability has solidified China’s position as the primary source of PCB imports for European companies.

Challenges to China’s Dominance:

Trade Tensions: The ongoing trade war between the US and China, and potential friction with Europe, could disrupt supply chains and lead to import restrictions.

Rising Labor Costs: While still lower than many developed economies, China’s labor costs have been rising in recent years, potentially eroding its cost advantage.

Shifting Priorities: China might be focusing on developing more advanced technologies, potentially leading to less emphasis on basic PCB production.

Europe’s Response:

Diversification: European countries might be looking to diversify their PCB suppliers by investing in domestic production or sourcing from Southeast Asian countries like Vietnam.

Focus on High-Tech PCBs: Europe might shift its focus to importing high-end, complex PCBs where China may not have such a strong presence.

Government Initiatives: European governments could introduce policies to incentivize domestic PCB production and reduce reliance on China.

Overall, China’s dominance in PCB exports to Europe faces potential challenges. While they still hold a significant market share, Europe might be taking steps to diversify its supply chain and potentially develop its own PCB manufacturing capabilities.

Read More: 49% Growth: Huawei HiSilicon’s Kirin SoCs Surpasses Google in Revenue in Q1Y24 – techovedas