Introduction:

Canon Inc., a Tokyo-based powerhouse, has set its sights on reshaping the semiconductor manufacturing landscape with its cutting-edge nanoimprint semiconductor manufacturing systems.

In this blog post, we will delve into the intricacies of Canon’s groundbreaking chipmaking machines and the potential they hold to redefine the competitive semiconductor industry.

1. Nanoimprint Lithography: A Technological Marvel

Canon’s chipmaking machines employ nanoimprint lithography, allowing the production of circuits at an impressive 5-nanometer scale when utilizing extreme ultraviolet lithography (EUV). This breakthrough puts Canon in direct competition with industry leader ASML Holding NV. With aspirations to achieve next-generation 2nm production, Canon’s technology represents a leap forward in semiconductor manufacturing capabilities.

Canon Inc. has initiated the sale of its nanoimprint semiconductor manufacturing systems, strategically positioning this technology as a simpler and more accessible option compared to the current state-of-the-art tools.

These new chipmaking machines, based in Tokyo, are capable of generating circuits at a 5-nanometer scale when utilizing extreme ultraviolet lithography (EUV), a domain currently dominated by industry leader ASML Holding NV.

Canon envisions advancing this technology to achieve next-generation 2nm production through continuous enhancements and innovations, as stated in a recent announcement.

While trailing behind ASML in the EUV sector, Canon, much like its domestic counterpart Nikon Corp., sees promise in its nanoimprint lithography approach to narrow the competitive disparity.

Read More: China to Challenge ASML with a better technology than EUV

NanoImprint Vs EUV Lithography

Manufacturers employ nanoimprint lithography (NIL) as a nanolithography technique in producing semiconductors and other nano-scale devices. In this process, a mold physically presses into a material, usually a polymer, on a substrate (such as a silicon wafer) to replicate the pattern from the mold onto the substrate, forming desired patterns at the nanoscale.

Let’s break down how NIL operates:

- Creating the Mold: First, a mold with the desired nanoscale pattern is created. Typically, this mold is produced using traditional lithography or other methods to craft a master template.

- Coating the Substrate: Next, a thin layer of a polymer or another imprintable material is coated onto the substrate, which will carry the final pattern.

- Initiating the Imprint Process: The mold is then pressed into the coated substrate, causing the material to conform to the surface of the mold and create the intended pattern on the material.

- Curing and Mold Removal: Subsequently, the material is cured or hardened. Following this, the mold is removed, leaving behind the patterned material on the substrate.

Now, let’s compare this with EUV lithography:

Extreme Ultraviolet Lithography (EUV):

In semiconductor manufacturing, the most advanced nanolithography technique is EUV Lithography. It uses extremely short wavelengths of light in the extreme ultraviolet range to create patterns on a substrate. Unlike NIL, EUV lithography doesn’t involve physical contact or pressing a mold onto the substrate. Instead, it uses light (EUV) to project the pattern onto the substrate.

Here are the key differences:

- Method: NIL involves physical contact with a mold to create patterns, whereas EUV lithography uses light (EUV) to project the pattern onto the substrate without direct contact.

- Resolution and Precision: EUV lithography typically achieves higher resolution and precision due to the extremely short wavelengths of EUV light, allowing for smaller features and intricate patterns.

- Throughput and Speed: EUV lithography is generally faster and more efficient for high-volume production, making it suitable for mass manufacturing of modern semiconductor devices.

In summary, NIL relies on physical molding to create patterns, while EUV lithography utilizes light for patterning, resulting in different capabilities and applications, with EUV often favored for high-volume, high-precision semiconductor manufacturing.

Image Credits: PSI

2. Navigating Trade Wars and Market Dynamics

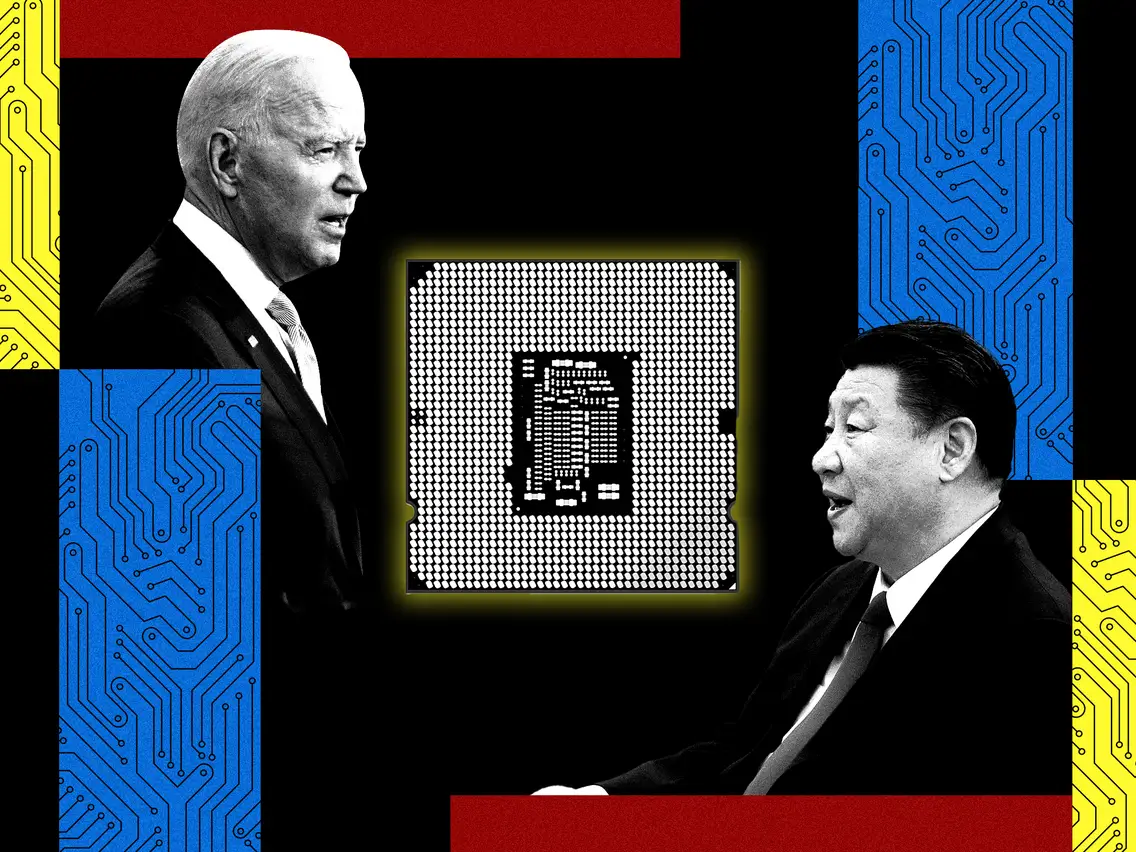

Moreover, Canon’s semiconductor manufacturing technology holds the potential to play a crucial role in the ongoing US-China trade conflict. The USA restricts the import of EUV machines, which are currently the primary and reliable means for producing 5nm chips and smaller, into China due to trade sanctions.

Canon’s Japanese innovation, which circumvents photolithography and directly imprints the desired circuit pattern onto the silicon wafer, offers a novel approach. Its unique nature makes it less likely for the existing trade restrictions to explicitly prohibit it, potentially opening up new dimensions in the dynamics of the trade war.

Recently, China caused a stir by manufacturing Huawei Phones despite the ban on Lithography tools. Huawei employed a range of strategies to procure components for the P60, including purchasing components from third-party suppliers, designing its own components, and utilizing stockpiled components.

Read more: How China is Penetrating US Sanctions to Achieve Chip Self-Reliance

3. Addressing Challenges: A Path to Perfection

Nanoimprint lithography has long held the promise of offering a cost-effective alternative to optical lithography. Past advocates of this technology include memory giants SK Hynix Inc. and Toshiba Corp. The former memory division of Toshiba, now Kioxia Holdings Corp., even conducted testing of Canon’s nanoimprint machines before they reached commercial maturity. However, Canon now faces the critical task of demonstrating that it has successfully tackled historical challenges such as high defect rates that had hindered previous attempts.

On the other hand, ASML, Europe’s most valuable tech company, has been on a remarkable growth trajectory, experiencing five consecutive quarters of revenue growth and a surge in orders. Based in Veldhoven, ASML stands as the go-to supplier of extreme ultraviolet (EUV) technology for the world’s leading chipmakers. The company anticipates a substantial 30% increase in net sales for the current year, underscoring its dominant position in the industry.

In the realm of market dynamics, Canon’s shares have witnessed a commendable 26% gain over the year. The broader rally in Japanese stocks and the heightened demand for chipmaking equipment, driven by advancements in artificial intelligence applications, are attributing to this surge.

Read More: 7 ways Huawei is Impacting US-China Tech war?

4. Strategic Acquisitions and Future Endeavors

Canon, traditionally focused on producing equipment for less advanced chips, expanded its horizons by acquiring nanoimprint pioneer Molecular Imprints Inc. in 2014. Over nearly a decade, the company has diligently honed this technology. Furthermore, as a supplier to the industry giant Taiwan Semiconductor Manufacturing Co., Canon is in the process of constructing its first lithography equipment plant in two decades.

Canon’s acquisition of Molecular Imprints Inc., a pioneer in nanoimprint technology, in 2014 has played a pivotal role in driving innovation. Over nearly a decade, Canon has steadfastly worked on perfecting this technology. Canon demonstrates its commitment to advancing semiconductor manufacturing and strengthening its position as a key industry player. The company plans to initiate operations at a new plant in Utsunomiya by 2025 and is actively forming partnerships to achieve this strategic goal.

Conclusion: Pioneering a Technological Revolution

Canon Inc.’s venture into nanoimprint semiconductor manufacturing marks a technological milestone. By offering an accessible alternative to prevailing high-end technologies, Canon aims to meet the evolving demands of the semiconductor market. Join us on this exciting journey as we witness the transformative potential of Canon’s nanoimprint lithography in the realm of chipmaking.