Introduction

Recent ban by the US to limit the export of advanced artificial intelligence (AI) chips to China have raised questions about the future of the AI chip market in the country & for Huawei. These restrictions may open doors for Huawei Technologies to expand its presence in its $7 billion home market, as they force Nvidia, a dominant player in the field, to retreat. In this blog post, we’ll explore the implications of these export controls on the AI chip industry in China and how Huawei is positioning itself to capitalize on this opportunity.

Nvidia’s Dominance and the Rise of Chinese Alternatives

Analysts and AI companies like China’s iFlyTek suggest that Huawei’s Ascend AI chips match Nvidia’s in raw computing power but fall behind in performance.

According to Jiang Yifan, chief market analyst at Guotai Junan Securities, a major limiting factor for Chinese firms is their heavy reliance on Nvidia’s chips and software ecosystem.

However, the recent U.S. restrictions could potentially change this dynamic.

Jiang expressed on his Weibo social media account that, in his opinion, these U.S. restrictions could be a significant opportunity for Huawei’s Ascend chips.

Nevertheless, seizing this opportunity comes with several challenges.

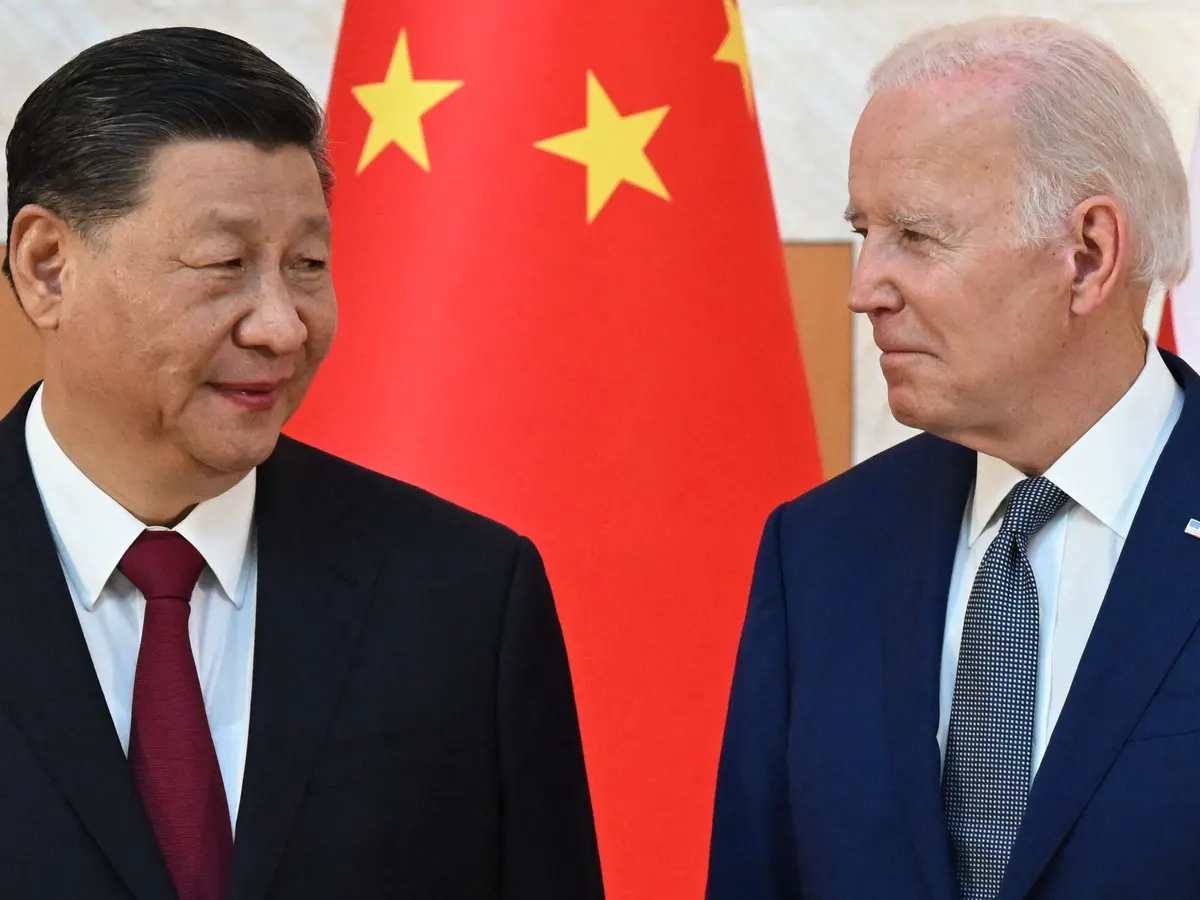

Read More: How Biden Intends to Prevent China from Obtaining Banned Chips?

Challenges and Limitations

Many cutting-edge AI projects rely on CUDA, a programming architecture pioneered by Nvidia. This has led to the development of a vast global ecosystem capable of training highly advanced AI models, including OpenAI’s GPT-4.

Huawei’s alternative, CANN, is considered more limited in its ability to train AI models, making Huawei’s chips far from a straightforward replacement for Nvidia.

Woz Ahmed, a former chip design executive turned consultant, emphasized that for Huawei to attract Chinese clients away from Nvidia, it must recreate the ecosystem established by Nvidia.

This includes providing support to help clients transition their data and models to Huawei’s platform.

Furthermore, the issue of intellectual property rights poses a significant challenge, as numerous U.S. firms hold essential patents related to GPUs.

Ahmed suggested that achieving a level of competitiveness comparable to Nvidia would likely take 5 to 10 years.

Read More: China to Challenge ASML with a better technology than EUV

Huawei’s Push for Self-Sufficiency

If Huawei succeeds in capturing Nvidia’s market share, it would mark another significant achievement in its ongoing battle against U.S. export controls imposed since 2019. During that year, Huawei launched its inaugural Ascend GPUs and stressed that it had developed these products entirely in-house, along with other offerings like its Harmony operating system.

Over the past year, Huawei, the telecommunications giant, has demonstrated signs of pushing back against the restrictions imposed by the U.S. It unveiled an advanced smartphone chip and claimed breakthroughs in chip design tools. Furthermore, Huawei has set its sights on becoming a vital provider of computing power for AI, with Chief Financial Officer Meng Wanzhou expressing the company’s desire to establish a computing infrastructure for China and offer the world an alternative to the dominant U.S. provider, albeit indirectly referenced.

Read more: How China is Penetrating US Sanctions to Achieve Chip Self-Reliance

Comparison with Nvidia A100

In China, Huawei has formed partnerships, such as the one with iFlyTek, a prominent Chinese AI software company. Despite being blacklisted by the United States in 2019, iFlyTek utilizes Huawei’s Ascend 910 for the training of its AI models. During iFlyTek’s recent earnings call, Senior Vice President Jiang Tao asserted that the capabilities of Ascend 910B were “comparable to Nvidia’s A100” and announced a collaboration with Huawei to develop a general-purpose AI infrastructure in China.

The company’s network of partners also includes state-owned software firms such as Tsinghua Tongfang and Digital China. In July, Huawei revealed that it currently powers more than 30 large language models (LLMs) in China with its AI chips, in a country where generative AI is experiencing a significant surge, boasting over 130 operational LLMs.

Charlie Chai, an analyst at 86Research, proposed that Nvidia’s ecosystem dominance can be overcome as long as domestic players are provided with sufficient time and a substantial customer base. China’s dedication to self-sufficiency, under President Xi Jinping’s leadership, is expected to bolster this effort. In essence, while there may be some short-term disruptions to supplies, this approach aligns with China’s long-term goal of achieving self-sufficiency in crucial technology sectors.

Read More: Why India is Paying for 70% of Micron’s ATMP Plant, Even Though Micron Owns It 100%

Conclusion

The recent U.S. export controls on advanced AI chips have created a unique opportunity for Huawei to expand its presence in the Chinese AI chip market. While challenges remain, such as ecosystem development and intellectual property concerns, Huawei’s commitment to self-sufficiency and partnerships with key players in China could position them as a significant contender in the industry. As China continues to prioritize self-sufficiency in technology, Huawei’s ambition to become a major player in AI chip production aligns with the nation’s long-term goals. This dynamic landscape will be fascinating to watch as it unfolds, with potentially far-reaching implications for the global tech industry.