Introduction:

The semiconductor industry is a crucial pillar of the modern technological landscape, driving innovations that shape our digital world. However, recent geopolitical tensions and supply chain disruptions have posed significant challenges for the industry. In Q1 2024, the semiconductor landscape witnessed notable shifts, with strong memory demand and increased shipments to China playing pivotal roles in mitigating revenue declines for the top wafer fab equipment (WFE) makers.

In this blog post, we delve into the dynamics of Q1 2024 and analyze the factors driving resilience in the semiconductor market.

Understanding the Semiconductor Landscape:

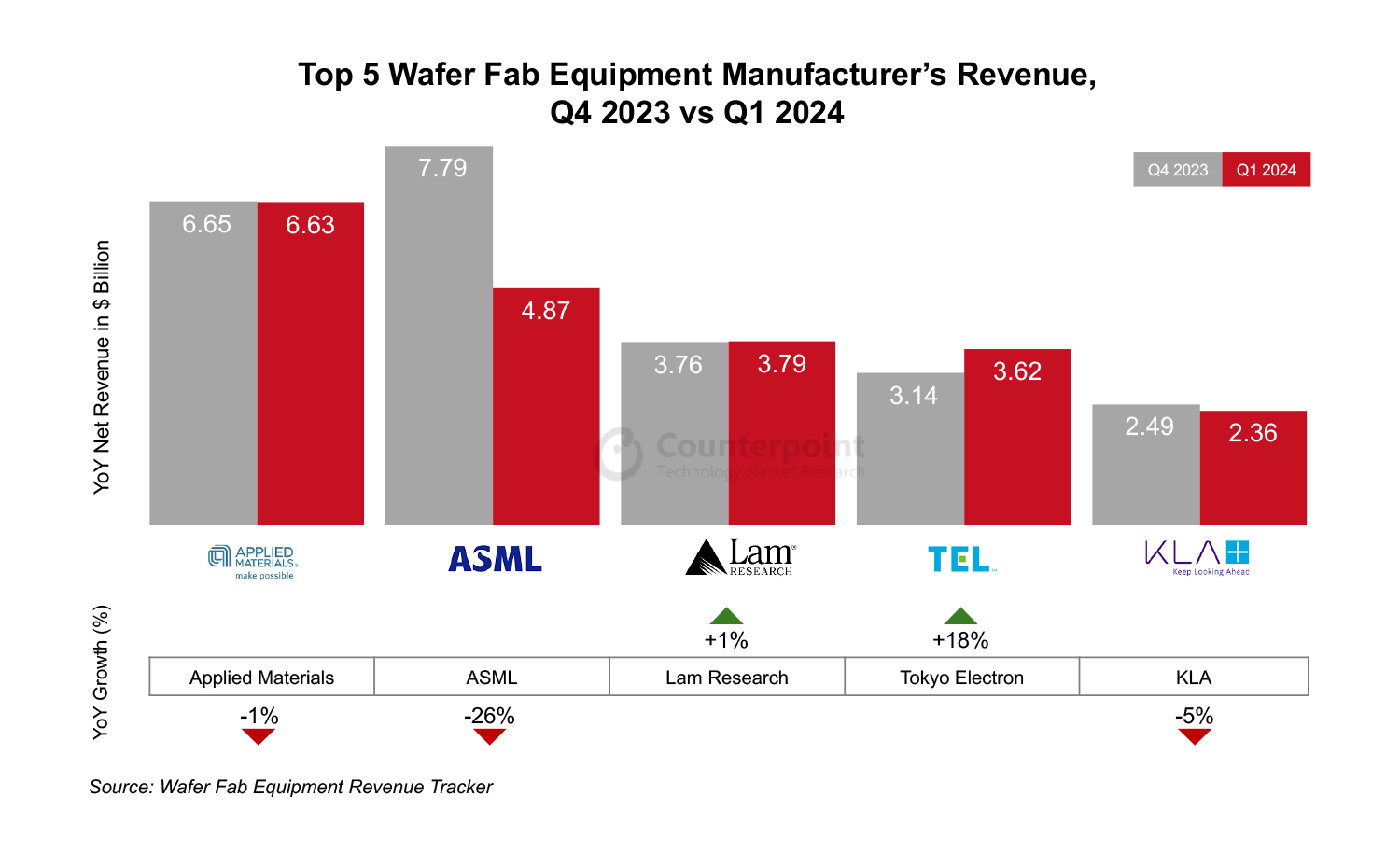

Q1 2024 saw the world’s top Wafer Fab Equipment manufacturers experiencing a 9% year-over-year revenue decline.

This decline was primarily attributed to delayed investments in leading-edge semiconductor technology.

However, amidst the revenue downturn, the memory end-market demonstrated resilience, fueled by robust demand for DRAM and NAND chips.

Regional Insights and Revenue Trends

Despite the overall downturn, revenue from China surged by 116% year-over-year in Q1 2024.

This spike was largely driven by increased DRAM shipments and demand from mid-critical and mature nodes used in applications such as IoT, automotive, and 5G.

These trends are expected to persist throughout the year. Among the top five WFE manufacturers, ASML and Tokyo Electron saw the steepest year-over-year revenue declines at 21% and 14%, respectively.

Image Source: Wafer Fab equipment Revenue Tracker

Conversely, Applied Materials, Lam Research, and KLA experienced smaller declines in low single digits compared to 2023.

When compared to the previous quarter, ASML’s revenue fell by 26%, while KLA’s revenue dropped by 5%, mainly due to customer capacity adjustments in advanced nodes.

Applied Materials and Lam Research maintained flat quarter-over-quarter revenues. Notably, Tokyo Electron recorded an 18% revenue increase, driven by strong demand for both DRAM and NAND.

Read More: Ilya Sutskever, Co-founder of OpenAI, Launches Startup to Tackle Safe Superintelligence – techovedas

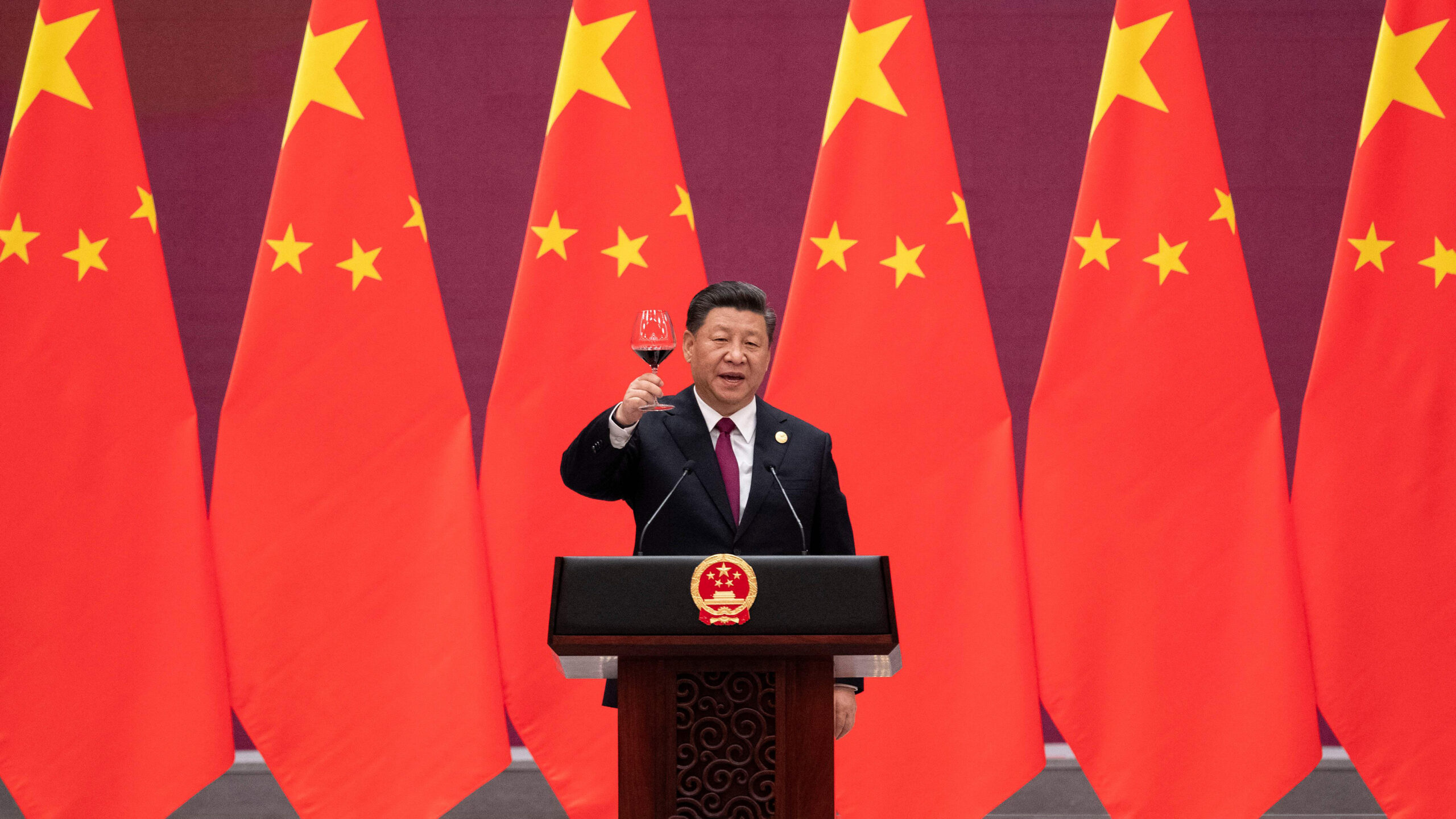

The Impact of Geopolitical Tensions:

Geopolitical tensions have significantly influenced the semiconductor industry, shaping market dynamics and supply chain operations.

Initiatives like the European Union’s Chips Act aimed to bolster semiconductor manufacturing capabilities and reduce dependence on Asian suppliers.

However, delays in project approvals and funding uncertainties underscored the challenges of navigating geopolitical complexities.

Read More :$2 Billion Boost: Onsemi Ambitious Expansion in Czech Republic – techovedas

China’s Role in Revenue Mitigation:

Despite broader revenue declines, China emerged as a significant revenue driver for the top WFE manufacturers in Q1 2024.

Revenue from China surged by an impressive 116% year-over-year, primarily driven by increased DRAM shipments.

This surge in demand from China helped offset declines in other regions, highlighting the country’s growing influence in the semiconductor market.

Read More:ASICs vs. FPGAs: Choosing the Right Technology for Your Design – techovedas

Emerging Technologies and Market Dynamics:

Emerging technologies, such as artificial intelligence (AI), continue to drive growth in the semiconductor industry.

The proliferation of AI applications across various sectors has led to increased demand for semiconductor chips, particularly in the memory segment.

Additionally, regional dynamics and supply chain disruptions have reshaped market trends, emphasizing the importance of adaptability and resilience.

Looking Ahead:

As we look towards the future, strategic investments and collaborative efforts will be crucial for navigating the complexities of the semiconductor landscape.

Initiatives like the Chips Act and technological advancements hold the key to unlocking new opportunities and driving sustainable growth.

Moreover, fostering partnerships and enhancing resilience will be essential for ensuring the long-term success of the semiconductor industry.

Read More: How Do We Measure Large Language Model(LLM) Performance? – techovedas

Conclusion:

Q1 2024 presented both challenges and opportunities for the semiconductor industry.

While revenue declines underscored the impact of geopolitical tensions and supply chain disruptions, strong memory demand and increased shipments to China showcased the industry’s resilience.

As stakeholders navigate the complexities of the semiconductor landscape, collaboration, innovation, and adaptability will be essential for driving growth and ensuring resilience in an ever-changing environment.