Introduction

SK Hynix recent announcement of $14.6 billion investment in constructing a state-of-the-art memory chip manufacturing plant in South Korea marks a significant milestone in the semiconductor sector. This strategic move underscores the company’s commitment to meeting the surging demand for advanced memory solutions, particularly in the context of the burgeoning AI chip market and digital transformation initiatives worldwide.

Investment: $14.6 billion (20 trillion won)

Location: South Korea (North Chungcheong Province)

Purpose: Build a new plant to manufacture HBM chips

Target Market: AI applications

The S.Korean memory giant was set to build a NAND fab at the site but changed the plan to meet rising HBM demand

Jeong-Soo Hwang, Eui-Myung Park and Chae-Yeon Kim

Follow us on Linkedin for everything around Semiconductors & AI

Background of SK Hynix HBM Investment

As a prominent player in the semiconductor arena, SK Hynix has garnered recognition for its innovative memory chip technologies and global market presence.

The pervasive integration of memory chips across diverse applications, ranging from cloud computing and data centers to smartphones and automotive electronics, underscores the pivotal role of memory solutions in driving technological advancement and digital innovation.

Read More:$545 Million: Shin-Etsu to Invest in Lithography Material Plant in Japan – techovedas

Strategic Rationale behind SK Hynix HBM Investment

SK Hynix, the prominent Korean semiconductor manufacturer and the world’s second-largest player in memory technology, has opted to discontinue NAND production in favor of expanding its DRAM lines.

This strategic decision proactively tackles the increasing demand for high-value DRAM products. It specifically targets high-bandwidth memory (HBM) and double data rate 5 (DDR5) chips, essential components in AI chip operations.

In the past year, SK Hynix initiated the integration of new HBM chip packaging lines into its M15 fabrication facility located in Cheongju.

As the top global producer of HBM chips, the company expects significant sales growth. They forecast a 60% compound annual growth rate in HBM chip sales over the next five years, fueled by the thriving global AI sector.

Companies such as Nvidia Corp., specializing in AI accelerators and machine learning processors with HBM chips, demonstrate commitment by making advance payments to SK Hynix. This ensures a continuous HBM chip supply to meet the anticipated demand for AI chips in the generative AI era.

Read More: What are Emerging Memories: Types and Advantages

Why HBM from SK Hynix?

Goldman Sachs predicts substantial growth in the global High Bandwidth Memory (HBM) market. By 2026, it’s expected to reach $23 billion, up from $3.3 billion in 2022, driven by increased demand.

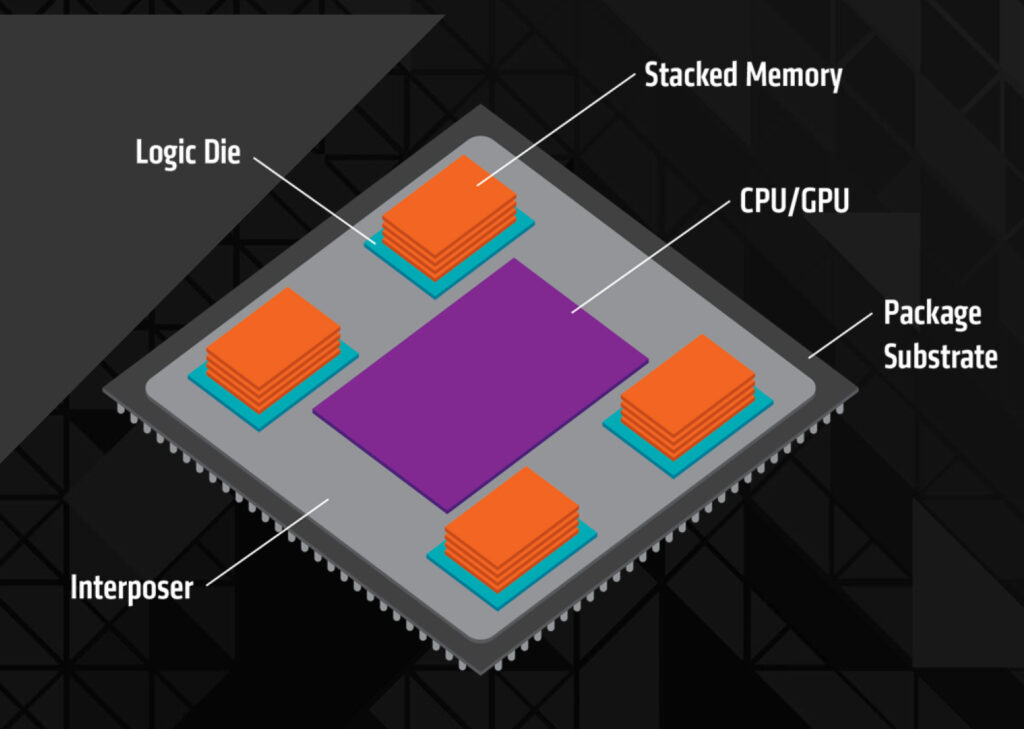

HBM is a high-performance DRAM chip composed of vertically stacked eight or 12 DRAM chips. It boosts data processing speed and bandwidth, crucial for AI accelerators paired with graphics processing units.

However, SK Hynix faces challenges in meeting the robust demand for HBM chips due to limited production capacity. Producing HBM chips requires advanced technology and complex processes. It also needs twice as much facility space as conventional DRAM chips to match output.

“We should have a manufacturing facility ready to produce chips promptly upon receiving orders,” a SK Hynix official said. “Capex will change depending on market conditions.”

Impact on the Semiconductor Industry

The investment in the M15X fab enhances SK Hynix’s production capacity and elevates South Korea’s position as a semiconductor manufacturing hub. Through fostering collaboration and supporting technological innovation, the initiative accelerates digital transformation and drives economic development locally and globally.

Read More:AI GPU Market 2024: NVIDIA dominates with $40B, AMD rises to $3.5B, Intel lags at $500M – techovedas

Job Creation and Economic Growth

The M15X fab’s establishment is projected to generate thousands of jobs, spanning skilled manufacturing to R&D roles. This surge in employment not only boosts local economic growth but also cultivates innovation and talent in the semiconductor industry.

Read More: 5 Step Method To Build Your First Electronic Gadget With Arduino – techovedas

Conclusion

SK Hynix’s $14.6 Billion investment in building an HBM plant in South Korea reflects its enduring vision and dedication to innovation.