Introduction:

It’s time to reflect on the highs and lows of the Semiconductor Stocks of 2023, a sector that continues to shape the technological landscape.

In this blog post, we’ll dive into the performance of the top 10 winners and losers in the semiconductor stocks market of 2023, exploring the factors that contributed to their success or struggles.

What were the most winning stocks of 2023

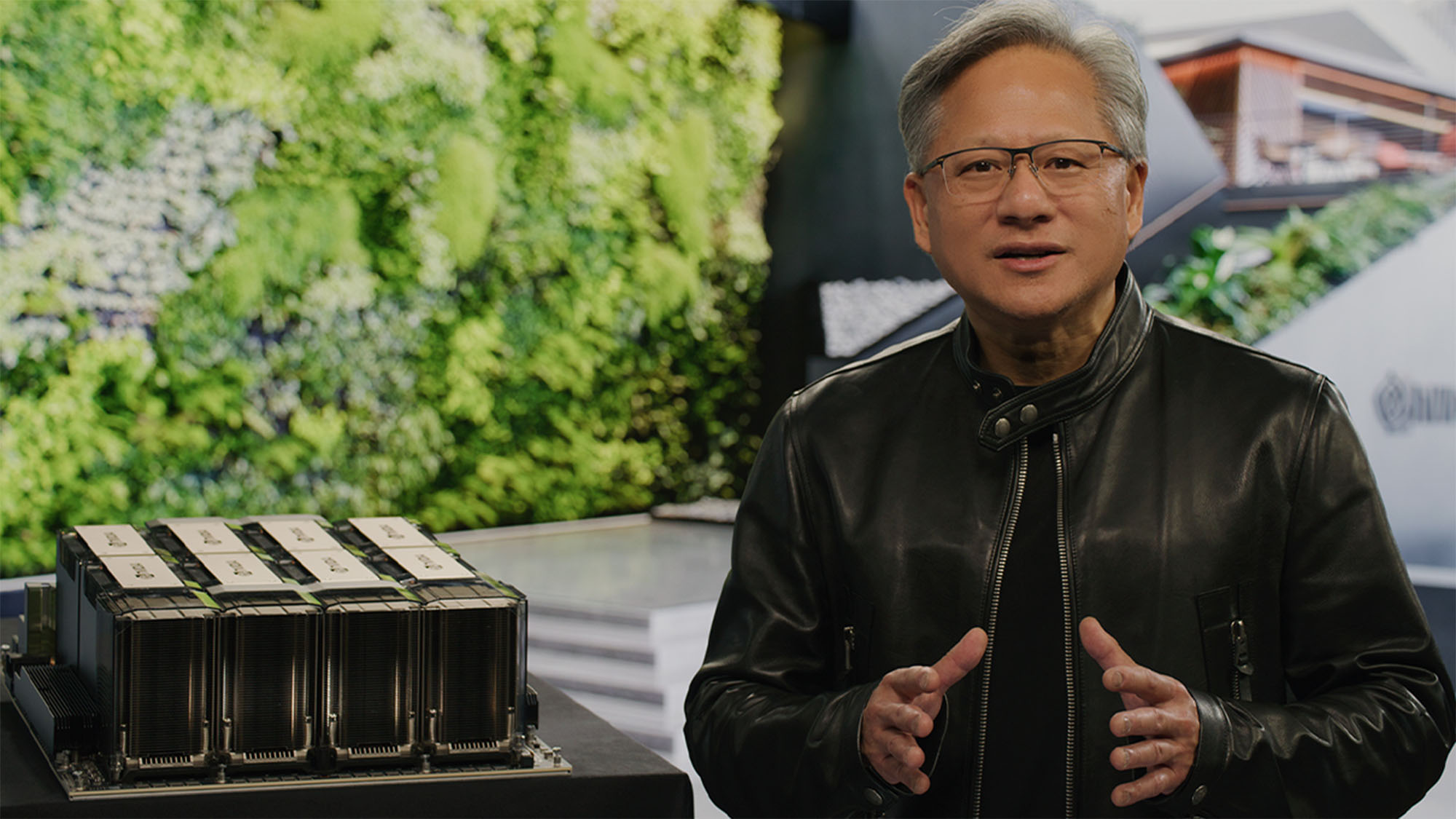

1. NVIDIA (Gain: 226%):

NVIDIA takes the lead as the top performer in 2023, showcasing remarkable growth. The company’s focus on artificial intelligence, gaming, and data centers has evidently paid off, solidifying its position as an industry leader.

2. Besi (Gain: 139%):

Besi’s impressive gains can be attributed to its strong position in the global semiconductor equipment market. The company’s innovative solutions and strategic partnerships have propelled its growth.

3. Navitas (Gain: 132%):

Specializing in gallium nitride (GaN) power ICs, Navitas has ridden the wave of increased demand for energy-efficient semiconductor solutions. The company’s cutting-edge technology has positioned it as a key player in the industry.

4. Advanced Micro Devices (Gain: 128%):

AMD’s continuous innovation in the CPU and GPU markets has paid off, with the company securing a strong position among semiconductor giants. The demand for high-performance computing has driven AMD’s stellar performance.

5. Advantest (Gain: 126%):

As a leading provider of test and measurement solutions for the semiconductor industry, Advantest has benefited from the growing complexity of semiconductor devices. Its robust product portfolio and global presence have contributed to its success.

6. Onto (Gain: 125%):

Onto’s success can be attributed to its focus on advanced packaging solutions and innovative semiconductor technologies. The company’s agility and adaptability in a dynamic market have proven to be key factors.

7. Renesas Electronics (Gain: 114%):

Renesas’ focus on automotive and industrial markets has driven its impressive gains. The increasing demand for semiconductor solutions in these sectors has positively impacted the company’s financial performance.

8. ASM International (Gain: 104%):

As a key player in the semiconductor equipment industry, ASM International has benefited from the expansion of semiconductor manufacturing capacity globally. The company’s technological expertise and strategic partnerships have contributed to its success.

9. Broadcom (Gain: 102%):

Broadcom’s diverse product portfolio, including semiconductor and infrastructure software solutions, has positioned it for success. The company’s ability to address a wide range of market needs has fueled its growth.

10. FormFactor (Gain: 94%):

FormFactor’s focus on advanced wafer probing solutions has proven to be a winning strategy. The increasing demand for semiconductor testing and measurement solutions has driven the company’s substantial gains.

Read More: Forget GPUs, CUDA is the Real Powerhouse Behind Nvidia Trillion-Dollar Ascent

What were the most losing stocks of 2023

1. Alpha and Omega Semiconductor (Loss: -9%):

Alpha and Omega Semiconductor’s decline could be attributed to various factors, including market sentiment, competition, or industry challenges. A closer look at the specific circumstances is necessary to understand the reasons behind this performance.

2. Magnachip (Loss: -14%):

Magnachip’s negative performance suggests potential struggles within the company or external market pressures. Further analysis is required to determine the factors influencing its decline.

3. Impinj (Loss: -20%):

Impinj faces a significant loss, raising questions about its market position and strategic decisions. Understanding the specific challenges the company encountered is essential to gauge its future prospects.

4. CVD Equipment Corporation (Loss: -20%):

CVD Equipment Corporation’s decline may stem from industry-specific challenges or internal issues. A detailed examination of the company’s operations and market conditions is necessary to assess its trajectory.

5. Semtech (Loss: -20%):

Semtech’s negative performance highlights the competitive nature of the semiconductor market. Examining the company’s product offerings and market strategy can provide insights into its challenges.

6. Ambarella (Loss: -25%):

Ambarella’s decline may be linked to factors such as market trends, competition, or shifts in consumer demand. A comprehensive analysis is essential to understand the company’s position in the semiconductor landscape.

7. MaxLinear (Loss: -30%):

MaxLinear’s substantial loss raises concerns about its market strategy and competitive positioning. Delving into the specifics of its performance can unveil the challenges it faced during the year.

8. Tower Semiconductor (Loss: -31%):

Tower Semiconductor’s notable loss suggests industry-specific challenges or internal issues affecting its performance. Analyzing the company’s operations and market dynamics is crucial to predicting its future trajectory.

9. Wolfspeed (Loss: -40%):

Wolfspeed’s significant decline may be indicative of challenges within the semiconductor sector or specific issues faced by the company. A closer examination of its market positioning and operations is necessary for a comprehensive understanding.

10. Valens Semiconductor (Loss: -49%):

Valens Semiconductor’s substantial loss raises questions about its viability in the market. An in-depth analysis of the company’s challenges and prospects is crucial to determining its future trajectory.

Read More: Meta and Microsoft Ditch Nvidia for AMD’s New AI Chip: Game Changer or Hype?

Conclusion:

The industry’s dynamism is reflected in the diverse performances of these Semiconductor Stocks of 2023. While winners capitalized on technological advancements and market trends, losers faced challenges that impacted their financial standing. Investors and industry enthusiasts alike will be keen to follow these developments as the semiconductor sector continues to shape the future of technology.