Introduction:

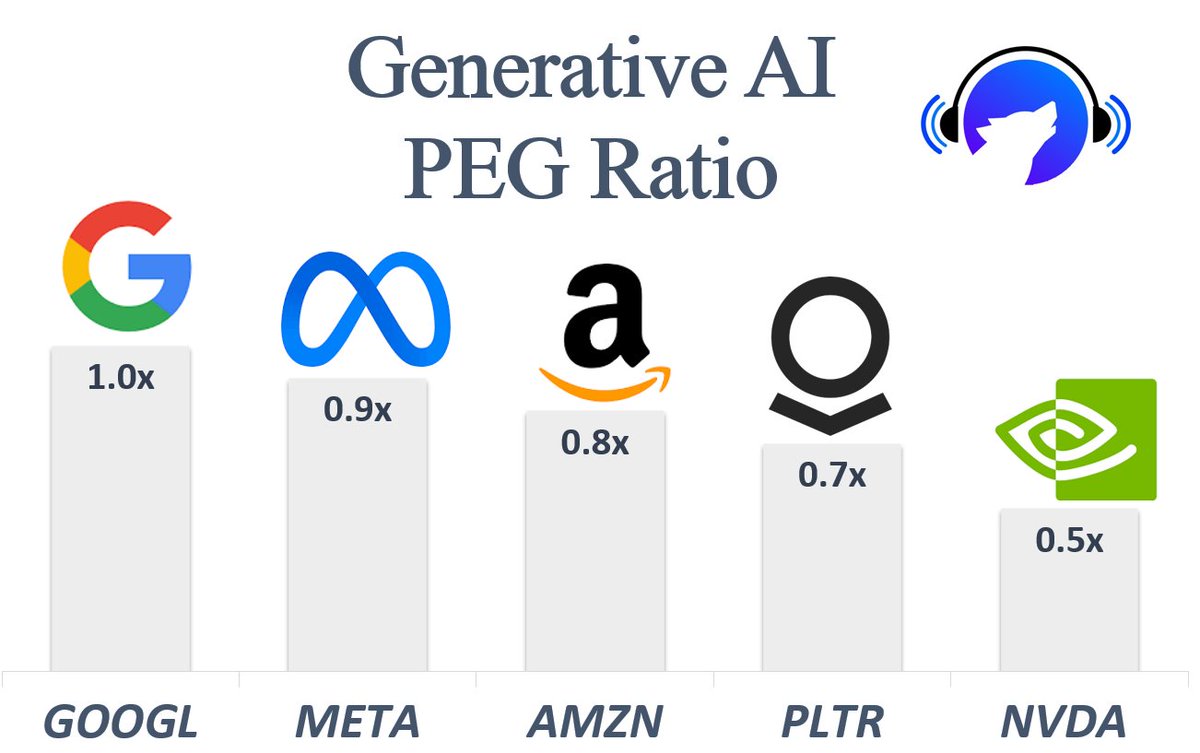

In today’s rapidly evolving landscape, artificial intelligence (AI) leads transformative technologies. It offers immense potential for growth-seeking investors. The demand for AI-driven solutions surges across industries. Identifying undervalued stocks is crucial. PEG ratios under 1.0 serve as valuable metrics. They indicate stocks trading at a discount relative to their earnings growth potential. In this article, we’ll explore 5 bargain AI stocks with PEG ratios under 1.0, presenting compelling investment opportunities in the burgeoning AI market.

Follow us on Linkedin for everything around Semiconductors & AI

The Price/Earnings to Growth (PEG) ratio, a valuation metric, assesses the relationship between a stock’s price, its earnings per share (EPS), and its anticipated future earnings growth rate. Investors calculate it by dividing the price-to-earnings (P/E) ratio by the expected earnings growth rate.

5 Bargain Artificial Intelligence (AI) Stocks to Ride the Wave

Alphabet Inc. ($GOOGL):

Alphabet Inc., the parent company of Google, has been at the forefront of AI innovation for years.

From search algorithms to self-driving cars, Alphabet’s investments in AI have positioned it as a leader in the field.

Despite its size and dominance, Alphabet’s PEG ratio remains below 1.0, making it an attractive option for investors seeking exposure to AI.

Read More: 5 Years Slashed to 2: TSMC Japan Fab is Ready ahead of Construction Timeline

Meta Platforms Inc. ($META):

Formerly known as Facebook, Meta Platforms Inc. is another heavyweight in the AI space.

With its vast trove of user data and advanced algorithms, Meta has leveraged AI to revolutionize social networking and digital advertising.

Despite regulatory challenges and concerns about user privacy, Meta’s PEG ratio suggests that its stock may be undervalued relative to its growth potential.

Read More: How WELL Do You Know Advanced Packaging? – techovedas

Amazon.com Inc. ($AMZN):

Amazon.com Inc. needs no introduction. As one of the largest e-commerce companies in the world, Amazon has embraced AI across its operations, from recommendation engines to logistics optimization.

Additionally, Amazon Web Services (AWS) provides cloud-based AI services to businesses worldwide.

Despite its status as a tech giant, Amazon’s PEG ratio indicates that its stock may still be undervalued compared to its growth prospects.

Palantir Technologies Inc. ($PLTR):

Palantir Technologies Inc. specializes in data analytics and AI-driven decision-making software.

Moreover, its platforms are used by governments, intelligence agencies, and large corporations to analyze large datasets and uncover insights.

Despite its relatively short time on the public markets, Palantir’s PEG ratio suggests that investors may have an opportunity to buy into its AI expertise at a reasonable valuation.

NVIDIA Corporation ($NVDA):

NVIDIA Corporation is a leading provider of graphics processing units (GPUs) used in AI applications, particularly in deep learning and data centers.

As demand for AI accelerates, NVIDIA’s GPUs have become indispensable tools for training and inference tasks.

Despite its strong performance in recent years, NVIDIA’s PEG ratio indicates that its stock may still be undervalued relative to its growth potential in the AI space.

Read More:A New RISC-V Breakthrough Chip Merges CPU, GPU & AI into One – techovedas

Conclusion:

In conclusion, while the past year has seen a surge in AI stocks, there are still bargain opportunities available for investors.

As always, investors should conduct their own research and consult with financial professionals before making investment decisions.

Reference: https://twitter.com/StockSavvyShay/status/1776594345874894913