Introduction:

In the world of investing, identifying stocks with the potential for substantial growth is a primary objective for many investors. While there are numerous factors to consider, such as market trends, industry analysis, and company fundamentals, one crucial aspect is the estimation of future earnings growth. In this blog post, we’ll delve into the analysis of 5 High Growth Stocks from the World of semiconductors that meet specific quality criteria and are estimated to grow their earnings the fastest in the next three years.

Follow us on Linkedin for everything around Semiconductors & AI

Quality Criteria:

Before we delve into the analysis of individual stocks, let’s outline the quality criteria that we’ll be using to identify high-growth potential candidates:

- Market Capitalization > $10 billion: This ensures that the companies are well-established and have the financial stability to support growth initiatives.

- Revenue Growth Next 3 Years > 10%: A strong indication of future earnings potential, as it reflects increasing demand for the company’s products or services.

- Free Cash Flow (FCF) Positive: Companies with positive free cash flow have the flexibility to reinvest in growth opportunities, return value to shareholders, or strengthen their balance sheets.

- Profitable (FQ): Consistent profitability is essential for sustainable growth and value creation.

- Return on Capital (ROC) Positive (FQ): Indicates efficient allocation of capital and a competitive advantage in the market.

- Altman Z Score > 3: A measure of financial health and the likelihood of bankruptcy, with a score above 3 indicating a low risk of financial distress.

Analysis of Selected Stocks:

BE Semiconductor ($BESI):

- Market Capitalization: > $10 billion

- Revenue Growth Next 3 Years: Strong demand for semiconductor solutions in various industries is expected to drive revenue growth.

- Free Cash Flow: Positive, indicating financial flexibility for growth initiatives.

- Profitable (FQ): Yes, demonstrating consistent earnings.

- Return on Capital (ROC) Positive (FQ): Efficient capital allocation leading to profitability.

- Altman Z Score: > 3, indicating financial health and low bankruptcy risk.

Read More: How WELL Do You Know Advanced Packaging? – techovedas

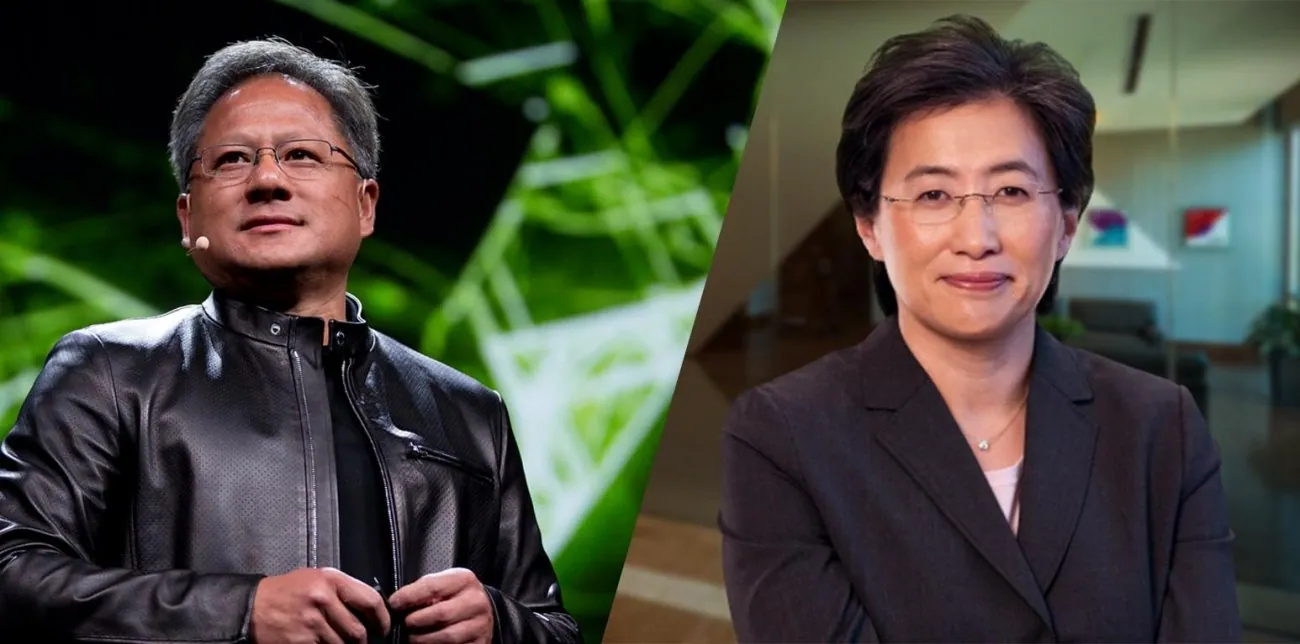

Nvidia ($NVDA):

- Market Capitalization: > $10 billion

- Revenue Growth Next 3 Years: Anticipated growth in gaming, data center, and artificial intelligence segments.

- Free Cash Flow: Positive, providing resources for future expansion.

- Profitable (FQ): Yes, driven by strong demand for graphics processing units (GPUs) and data center solutions.

- Return on Capital (ROC) Positive (FQ): Efficient use of capital leading to profitability.

- Altman Z Score: > 3, reflecting a solid financial position.

AMD ($AMD):

- Market Capitalization: > $10 billion

- Revenue Growth Next 3 Years: Expected growth fueled by strong demand for CPUs and GPUs across multiple sectors.

- Free Cash Flow: Positive, supporting growth initiatives.

- Profitable (FQ): Yes, driven by product innovation and market demand.

- Return on Capital (ROC) Positive (FQ): Efficient capital allocation driving profitability.

- Altman Z Score: > 3, indicating financial stability.

Crowdstrike ($CRWD):

- Market Capitalization: > $10 billion

- Revenue Growth Next 3 Years: Growing demand for cybersecurity solutions amidst increasing cyber threats.

- Free Cash Flow: Positive, reflecting strong financial performance.

- Profitable (FQ): Yes, driven by the adoption of its cloud-native security platform.

- Return on Capital (ROC) Positive (FQ): Efficient use of capital leading to profitability.

- Altman Z Score: > 3, indicating financial strength.

Teradyne ($TER):

- Market Capitalization: > $10 billion

- Revenue Growth Next 3 Years: Expected growth in semiconductor test solutions and industrial automation.

- Free Cash Flow: Positive, providing resources for expansion and innovation.

- Profitable (FQ): Yes, driven by diversified revenue streams.

- Return on Capital (ROC) Positive (FQ): Efficient capital allocation driving profitability.

- Altman Z Score: > 3, indicating a healthy financial position.

Read More:A New RISC-V Breakthrough Chip Merges CPU, GPU & AI into One – techovedas

Conclusion:

In conclusion, the stocks analyzed—BE Semiconductor, Nvidia, AMD, Crowdstrike, and Teradyne—meet the specified quality criteria and are estimated to grow their earnings the fastest in the next three years. 5 High Growth Stocks from the World of semiconductors companies operate in high-growth industries and have demonstrated strong financial performance, making them potential market leaders in the years to come. However, investors should conduct further research and consider their own investment objectives and risk tolerance before making any investment decisions.