Introduction:

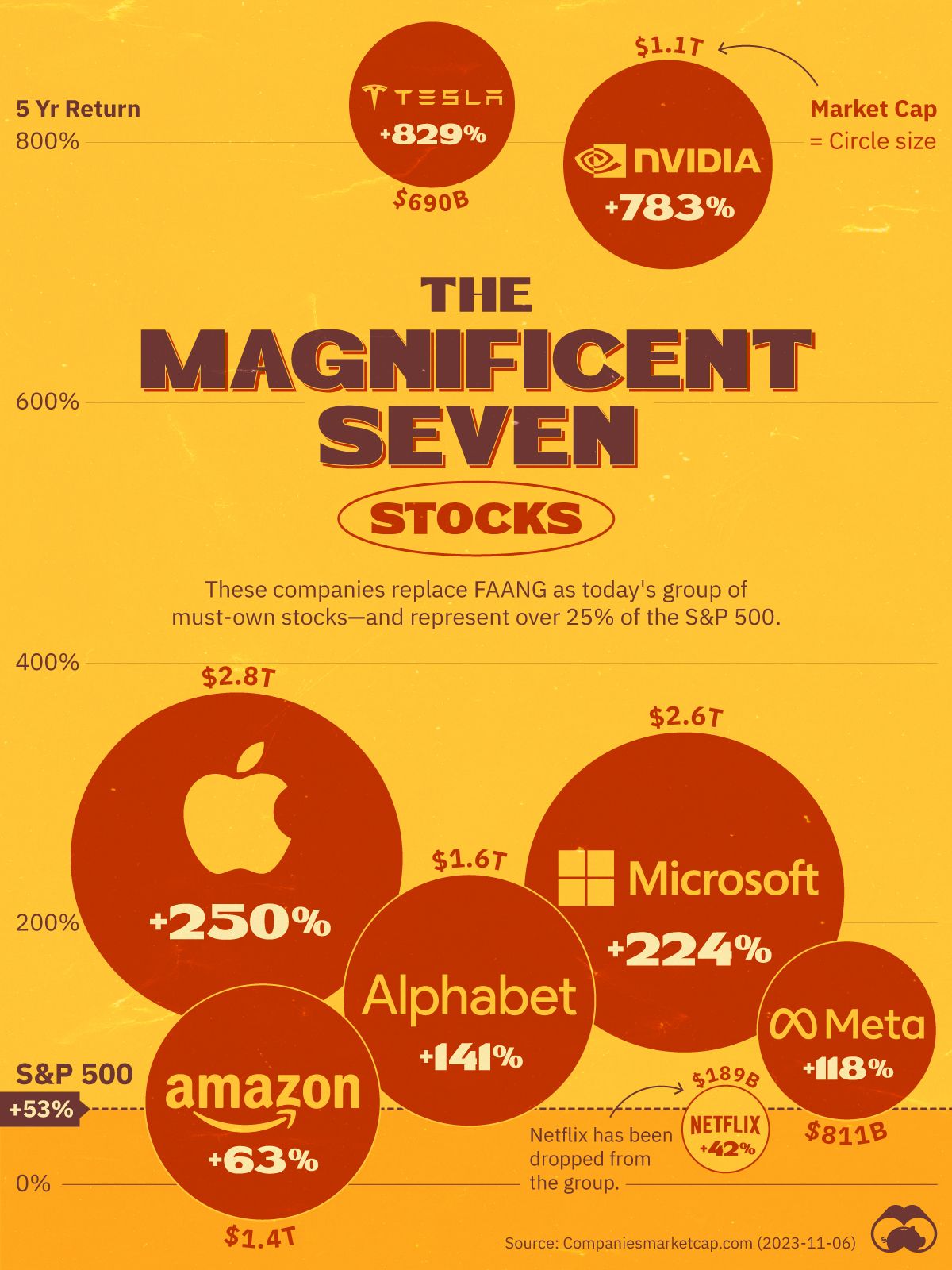

The Magnificent 7 Tech Companies astounding market cap surge of $4.96 trillion in 2023 is not merely a financial feat; instead, it’s a testament to the strength of their economic moats. Moreover, as these companies continue to innovate and solidify their positions, their moats act as formidable defenses, safeguarding them against potential threats and ensuring their enduring relevance in the fast-paced world of technology and finance.

As we explore their remarkable financial success, we’ll also delve into the moats that contribute to their resilience and sustained growth.

Join TechoVedas Community here

1. Apple Inc. ($AAPL): Fortifying the Ecosystem Moat

Apple Inc. has fortified its ecosystem moat, adding a staggering $1.01 trillion to its market cap YTD.

The company’s seamless integration of hardware, software, and services creates a user experience that is hard to replicate. The loyalty of Apple users, coupled with the strength of the brand, forms an ecosystem moat that acts as a barrier to entry for competitors.

2. Microsoft Corporation ($MSFT): The Multi-Faceted Moat of Diversification

Microsoft Corporation, with a YTD market cap increase of $1 trillion, boasts a multi-faceted moat built on diversification. Furthermore, its presence in cloud computing, enterprise solutions, and gaming provides a diversified revenue stream that shields it from market fluctuations. This strategic diversification positions Microsoft as a resilient giant in the ever-evolving tech landscape.

This strategic diversification enhances Microsoft’s resilience and cements its position as a tech juggernaut.

3. NVIDIA Corporation ($NVDA): The Specialized Moat in Graphics and AI

NVIDIA Corporation, an $829 billion market cap gainer YTD, has established a specialized moat in graphics processing units (GPUs) and artificial intelligence (AI). Moreover, as a leader in these cutting-edge technologies, NVIDIA’s moat is reinforced by the high entry barriers associated with developing comparable hardware and software solutions. This specialization not only secures its dominance in key sectors but also insulates the company from potential competitors, solidifying its position in the tech landscape.

Also Read: Why Silicon Wafers Are Round and Chips are Square?

4. Amazon.com Inc. ($AMZN): The All-Encompassing E-Commerce Moat

Amazon.com Inc. has added $680 billion to its market cap YTD, underlining its dominance in e-commerce and beyond. The e-commerce giant’s vast logistics network, extensive product offerings, and customer-centric approach form an all-encompassing moat. This moat not only fends off competition but also positions Amazon as a one-stop-shop for consumers, strengthening its grip on the retail landscape.

5. Meta Platforms Inc. ($META): The Social Network Turned Metaverse Moat

Formerly known as Facebook, Meta Platforms Inc. has experienced a $545 billion increase in market cap YTD, driven by a strategic shift toward the metaverse. Meta’s moat is evolving from social networking to the metaverse, where its early investments in virtual reality and augmented reality technologies create a unique and expansive digital space. This transition strengthens Meta’s moat by aligning with the future trajectory of digital interaction.

6. Alphabet Inc. ($GOOG): The Search and Data Moat

Alphabet Inc., the parent company of Google, has gained $526 billion in market cap YTD, propelled by its dominance in online search, digital advertising, and cloud services. Furthermore, Google’s moat is intricately tied to the vast amounts of data it collects, enabling superior algorithms and targeted advertising. This data-centric moat not only reinforces Google’s position as the go-to search engine and advertising platform but also solidifies its standing as a powerhouse in the tech industry.

7. Tesla Inc. ($TSLA): The Sustainable Innovation Moat

Tesla Inc. has added $371 billion to its market cap YTD, reflecting its leadership in electric vehicles and sustainable energy. Tesla’s moat is built on continuous innovation, proprietary technology, and a commitment to sustainability. The company’s brand strength in the electric vehicle market, coupled with advancements in battery technology, creates a moat that positions Tesla as a trailblazer in the transition to clean energy.

Conclusion:

The Magnificent Seven’s astounding market cap surge of $4.96 trillion in 2023 is not merely a financial feat; instead, it’s a testament to the strength of their economic moats. Moreover, as these companies continue to innovate and solidify their positions, their moats act as formidable defenses. Furthermore, these defenses safeguard them against potential threats, ensuring their enduring relevance in the fast-paced world of technology and finance.