Introduction

Advanced Micro Devices, Inc. (AMD) recently released its financial results for the Q3, which saw the company surpass revenue and profit expectations.

However, its projection for the next quarter fell short of analysts’ estimates, leading to a 4% decline in the company’s stock price in after-hours trading.

This article delves into AMD’s performance, its pursuit of AI chip manufacturing, and what lies ahead for the semiconductor giant.

AMD Q3 Earnings Surpass Expectations

In the third quarter, AMD reported revenues of $6.8 billion, beating analysts’ expectations of $6.7 billion.

The revenue increase, driven by strong demand for its Ryzen 7000 series PC processors, marked a 4% year-over-year growth, reflecting the company’s continued success in the highly competitive semiconductor industry.

This success is underpinned by AMD’s ongoing efforts to deliver innovative and high-performance products to meet consumer demands.

Here’s a table summarizing AMD’s earnings for the third quarter of the year, along with growth or decline percentages compared to the same period last year:

| Metric | Q3 2023 | Q3 2022 | Growth/Decline |

|---|---|---|---|

| Earnings per Share | $0.70 | $0.04 | +1625% |

| Revenue | $5.8 billion | $5.6 billion | +4% |

| Data Center Sales | $1.6 billion | $1.6 billion | Flat |

| Client Group Sales | $1.5 billion | $1.05 billion | +42% |

| Embedded Sales | $1.2 billion | $1.26 billion | -5% |

| Gaming Segment Sales | $1.5 billion | $1.63 billion | -8% |

Read More: Western Digital to Split into 2 Companies After Kioxia Merger Fails

The AI Chip Market and AMD’s Ascent

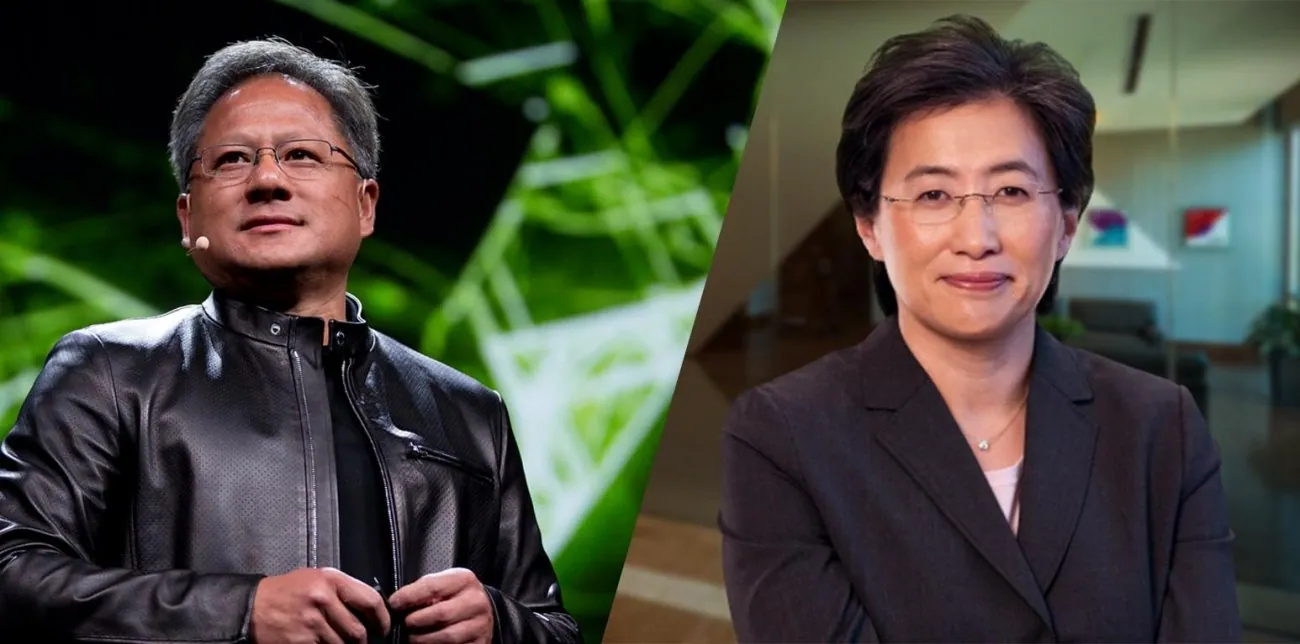

While AMD is best known for its CPU and GPU offerings, the company is increasingly making its presence felt in the AI chip market, which has long been dominated by NVIDIA. AMD is actively working to narrow the gap, and its progress in this field is promising.

AI is a transformative technology, powering everything from autonomous vehicles to data analytics and more.

AI relies on high-performance GPUs (Graphics Processing Units) for training and inference tasks. As a result, the market for AI chips has become highly competitive, and AMD is vying for a slice of this lucrative pie.

AMD’s upcoming AI chips, MI300A and MI300X, are touted to be making substantial progress, with production expected to commence in the fourth quarter.

These chips are designed to meet the growing demand for AI capabilities in various industries. While AMD anticipates fourth-quarter revenues of $6.1 billion, reflecting a 9% year-over-year increase, this figure falls short of analysts’ expectations, which were pegged at $6.4 billion.

Read More: Samsung 1.4 nm to Feature 4 Nanosheets, Competitive Edge Over TSMC and Intel

GPU Vs CPU

A particular analyst during the $AMD call expressed a view that many people they’ve conversed with believe there’s a fundamental shift happening in the realm of computing, with GPUs taking over the role traditionally dominated by CPUs.

However, this viewpoint reflects a misconception about fundamental computer science principles.

In reality, CPUs will continue to be the primary drivers for running conventional code. GPUs excel in scenarios involving highly parallelized workloads, such as those driving AI applications.

While it’s true that GPUs can make inroads into the datacenter space, the trusty CPUs will remain the essential workhorses for the majority of computing tasks. It’s essential not to be swayed by the notion that GPUs will completely replace CPUs.

“We now expect data center GPU revenue to be approximately $400 million in the fourth quarter and exceed $2 billion in 2024 as revenue ramps throughout the year,”

~ Lisa Su, AMD CEO

Read More: Samsung 1.4 nm to Feature 4 Nanosheets, Competitive Edge Over TSMC and Intel

AMD Q3 Market Reaction and Future Outlook

In the wake of the earnings release, AMD’s stock price initially dipped by approximately 4% in after-hours trading. The discrepancy between projected revenues and analyst estimates contributed to this decline.

However, the stock rebounded slightly after the company expressed its optimistic outlook for the AI chip business in 2024.

AMD reported strong year-over-year growth in Q3 across various metrics, including revenue, gross margin, and earnings per share.

Additionally, the data center segment of the business continued to show robust growth, with revenue amounting to $1.6 billion.

While this segment’s performance remains consistent with the previous year, it remains a vital revenue source due to the ongoing influence of data centers in digital transformation.

AMD’s Q4 guidance of approximately $6.1 billion in sales falls slightly short of the anticipated $6.37 billion expected by analysts.

AMD stock for last 5 days shows the response from market

Read More: Samsung wins Tensor chip order From Google for Second Year, beating TSMC

Conclusion

AMD’s Q3 earnings release showcases the company’s ability to outperform market expectations in a highly competitive industry.

The company’s foray into AI chip manufacturing presents an exciting growth opportunity, despite some near-term discrepancies with analyst estimates.

AMD’s entry into the AI chip market positions it as a strong competitor, offering innovative solutions for diverse industries. The company’s ongoing success and optimistic outlook demonstrate its adaptability in a rapidly changing tech landscape.