Introduction

In the ever-evolving world of semiconductor manufacturing, recent developments in Europe have sparked significant interest and speculation. Taiwan Semiconductor Manufacturing Company (TSMC), the world’s largest contract chipmaker, is expected to begin construction of a new wafer fabrication facility German fab in Dresden, Germany, sometime in the second half of 2024.

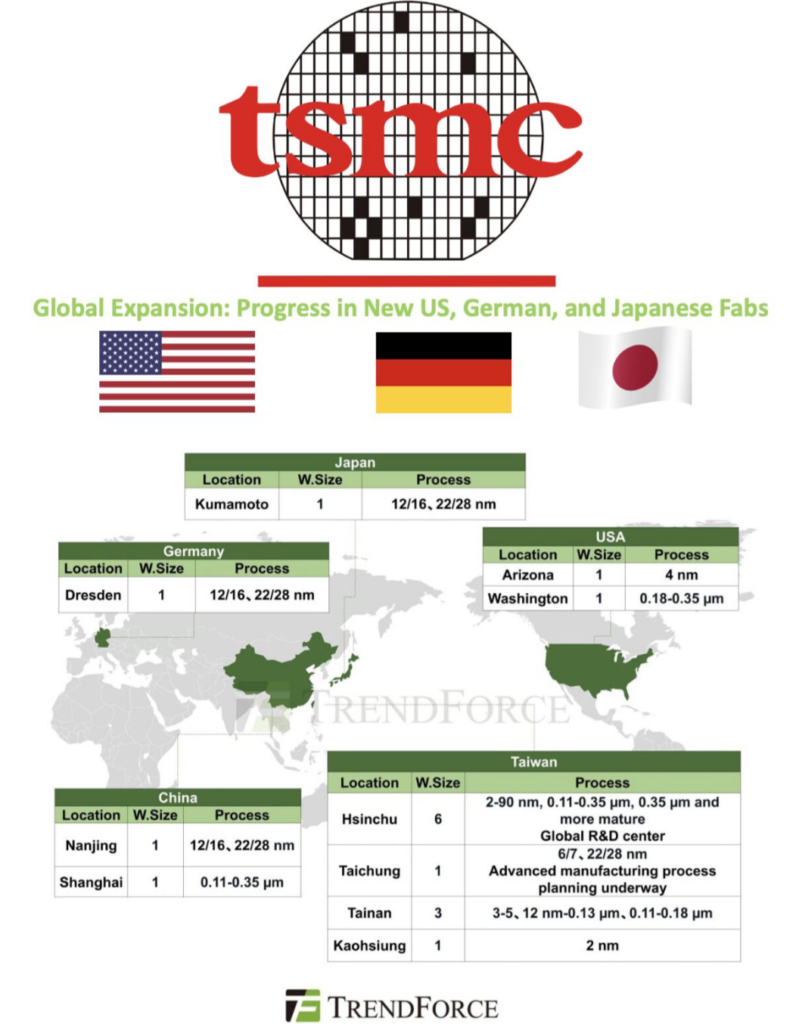

This news comes after TSMC recently unveiled its latest fab in Kumamoto, Japan. The Dresden facility will cater to the specific needs of the industrial and automotive sectors, and has already secured orders from key partners like Bosch, Infineon, and NXP. Additionally, the project is supported by both the Saxony state and Dresden city governments.

The construction of this new fab signifies TSMC’s growing presence in Europe and its commitment to meeting the demands of the global semiconductor market.

1. A Joint Venture

TSMC Dresden is a joint venture between Taiwan Semiconductor Manufacturing Company (TSMC) and three prominent European electronics companies: Robert Bosch, Infineon, and NXP. Moreover, this partnership marks a notable shift in the semiconductor industry landscape, with implications ranging from technological advancements to economic and geopolitical considerations.

- Germany: TSMC has established a joint venture called European Semiconductor Manufacturing Company (ESMC) GmbH with Bosch, Infineon, and NXP. TSMC holds a majority stake (70%), with the other partners holding 10% each.

- Japan: TSMC operates a joint venture called Japan Advanced Semiconductor Manufacturing, Inc. (JASM) with Sony Semiconductor Solutions and Denso. However, TSMC holds a dominant stake in JASM (around 60%).

- US: TSMC operates independently in the US, without any current joint ventures announced.

Read More: Which Country has Highest No. of Semiconductor Fabs

2. Joint Venture Dynamics

TSMC, renowned for its cutting-edge semiconductor fabrication technologies, will hold a 70% stake in the venture, while the European partners will each own a 10% share. This distribution reflects a strategic alignment aimed at leveraging TSMC’s technological expertise with the regional knowledge and market presence of its European counterparts. TSMC’s operational control of the German fab underscores its commitment to ensuring seamless integration and efficient production processes.

The decision to produce two nodes, a 28/22 nanometer planar node and a 16/12 nanometer FinFET node, underscores the joint venture’s focus on catering to diverse German fab market demands. The distinction between planar and FinFET nodes highlights the technological nuances inherent in transistor gate designs, with FinFET technology representing a notable advancement in three-dimensional transistor architecture.

3. Technological Timeline and Economic Considerations

It’s noteworthy that the Fab’s technological trajectory aligns with established industry standards, albeit with a lag of approximately a decade from the forefront of innovation. While FinFET technology was pioneered by Intel in 2011, TSMC and Samsung subsequently adopted it, positioning TSMC Dresden’s offerings as competitive albeit not at the bleeding edge of semiconductor manufacturing.

Focus and Technology:

- Germany: Projected to focus on mature process nodes (22nm to 28nm), targeting the automotive and industrial sectors.

- Japan: Specializes in both mature and advanced nodes (22nm to 12nm), catering to markets encompassing automotive, industrial, and consumer electronics.

- US (Arizona): Currently focusing on cutting-edge 5nm and 4nm process nodes, with a planned 3nm facility. Main clients are in the high-performance computing, smartphone, and AI sectors.

The substantial financial investment required for the Fab’s construction, estimated at $11 billion, underscores the magnitude of this undertaking. The German government’s contribution of approximately $5 billion highlights the strategic importance of semiconductor manufacturing in fostering economic growth and technological innovation within the region. TSMC’s investment of $3.8 billion underscores its commitment to securing majority control of the venture, signaling confidence in the long-term viability of the project despite initial capital outlays.

Read More: 4 Reasons why Moore’s Law Might be Dead, Finally!

4. Market Dynamics and Future Prospects

The decision to situate the German fab in Dresden, amidst a landscape already populated by semiconductor giants like GlobalFoundries, Wolfspeed, and Infineon, underscores the competitive dynamics shaping Europe’s semiconductor industry. The proximity to existing fabs presents both opportunities and challenges, with access to talent and resources offset by intensified competition.

Market Demands and Customers

- Germany: Aims to serve the robust European automotive and industrial chip markets where reliability and stability are often prioritized over bleeding-edge performance.

- Japan: Caters to a mix of industrial, automotive and consumer electronics customers within Japan and broader Asia.

- US: Targets primarily American companies demanding the latest technologies in sectors like smartphones and advanced computing.

The anticipated demand for chips, particularly in the automotive sector, underscores the strategic significance of TSMC Dresden’s offerings. Moreover, the potential applications of FinFET technology, including the development of Magnetic RAM (MRAM) by NXP, highlight the collaborative efforts driving innovation within the semiconductor ecosystem.

Follow us on Linkedin for everything around Semiconductors & AI

5. Regulatory and Strategic Implications

The European Commission’s role in approving the deal underscores the regulatory scrutiny surrounding such ventures, particularly given the significant subsidies involved. However, the strategic importance of semiconductor manufacturing within the European Union (EU) bodes well for regulatory approval, with chips being recognized as critical components driving innovation and economic competitiveness.

Comparisons with TSMC’s other ventures, such as TSMC Arizona and Japan Advanced Semiconductor Manufacture (JASM), highlight distinct operational and strategic considerations. While TSMC Arizona represents a fully-owned and operated venture, the Dresden and JASM partnerships underscore TSMC’s willingness to collaborate with local partners to navigate regulatory frameworks and establish a foothold in new markets.

Read More: Taiwan Govt. Approves TSMC 3.5 B Euros investment for 12-inch fab in Germany

Conclusion

In conclusion, TSMC Dresden represents a significant milestone in Europe’s semiconductor landscape, with far-reaching implications for technological innovation, economic growth, and strategic partnerships. While challenges and uncertainties undoubtedly accompany such ventures, the collective expertise and resources of TSMC and its European partners position TSMC Dresden for success in an increasingly competitive global market. However, as the project progresses towards completion, all eyes will be on Dresden, anticipating the unveiling of a state-of-the-art semiconductor fabrication facility poised to shape the future of Europe’s technology industry.