Introduction:

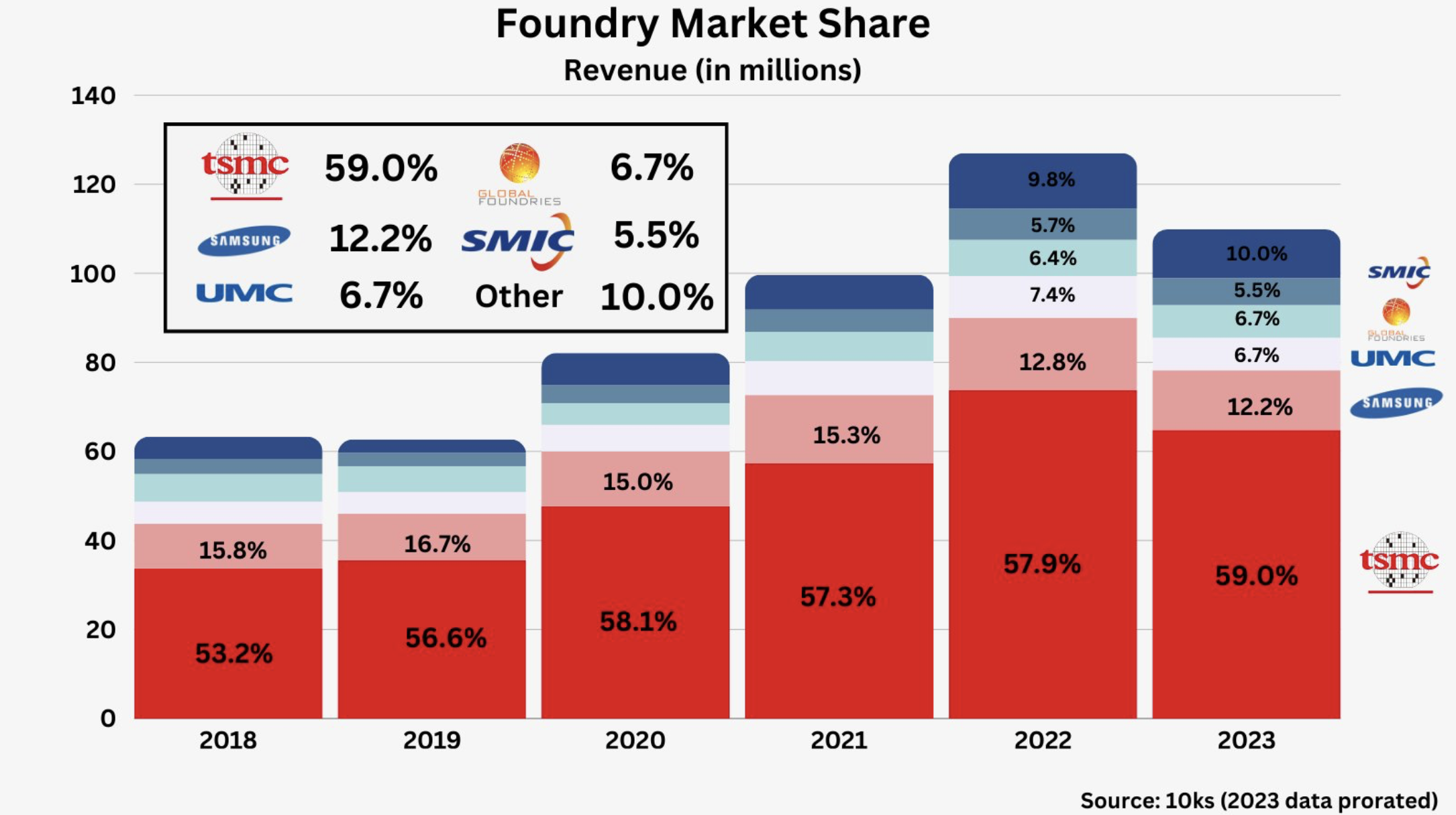

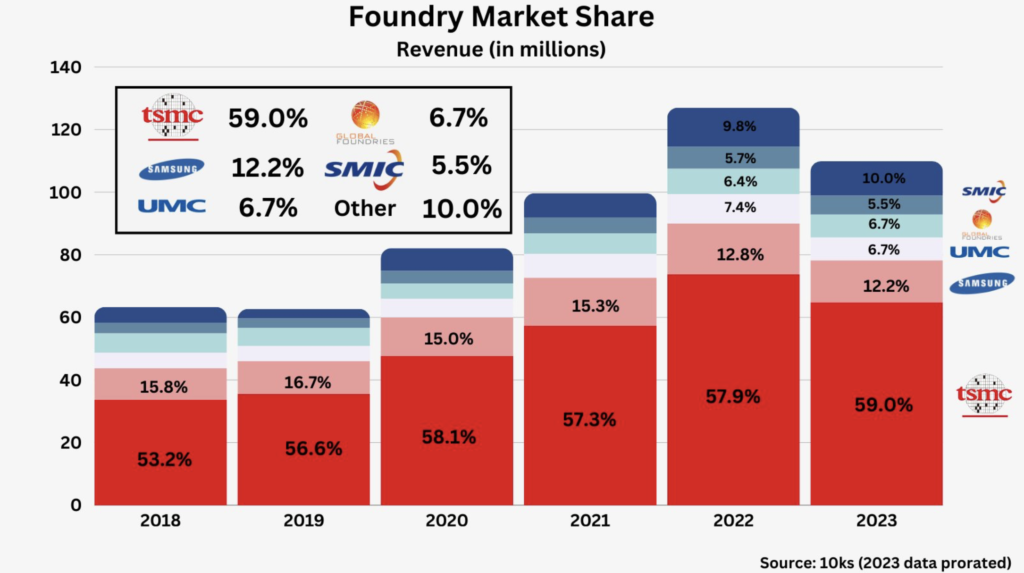

In recent years, the foundry market share has witnessed a clear hierarchy, with Taiwan Semiconductor Manufacturing Company (TSMC) leading the way.

The semiconductor industry is the backbone of modern technology, powering everything from smartphones to data centers.

At the heart of this industry are semiconductor foundries, companies that specialize in the manufacturing of integrated circuits for various applications.

This blog post will delve into the current market share dynamics, highlighting TSMC’s dominance, Samsung’s notable advancements, Intel’s emergence as a wildcard, and the positions of other key players.

1. TSMC’s Commanding Presence:(59%)

Taiwan Semiconductor Manufacturing Company (TSMC) stands tall as the undisputed leader in the semiconductor foundry market.

Holding a staggering 59% of the total market share, TSMC has established itself as the go-to manufacturer for cutting-edge semiconductor technologies.

The company’s prowess extends beyond mere market share, as it claims an even higher percentage in the production of the most advanced chips. TSMC’s commitment to innovation and efficiency has solidified its position as the industry leader.

With impressive financial results, remarkable operating profits, and a promising outlook for the remainder of the year, TSMC is well on its way to securing its first-ever full-year chip revenue title in 2023.

Read More: TSMC Continues to beat Intel & Samsung to Dominate Chip Revenue

2. Samsung’s Resilient Rise:(12.2%)

In second place, Samsung Foundry commands a respectable 12.2% of the market share. What makes Samsung noteworthy is its ability to adapt and move swiftly into more complex processes.

In some instances, Samsung has outpaced TSMC in adopting advanced manufacturing technologies. This resilience has allowed Samsung to maintain a competitive edge and remain a key player in the semiconductor foundry landscape.

As technology continues to evolve, Samsung’s nimbleness positions it as a formidable competitor to TSMC.

Explore Samsung’s roadmap for GAA nanosheet transistor technology, including SF3, SF3P, SF2, and SF1.4. Learn how these innovations are set to redefine semiconductor performance and power efficiency.

Read More: Samsung 1.4 nm to Feature 4 Nanosheets, Competitive Edge Over TSMC and Intel

3. Intel’s Foray into Foundry Business:(<2%)

Intel, traditionally known for its microprocessor business, has entered the foundry arena with ambitious plans. Although currently holding less than 2% of the market share, Intel is a wildcard that industry experts are closely watching.

The company’s move to expand its foundry business is significant, as Intel is one of the few entities worldwide capable of challenging TSMC and Samsung in the production of the most advanced semiconductor processes.

Intel’s success in this endeavor could reshape the competitive landscape and introduce a new powerhouse in semiconductor manufacturing.

CEO Pat Gelsinger’s vision for Intel’s diversified manufacturing network and its commitment to becoming customer-obsessed are discussed, along with insights into competition from ARM-based chips and the role of artificial intelligence in Intel’s future plans.

Read More: How Intel 2.0 is making a Diverse Global Supply Chain Under Pat Gelsinger

Other Players in the Mix:

TSMC, Samsung, and Intel lead the market, but other foundries play vital roles in meeting industry needs.

UMC and GlobalFoundries, though not at the forefront of advanced processes, maintain respectable businesses by offering cost-effective solutions.

On the geopolitical front, Semiconductor Manufacturing International Corporation (SMIC) emerges as China’s foundry crown jewel.

SMIC’s significant investments showcase China’s commitment to competing at the forefront of semiconductor manufacturing, adding complexity to the global landscape.

| Rank | Company | Market Share | Key Strengths |

|---|---|---|---|

| 1 | TSMC | 59% | Dominance in semiconductor manufacturing, leading in cutting-edge chip production, industry leader in innovation and efficiency. |

| 2 | Samsung Foundry | 12.2% | Resilient rise, agile adoption of complex processes, competitive positioning, providing a strong alternative to TSMC. |

| 3 | Intel | <2% | Wildcard entry, strategic move into the foundry business, potential to challenge TSMC and Samsung in advanced semiconductor processes. |

| Others | UMC, GlobalFoundries, SMIC | Varied | UMC and GlobalFoundries offer cost-effective solutions, SMIC (China) emerging as a significant player with substantial investments in cutting-edge processes. |

Conclusion:

The semiconductor foundry market is dynamic and competitive, with TSMC setting the standard for technological advancement.

Samsung’s agility and Intel’s ambitious entry into the foundry business bring intrigue and potential shifts to the landscape. Watching emerging players and geopolitical factors, like China’s investments in SMIC, is crucial as the industry evolves.

The next chapters in this story will likely involve technological breakthroughs, strategic partnerships, and potential disruptions that could reshape the semiconductor foundry market in the coming years.