Introduction:

The cryptocurrency landscape is evolving rapidly, and recent developments suggest that the approval of Bitcoin exchange-traded funds (ETFs) could significantly impact Nvidia revenue in 2024.

As Bitcoin mining activities gain traction, the demand for powerful and efficient GPUs has the potential to skyrocket. In this blog post, we will delve into the complex and multifaceted factors that contribute to this potential surge in revenue for Nvidia.

Follow us on Linkedin for everything around Semiconductors & AI

Background

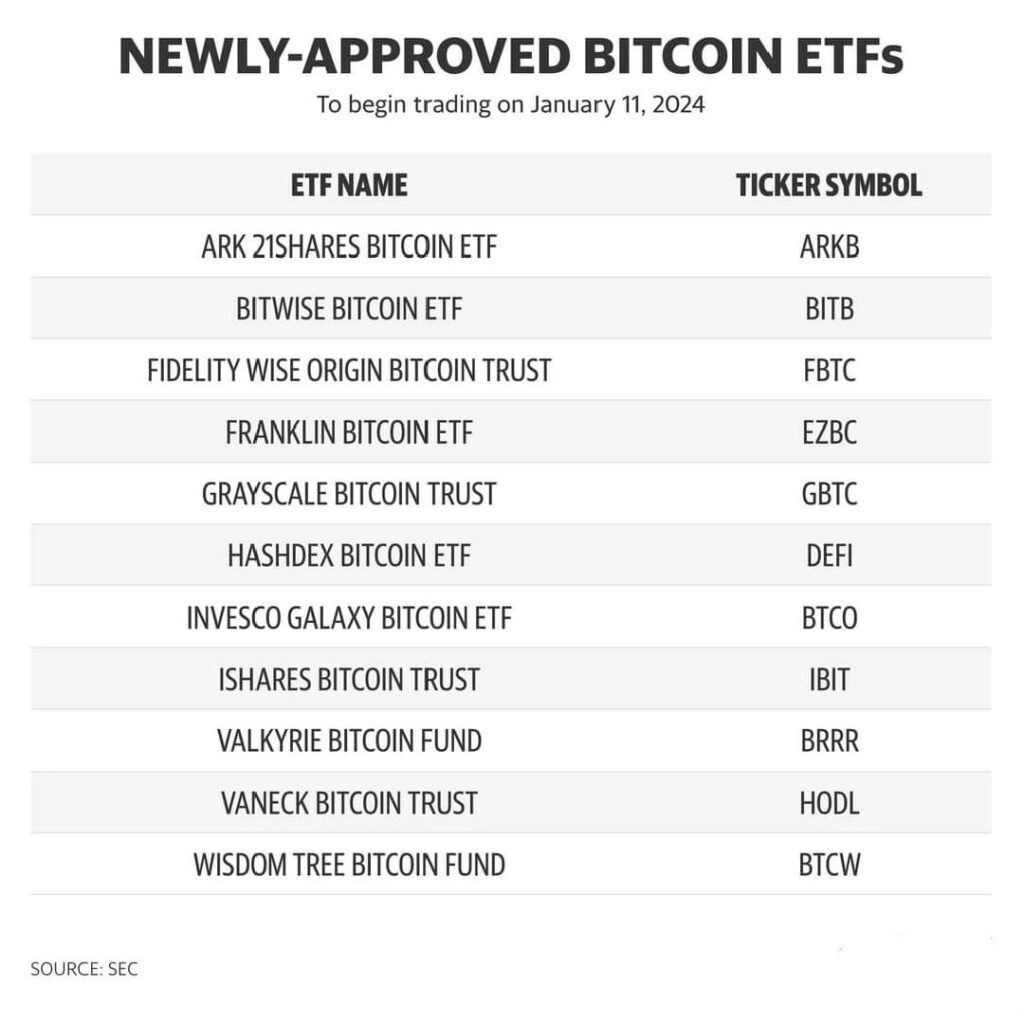

The US Securities and Exchange Commission (SEC) has granted approval for eleven spot bitcoin ETFs, including offerings from prominent entities such as Grayscale, Fidelity, and Bitwise. A Grayscale spokesperson confirmed that the SEC has given the green light to “uplist the shares of Grayscale Bitcoin Trust to NYSE Arca as a spot Bitcoin ETF.”

In a statement, SEC Chairman Gary Gensler conveyed his ongoing reservations about bitcoin, asserting that it is primarily a speculative, volatile asset also utilized for illicit activities, including ransomware, money laundering, sanction evasion, and terrorist financing. While we approved the listing and trading of certain spot bitcoin ETP shares today, we did not approve or endorse bitcoin.”

The approved ETFs are still expected to start trading as early as Thursday.

Read More: Nvidia: China to get a “Special” Gaming Chip with 10% less Processing Power

Why Bitcoin Miners need Nvidia GPUs

Bitcoin miners, as well as miners of other cryptocurrencies, often turn to Nvidia products, particularly their high-performance graphics processing units (GPUs), for several reasons:

1. Parallel Processing Power:

Designing with a focus on parallel processing power, Nvidia tailors its GPUs to be well-suited for the computationally intensive tasks required in cryptocurrency mining. Mining involves solving complex mathematical problems to validate transactions on the blockchain, and the parallel processing capabilities of Nvidia GPUs allow for efficient and speedy execution of these calculations.

2. CUDA Cores:

CUDA (Compute Unified Device Architecture) cores, specifically designed for parallel computing tasks, feature prominently in Nvidia GPUs. These cores enable efficient handling of the simultaneous computations required in cryptocurrency mining algorithms. Miners often leverage CUDA cores to achieve high hash rates, which are crucial for successful and profitable mining.

3. Performance and Efficiency:

Nvidia’s GPUs, such as the RTX series, are known for their high performance and energy efficiency. This is a critical factor for miners as it directly affects the cost-effectiveness of their mining operations. Efficient GPUs can provide higher hash rates while consuming less power, leading to better mining profitability.

4. Versatility Across Algorithms:

Nvidia GPUs are renowned for their versatility in handling a broad range of mining algorithms utilized by cryptocurrencies. This versatility allows miners to switch between different cryptocurrencies or mining algorithms based on market conditions and profitability, providing flexibility in their mining strategies.

5. Optimized Software Support:

Nvidia has a strong developer ecosystem and provides robust software support for its GPUs. This includes optimized drivers and software development kits (SDKs) that enhance the performance of Nvidia GPUs in mining applications. Reliable and well-supported hardware that miners can fine-tune for optimal mining performance is a benefit.

Read More: Forget GPUs, CUDA is the Real Powerhouse Behind Nvidia Trillion-Dollar Ascent

4 Reasons why Bitcoin Approval would Help Nvidia

1. Surging Demand for GPUs:

The approval of Bitcoin ETFs is expected to drive a significant surge in demand for GPUs, especially Nvidia’s RTX 3080 and 3090 series. Renowned for their high performance and efficiency, these GPUs are considered ideal for cryptocurrency mining activities.

The increasing interest in Bitcoin mining could lead to a significant uptick in the sales of these GPUs, contributing to Nvidia’s revenue growth.

2. Higher GPU Prices:

The confluence of increased demand and the ongoing global chip shortage could result in higher GPU prices. As miners seek to enhance their mining capabilities, they may be willing to pay a premium for Nvidia’s top-tier GPUs.

Higher prices for these graphics cards would not only boost revenue per unit but also have a positive impact on the overall revenue stream for Nvidia.

3. Specialized Crypto Mining Hardware:

Nvidia has strategically entered the cryptocurrency mining hardware market with its Crypto Mining Processor (CMP) product line. Designing specifically for mining purposes, these specialized chips offer cryptocurrency miners enhanced efficiency and performance.

The approval of Bitcoin ETFs could act as a catalyst, encouraging further development and sales of Nvidia’s CMP products, creating an additional and dedicated revenue stream for the company.

4. Potential Challenges and Considerations:

While the potential for increased revenue is evident, there are several challenges and considerations that Nvidia may face. Regulatory uncertainties, stemming from the known volatility of the cryptocurrency market, could impact the overall demand for GPUs and specialized mining hardware.

Additionally, the global chip shortage poses logistical challenges for manufacturing and distribution, potentially hindering Nvidia’s ability to meet the heightened demand promptly.

Read More: How Well do you know Nvidia- Take Our Quiz to Find out

Conclusion:

In conclusion, the approval of Bitcoin ETFs in 2024 has the potential to reshape the landscape for Nvidia. The surge in demand for GPUs, coupled with higher prices and the continued growth of the cryptocurrency mining industry, positions Nvidia to capitalize on this evolving market. The strategic entry into specialized crypto mining hardware further diversifies Nvidia’s product portfolio and revenue streams. However, it is crucial for the company to navigate potential challenges and uncertainties in the cryptocurrency market to fully realize the benefits of this opportunity. As the cryptocurrency ecosystem continues to evolve, Nvidia’s role in powering the infrastructure of this digital frontier remains a fascinating and dynamic aspect to watch in the coming year.