Introduction:

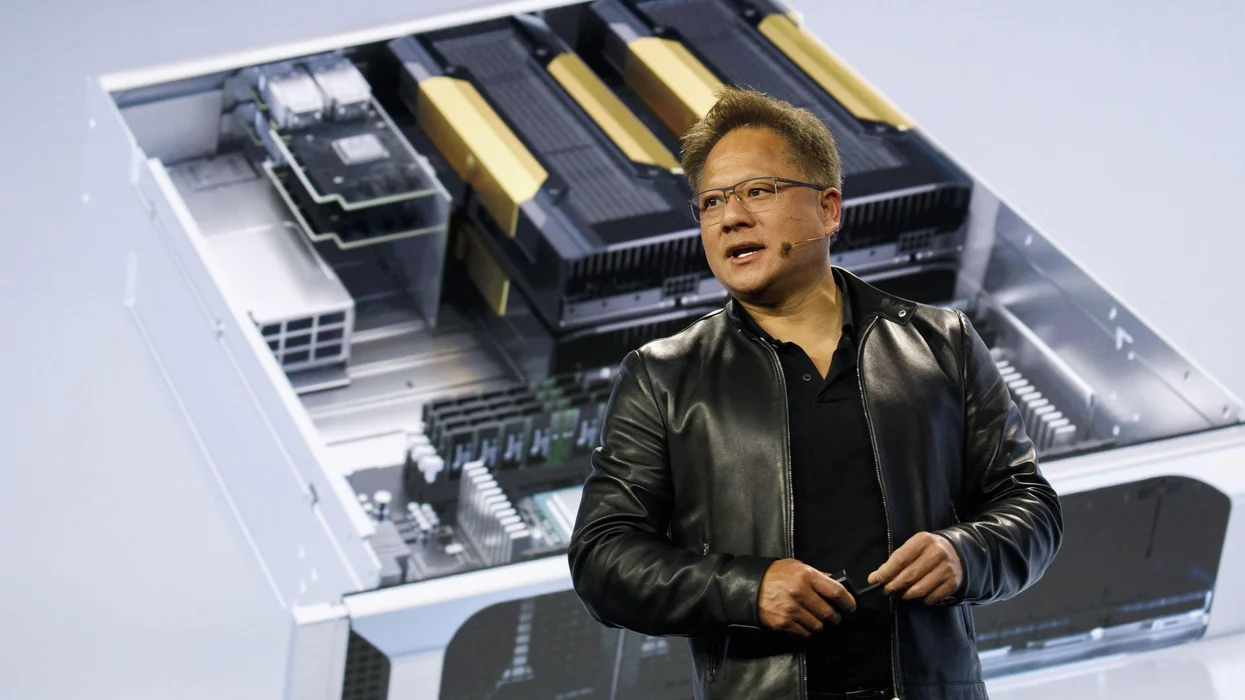

In a significant strategic move, Nvidia is reportedly establishing a new business unit dedicated to designing custom processors for a broad spectrum of applications.

The initiative aims to cater to the evolving demands of various industries, including artificial intelligence (AI), automotive, datacenters, gaming, and telecom.

While Nvidia has not officially confirmed the existence of this unit, reports indicate that it is already engaging in preliminary talks with tech giants such as Amazon, Meta, Microsoft, Google, and OpenAI, signaling a potential expansion of its business beyond traditional datacenter offerings.

Follow us on LinkedIn for everything around Semiconductors & AI

The New Business Unit:

The unit will be Led by Vice President Dina McKinney, who brings a wealth of experience from her roles at AMD, Qualcomm, and Marvell, the new unit is poised to address the diverse needs of industries seeking custom silicon solutions.

However, McKinney’s profile on LinkedIn indicates her responsibility for silicon aimed at ‘cloud, 5G, gaming, and automotive,’ underscoring the unit’s multi-faceted approach.

The move positions Nvidia to tap into various sectors, including automotive, consoles, datacenters, and telecommunications, reflecting the company’s commitment to offering tailored solutions for different applications.

Nvidia not successful in Automotive Market

Nvidia has seen significant success in meeting the demands of AI applications through its readily available A100 and H100 processors, alongside their variations like the A800 and H800, in addition to RTX-series graphics processors catered to client PCs and datacenters. Furthermore, the company’s Mellanox connectivity and networking products are highly sought after by cloud service providers.

However, in the automotive market, Nvidia’s sales for automotive solutions have not matched the profitability of its datacenter, gaming, and professional visualization solutions. To some extent, the automotive market’s preference for custom silicon solutions to power their software-defined vehicles contributes to Nvidia’s relatively lower sales in this sector. Although Nvidia’s Drive platform leads in various advancements, certain vehicle manufacturers opt for developing their own highly customized platforms. Considerations such as cost, competitiveness, and the desire for greater control over intellectual property drive this choice.

This shift not only presents new opportunities for Nvidia but also places it in direct competition with other custom chip designers like AMD, Alchip, Broadcom, Marvell Technology, and Sondrel. While Nvidia’s competitors have significant experience, Nvidia holds a wealth of highly competitive intellectual property (IP) across CPU, GPU, AI, HPC, networking, and sensor processing technologies, all of which are already established in the market. Leveraging some of these IPs in custom packages could substantially broaden Nvidia’s total addressable market (TAM) and potentially lead to increased earnings over time.

Why Nvidia wants to do Custom Processor Unit?

Specialized microchips, known as custom processors or application-specific integrated circuits (ASICs), are designed to perform specific tasks or functions tailored to the needs of a particular application or industry. Unlike general-purpose processors such as CPUs or GPUs, which handle a wide range of tasks, custom processors optimize performance, power efficiency, and cost-effectiveness for targeted applications.

Here’s an example to illustrate the concept of custom processors:

Let’s consider a scenario where a cloud service provider (CSP) requires processors optimized for AI inference tasks in its datacenters. Instead of using off-the-shelf GPUs like Nvidia’s A100 or H100 processors, the CSP decides to develop custom processors specifically designed for AI inference workloads. Companies could optimize these custom processors for tasks like image recognition, natural language processing, or recommendation systems, providing higher performance and efficiency compared to general-purpose GPUs.

How custom processors differ from Nvidia’s current offerings:

Specificity: Custom processors cater to specific applications or industries, whereas Nvidia’s current offerings, such as the A100 and H100 processors, optimize general-purpose GPUs for a wide range of workloads, including AI, high-performance computing (HPC), and graphics rendering.

Tailored Optimization: Custom processors undergo optimization to meet the precise requirements of a particular workload or application, resulting in enhanced performance, power efficiency, and cost-effectiveness. In contrast, Nvidia’s off-the-shelf GPUs offer versatility but may not provide the same level of optimization for specific tasks.

Flexibility: Custom processors offer flexibility in terms of design and functionality, allowing companies to incorporate custom features, interfaces, or accelerators tailored to their unique needs. Nvidia’s GPUs, while powerful and versatile, may not provide the same level of customization as ASICs designed for specific applications.

In summary, custom processors represent a specialized approach to hardware design, offering tailored solutions optimized for specific tasks or industries. While Nvidia’s GPUs continue to excel in various applications, the rise of custom processors reflects the growing demand for specialized hardware optimized for specific workloads, driving innovation and differentiation in the semiconductor industry.

Examples of Companies doing Custom Processors

Google (Tensor Processing Units – TPUs): Google has developed TPUs, custom-designed ASICs specifically optimized for machine learning workloads. TPUs offer high performance and energy efficiency for tasks such as training and inference in Google’s AI-powered services, including Google Search, Gmail, and Google Photos.

Amazon (Graviton Processors): Amazon’s AWS Graviton processors are custom-designed ARM-based chips optimized for cloud computing workloads. These processors offer cost-effective and scalable solutions for running various applications on Amazon Web Services (AWS), including web servers, containerized applications, and microservices.

Diversification in Response to Market Trends:

The custom processor market has witnessed significant growth, with major players such as Amazon Web Services, Google, and Microsoft developing their own processors for AI and general-purpose computing.

This trend enables these companies to optimize costs, enhance datacenter capabilities, and achieve better performance and power consumption efficiency. By establishing a unit dedicated to custom processors, Nvidia aims to stay ahead in this competitive landscape, offering clients specialized solutions while expanding its total addressable market (TAM) and potentially increasing earnings.

Read More: What are Nvidia’s Top 4 Customers Driving Humongous Revenue Growth – techovedas

Competition and Collaborations:

Nvidia’s venture into custom processors not only positions the company as a formidable competitor in the market but also opens up opportunities for collaboration with industry leaders. The reported talks with Amazon, Meta, Microsoft, Google, and OpenAI suggest a willingness to explore partnerships that could lead to the creation of custom chips tailored to the specific needs of these tech giants.

Read More: What are 5 Countries Apple Supply Chain is heavily Dependent On? – techovedas

Conclusion:

Nvidia’s foray into custom processors marks a strategic move to diversify its offerings and address the evolving needs of various industries. The reported engagements with tech giants and the leadership of experienced professionals like Dina McKinney indicate the company’s commitment to staying at the forefront of technological advancements. As the demand for custom silicon continues to grow, Nvidia’s move positions it as a key player in the competitive landscape, offering specialized solutions that cater to the unique requirements of diverse sectors. The success of this venture could significantly expand Nvidia’s market presence and contribute to its long-term growth in the ever-evolving technology industry.