Introduction:

In the realm of datacenter technology, AMD’s Antares MI300 GPU series emerges as a beacon of potential amidst a landscape of evolving demands and competitive pressures.

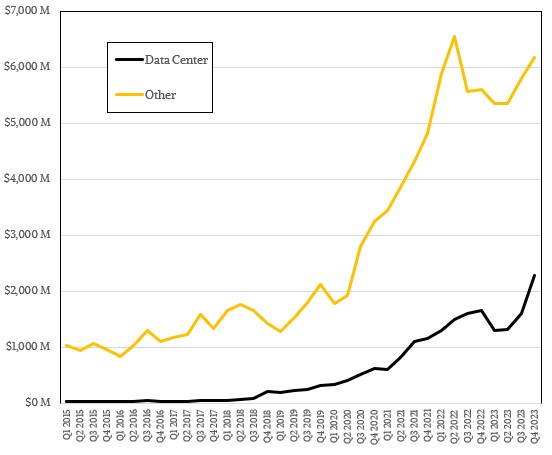

With the datacenter market witnessing a surge in GPU accelerator requirements, AMD’s strategic decision to intensify production of the MI300 series holds the promise of reinvigorating its standing in this pivotal sector.

Analysts believe the Antares MI300 GPU ramp has a significant positive impact on AMD’s datacenter business, here’s why:

Market Share Gains: AMD has traditionally lagged behind Nvidia in datacenter GPUs. The MI300’s performance is believed to be competitive enough to capture significant market share, potentially reaching billions in sales.

Data Center Growth Driver: With the PC market softening, the datacenter segment becomes even more crucial for AMD. The MI300’s success can propel datacenter revenue to a third of AMD’s total income.

Filling the AI Gap: The delayed adoption of AI solutions (“GenAI”) impacted datacenter growth in 2023. The MI300 caters to this demand and could offset the slowdown.

This blog post delves into the multifaceted significance of the Antares MI300 GPU ramp and its potential to reshape AMD’s datacenter business landscape.

Follow us on Linkedin for everything around Semiconductors & AI

The Antares MI300 GPU: A Strategic Asset

AMD’s Antares MI300 GPU series epitomizes a quantum leap in GPU technology, boasting an enticing blend of performance, efficiency, and adaptability.

Featuring variants like the MI300A hybrid CPU-GPU device and the MI300X all-GPU device, AMD endeavors to cater to a diverse array of workload requirements within datacenter environments.

The strategic positioning of the Antares MI300 series underscores AMD’s unwavering commitment to delivering state-of-the-art solutions tailored to the evolving needs of discerning datacenter clientele.

Read More:A New RISC-V Breakthrough Chip Merges CPU, GPU & AI into One – techovedas

Addressing Market Dynamics

In this dynamic landscape, AMD’s Antares MI300 GPU ramp assumes pivotal significance, offering a compelling alternative to incumbent solutions.

Moreover, it addresses the growing demand for advanced GPU technology in datacenters. Additionally, it positions AMD as a formidable player in the burgeoning market for AI, machine learning, and high-performance computing workloads.

Image Credits: The Next Platform

Furthermore, it underscores AMD’s commitment to innovation and technological advancement. Lastly, it sets the stage for a paradigm shift in datacenter GPU offerings.

By harnessing advanced technologies such as HBM3 memory and CoWoS 2.5D packaging. AMD seeks to elevate the performance and scalability of its GPU offerings, aligning with the escalating demand for compute-intensive applications.

Read More: 5 High Growth Stocks From the World of Semiconductors – techovedas

Navigating Through Challenges

While the Antares MI300 GPU ramp holds immense promise, AMD must navigate through a myriad of challenges to realize its ambitious objectives.

Supply chain constraints, formidable competition from industry stalwarts like Nvidia, and shifting customer preferences pose formidable obstacles.

Image Credits: The Next Platform

Furthermore, the prevailing downturn in server spending adds layers of complexity, necessitating a judicious and strategic approach to market penetration and revenue generation.

Nevertheless, AMD remains resolute in its optimism regarding the transformative potential of the Antares MI300 series in driving growth and innovation in the datacenter domain.

Read More: A New RISC-V Breakthrough Chip Merges CPU, GPU & AI into One – techovedas

Financial Implications and Revenue Projections

The success of AMD’s datacenter business hinges on the financial performance of the Antares MI300 GPU series.

With CEO Lisa Su projecting datacenter GPU sales exceeding $3.5 billion in 2024, the stakes are undeniably high for AMD’s revenue growth and market share expansion.

Image Credits: The Next Platform

However, realizing these ambitious targets demands not only technological prowess but also impeccable execution across the entire value chain.

By capitalizing on the GenAI boom, aligning its product roadmap with market dynamics, and demonstrating agility in navigating challenges, AMD endeavors to position itself as a formidable contender in the fiercely competitive datacenter GPU market.

However, some points to consider:

Limited Impact on Other Segments: While the MI300 helps the datacenter business, it might not significantly impact other segments like gaming or consumer PCs. Overall company success relies on all segments performing well .

Competition Still Exists: While strong, the MI300 might not completely dominate the market. Nvidia remains a competitor, and its offerings will influence overall market dynamics.

Read More:Who Owns OpenAI after Sam ? – techovedas

AMD Vs Nvidia GPUs

Here’s a breakdown comparing MI300 to Nvidia GPUs, focusing on the MI300’s presumed competitor, the Nvidia H100:

MI300 Strengths

- Memory: The MI300 boasts a whopping 192GB of HBM memory compared to the H100’s 80GB. This gives the MI300 an edge in memory-intensive tasks like large-scale simulations and rendering complex scenes.

- Bandwidth: The MI300 features superior memory bandwidth at 5.3 TB/s compared to the H100’s 3.3 TB/s. This translates to faster data transfer speeds, potentially improving performance in tasks that rely heavily on data movement.

- Double-Precision Performance: MI300 has a slight lead in raw double-precision (FP64) performance, reaching 61.3 TFLOPs against the H100’s 60 TFLOPs. This can be beneficial for specific high-performance computing workloads.

Nvidia H100 Strengths

- AI and Deep Learning: Nvidia has a strong track record in AI. The H100 excels in AI workloads due to optimized architecture and software tools like Tensor cores. Benchmarks suggest it might outperform the MI300 in specific AI tasks.

- Ray Tracing: Nvidia H100 boasts dedicated RT cores for superior ray-tracing performance. This translates to faster and more realistic rendering in applications that leverage ray tracing, like Blender.

- Software Ecosystem: Nvidia has a well-established developer ecosystem with extensive software libraries and tools specifically designed for their GPUs. This can be advantageous for tasks that rely on mature software support.

In summary:

- MI300 shines in memory-intensive tasks and boasts higher raw FP64 performance.

- Nvidia H100 excels in AI, deep learning, and ray-tracing workloads, with a strong software ecosystem.

The best choice depends on your specific needs. If your priority is raw power for large datasets or simulations, the MI300 might be ideal. If your focus is on AI, deep learning, or ray tracing, the H100 could be a better fit.

Conclusion

In conclusion, the Antares MI300 GPU ramp heralds a watershed moment for AMD’s datacenter business, offering a beacon of hope amidst the turbulence of an ever-evolving industry landscape.