Introduction

In the realm of cutting-edge semiconductor technology, China is making bold strides to establish itself as a formidable player. Recent reports from DigiTimes shed light on Wuhan Xinxin Semiconductor Manufacturing (XMC), a subsidiary of Yangtze Memory Technology Co. (YMTC), delving into the development and manufacturing of High-Bandwidth Memory (HBM).

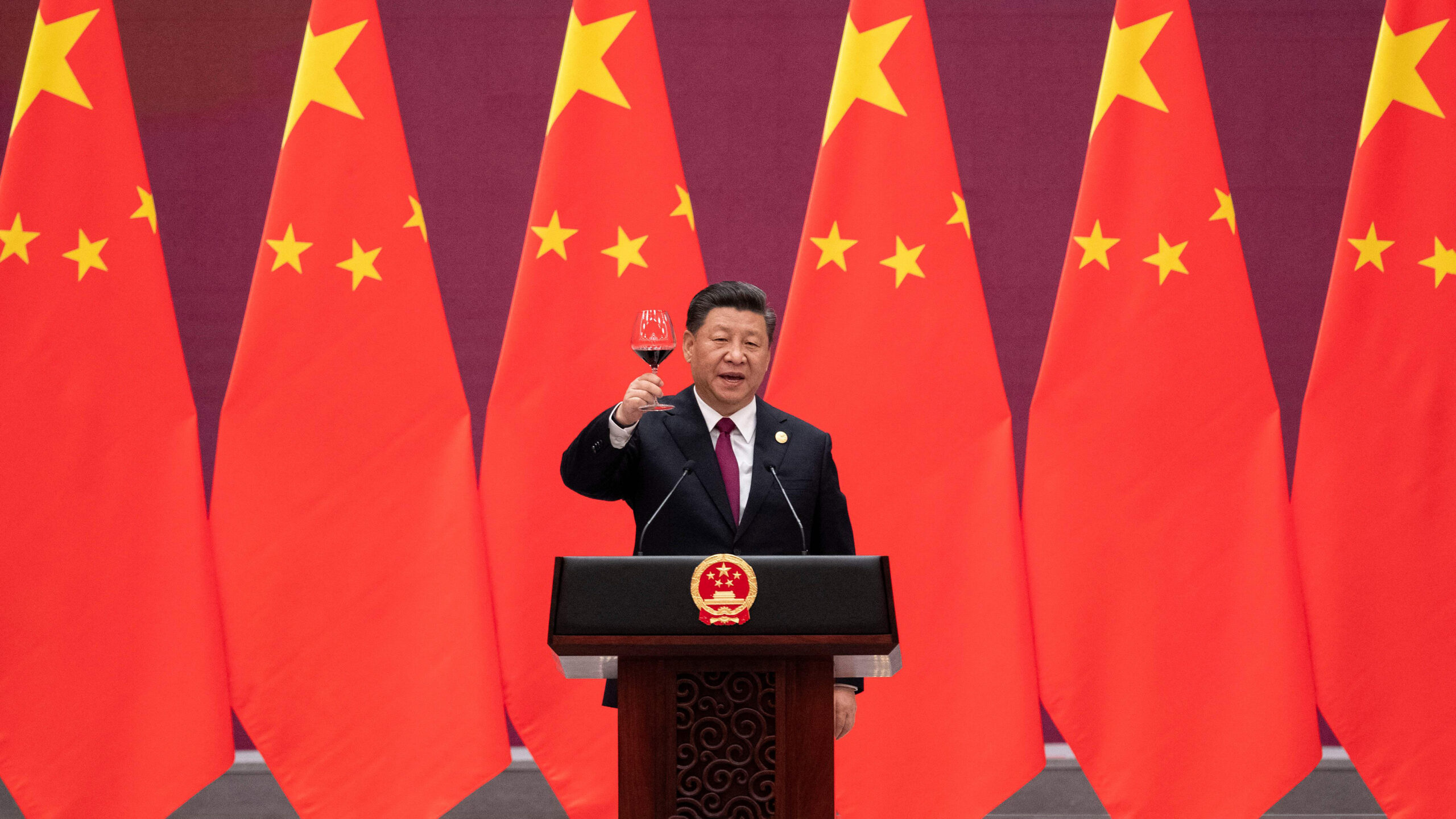

This strategic move signifies China’s concerted effort, backed by government support, to propel its domestic semiconductor industry forward and reduce reliance on foreign technology.

Follow us on Linkedin for everything around Semiconductors & AI

Understanding the Significance of High-Bandwidth Memory (HBM)

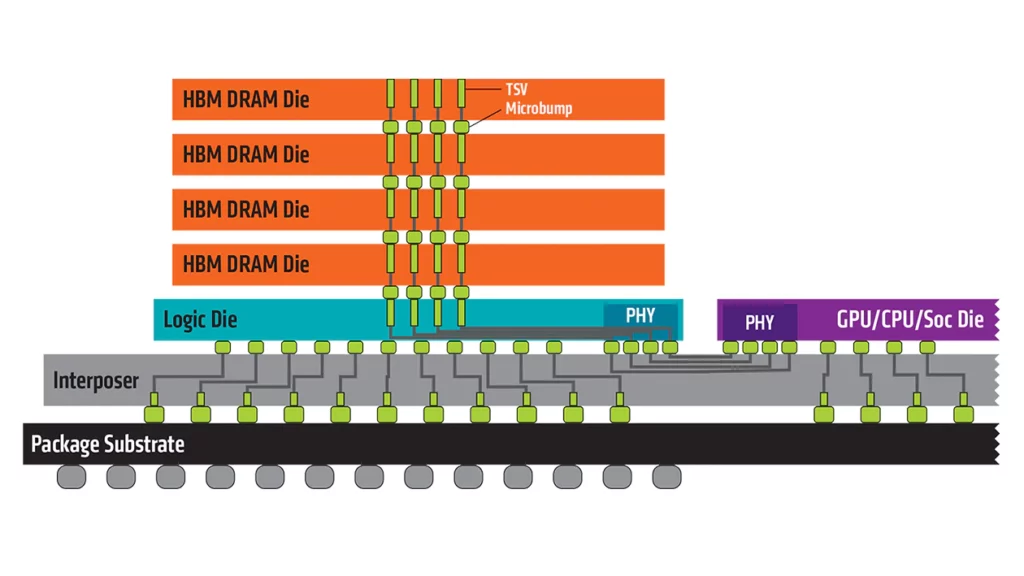

High-Bandwidth Memory (HBM) stands as a crucial component in advancing technologies like Artificial Intelligence (AI) and High-Performance Computing (HPC).

Its ability to deliver exceptional data transfer speeds and efficiency makes it indispensable for processors handling massive datasets and complex computational tasks.

As the demand for AI and HPC continues to surge, the need for high-speed memory solutions like HBM becomes increasingly pronounced.

The major players in the HBM market currently are:

- SK Hynix: They are the frontrunner, holding an estimated market share of around 50%. They are a South Korean multinational semiconductor manufacturer.

- Samsung Electronics: Another South Korean giant, Samsung is a major player in HBM production.

- Micron Technology: This American multinational corporation is another major player in the HBM market.

Read More:Is Coding About to Become Obsolete? The Rise of Devin First AI Developer – techovedas

What is XMC?

XMC, which stands for Wuhan Xinxin Semiconductor Manufacturing Corporation, is a Chinese foundry owned by YMTC (Yangtze Memory Technology Corporation). Here’s a breakdown of what we know about XMC:

Core Business:

- Foundry: XMC manufactures semiconductor devices based on designs provided by other companies. They don’t design their own chips.

- Products:

- Logic chips: These are the workhorses of electronics, handling general processing tasks.

- CMOS image sensors (CIS): These are the image sensors used in digital cameras and smartphones.

- NOR flash memory: This is a type of non-volatile memory used for storing data that persists even after power is turned off.

Role in YMTC’s Strategy:

- 3D NAND Production: XMC plays a vital role in YMTC’s production of 3D NAND flash memory, a key technology for high-density storage devices like solid-state drives (SSDs).

- Expansion into HBM: XMC’s venture into HBM (High-Bandwidth Memory) signifies YMTC’s ambition to become a player in the high-performance memory market.

China’s Foray into HBM: The XMC Initiative

XMC’s decision to venture into HBM production underscores China’s strategic vision to bolster its semiconductor capabilities comprehensively.

As a subsidiary of YMTC, a prominent player in 3D NAND technology, XMC possesses the necessary infrastructure and expertise to embark on this ambitious endeavor.

The involvement of state-owned entities like Tsinghua Unigroup further solidifies the government’s support for this venture.

Focus on 3D Stacking: XMC will leverage its existing 3D IC technology (3DLink™) for HBM development. This expertise is crucial for stacking multiple memory layers vertically to achieve high bandwidth.

Production Capacity: The target of 3,000 wafers per month indicates a pilot line or initial production stage. This is a common approach for new technology before full-scale manufacturing.

Equipment Acquisition: Bidding for equipment suggests XMC is setting up a new production line specifically for HBM. This signifies a significant investment in the technology.

Technical Challenges and Competitive Landscape

While the prospect of entering the HBM market holds immense promise, it also presents formidable technical challenges.

XMC is not a member of the JEDEC standard-setting organization, which means it cannot officially access or use HBM specifications. YMTC, its owner, is a member, so that might provide a workaround.

Moreover, competition within China’s semiconductor landscape intensifies with other players like CXMT expressing interest in HBM technology.

The complexity of HBM production necessitates collaboration across various domains, including material suppliers and packaging houses.

Companies like JECT, Tongfu Microelectronics, JCET, and SJ Semiconductor are already investing in HBM packaging technology. Moreover, signaling a vibrant ecosystem emerging within China.

Read More: What are Top 10 Most Innovative Companies of 2023 As per BCG – techovedas

Implications for China’s Semiconductor Industry

The pursuit of HBM technology symbolizes China’s ambition to achieve self-sufficiency in critical semiconductor components.

By reducing reliance on foreign suppliers and mastering key technologies domestically, China aims to enhance its economic resilience and technological sovereignty.

Furthermore, advancements in HBM production can potentially position Chinese firms competitively in the global semiconductor market, fostering innovation and driving industry growth.

Read More: Chat with Any PDF: Powered By ChatGPT – techovedas

Conclusion

China’s foray into High-Bandwidth Memory (HBM) production marks a significant milestone in its quest to establish a robust semiconductor ecosystem. With state-backed initiatives and concerted efforts by leading industry players like XMC and YMTC, China is poised to carve a niche in the burgeoning market for high-speed memory solutions. As the competition intensifies and technological barriers are overcome, China’s semiconductor industry is primed for accelerated growth and greater prominence on the world stage.