Introduction:

Did you know that Malaysia is recognized as a prominent semiconductor manufacturer on a global scale?

Various reports, including those by Insider Monkey and government sources, consistently rank Malaysia within the top 10 semiconductor manufacturing countries, typically placing it between the UK and the Netherlands at around the seventh or eighth position.

In 2022, Statista reported that approximately 32.64 billion semiconductors were produced in Malaysia. The thriving electrical and electronics (E&E) and semiconductor industry played a significant role in attracting companies like Tesla to establish a presence in the country.

Forbes Asia, in its 200 Best Under a Billion 2023 list, highlighted the surging demand for semiconductors, attributed to the rapid adoption of AI technologies. Notably, out of the nine Malaysian companies listed, three were operating in the semiconductor sector.

This remarkable growth and recognition raise the question of how Malaysia evolved into a well-established hub for semiconductors. Let’s find out.

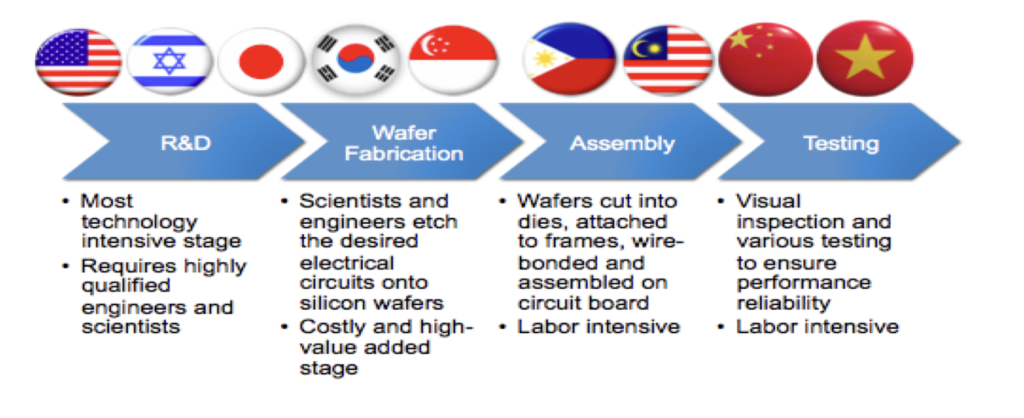

Fig. 1: Global Semiconductor Supply Chain

History of Malaysia Semiconductor Industry

The origins of Malaysia’s semiconductor cluster can be traced back to the 1970s. Following the establishment of the first Free Trade Zone in 1972, Malaysia strategically attracted multinational firms, particularly in the electronics industry, to set up assembly plants, emphasizing export-driven growth and offering various financial incentives. During the 1970s, intense competition among major semiconductor firms, predominantly from the U.S. and Japan, led to the relocation of their assembly plants to countries with lower labor costs. For instance, Intel initiated its first offshore assembly plant in Penang, Malaysia in 1972. Similarly, other prominent foreign firms like AMD, HP, Hitachi, and National Semiconductor began operations between 1971 and 1974.

In the 1980s, this competition among multinational corporations, coupled with increasing costs in other East Asian economies like South Korea, Taiwan, Singapore, and Hong Kong, expedited the relocation of assembly plants to Malaysia. During this period, the government focused on strengthening ties between foreign and domestic firms, unveiling the “First Industrial Master Plan (1986-95).” Additionally, the government reintroduced incentives for inward foreign direct investment (FDI) and established new export processing zones to further stimulate industrial growth.

Follow us on Linkedin for everything around Semiconductors & AI

Intel’s first offshore production Facility

Multinational corporations (MNCs) responded positively to the incentives and the availability of cost-effective labor. This led to a substantial relocation of semiconductor firms to Malaysia.

During this period of significant industry movement, Intel inaugurated its initial 5-acre assembly plant in Penang in 1972, marking a significant milestone as the first offshore production facility.

According to Intel, by 1975, the plant had a workforce of approximately a thousand employees and had become a vital component of the company’s manufacturing network. However, a fire in May of that year necessitated the construction of a new facility, completed the following year.

During the 1970s, other notable companies such as AMD, HP, and Hitachi also established their presence in the country. Dr. Goh’s paper highlighted that by the early 1980s, Malaysia hosted fourteen multinational semiconductor firms (excluding subsidiaries).

Since that time, the local semiconductor industry has witnessed continuous growth, particularly in Penang. In fact, Penang was estimated to contribute to 5% of global semiconductor exports in 2019, underlining its significance in the global semiconductor market.

East Asian competition led to Malaysia Getting Semiconductor opportunities

During the 1980s, escalating competition among major multinational corporations, coupled with the increasing costs in other East Asian economies like South Korea, Taiwan, Singapore, and Hong Kong, expedited the relocation of their assembly plants to Malaysia. Concurrently, the government embarked on strengthening connections between foreign and domestic firms and devised the “First Industrial Master Plan (1986-95).” Additionally, the government reinstated incentives to attract inward foreign direct investment (FDI) and established new export processing zones.

In the 1990s, Malaysia faced challenges in upgrading its industrial cluster for higher value-added activities due to competitive pressure from other East Asian countries benefiting from abundant low-wage labor, including China, Vietnam, and Indonesia. This was a result of market-oriented reforms and political stabilization in former communist regimes. As a consequence, certain labor-intensive production processes shifted away from Malaysia. To address this, the Malaysian government initiated various research and training institutions, formulating the “Action Plan for Industrial Technology Development 1990” and the “Second Industrial Master Plan 1996-2005.”

Moving into the 2000s, persistent competitive threats from other East Asian nations with lower labor costs, such as China, Vietnam, and Indonesia, compelled the government to drive higher-value added activities. This objective was underscored in the “Third Industrial Master Plan (2006-2020)” and the “Economic Transformation Program” enacted in 2010. Some semiconductor firms began transitioning their operations towards research and development, although the majority still primarily engaged in assembly operations.

Also Read: The $400 B Semiconductor Cluster That Made Korea a Powerhouse

Semiconductor facilities in Malaysia

According to The Edge, the Malaysian semiconductor industry comprises three primary groups: entities engaged in outsourced semiconductor assembly and testing (OSAT), manufacturers of automated test equipment (ATE), and companies involved in the design and production of high-performance test sockets.

The category of actual foundries, directly manufacturing semiconductor chips, is less common. Insider Monkey’s analysis in December 2022 identified seven operational and planned fabs (facilities transforming silicon wafers into integrated circuits or ICs) in Malaysia. Notably, Infineon owns two of these manufacturing plants, while Osram Licht operates two plants—one in Kulim and another in Penang.

Additionally, ON Semiconductor runs a plant in Seremban. In Sarawak, X-Fab is operational, and another fab is under development in collaboration with Sarawak Microelectronic Design Semiconductor and the Belgian company Melexis Technologies.

Intel to Build First Overseas 3D Chip Packaging Facility in Malaysia

Intel’s vision for expansion is taking shape in Penang, Malaysia. The US chip giant’s plans involve the establishment of its first overseas facility for advanced 3D chip packaging, a testament to the company’s commitment to innovation.

This facility, fueled by Intel’s cutting-edge Foveros technology, marks a significant step in Intel’s journey toward becoming a leader in advanced packaging.

Foreseeing the potential of this venture, Intel is projecting Malaysia to become its largest production base for advanced 3D chip packaging.

This strategic move positions Intel to leverage the burgeoning semiconductor industry in the southeast Asian nation and establish a stronghold in the advanced packaging market.

To support its expansion plans, Intel is not stopping at one facility. The company is concurrently constructing an additional chip assembly and testing factory in Kulim, as part of its $7 billion expansion initiative in Malaysia.

This multi-faceted approach underscores Intel’s commitment to enhancing its global manufacturing and packaging capabilities.

Intel’s prowess in 3D chip packaging technology was previously concentrated in its US facilities, particularly in Oregon.

Future of Malaysian Semiconductor Industry:

In recent times, the semiconductor industry has grappled with shortages attributed to various factors, including the pandemic, as reported by S&P Global. Deloitte’s 2023 semiconductor industry outlook highlighted the disruptions caused by the Ukraine war on global supply chains. The imbalance in supply and demand has led to a surge in demand for semiconductors, although numerous sources, including Forbes, anticipate a slowdown in the industry this year.

Datuk Seri Wong Siew Hai, the president of the Malaysia Semiconductor Industry Association (MSIA), also foresaw a deceleration in the industry in January 2023. However, Deloitte’s report sees this downturn as an opportunity for the industry to refocus on critical issues. This includes addressing environmental, social, and governance (ESG) goals, tackling challenges in talent management (such as shortages or layoffs), and considering the expansion of existing facilities or the establishment of new fabrication facilities (fabs).

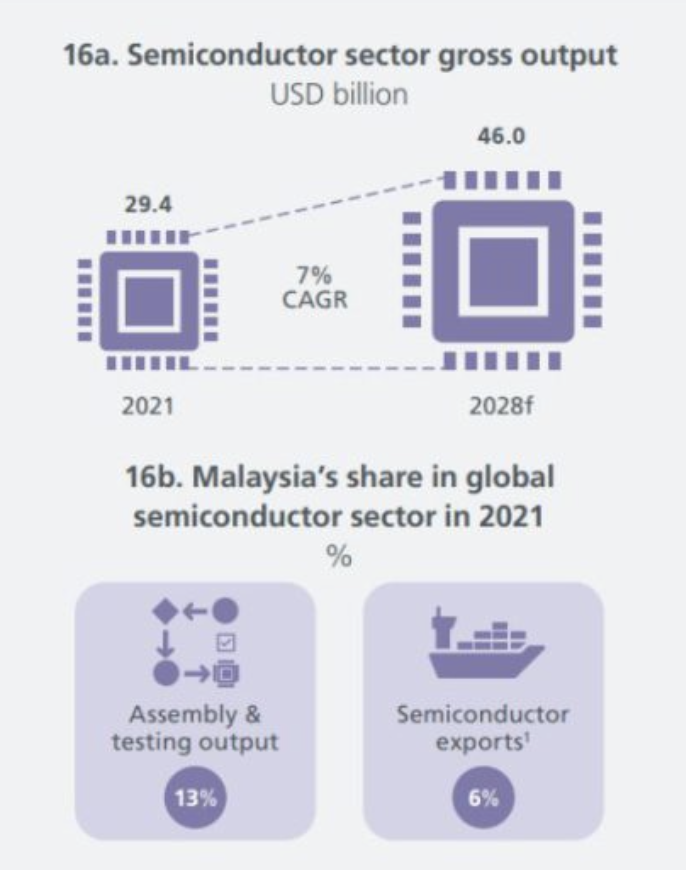

Despite these challenges, a report by Eastspring Investments and PwC Singapore underlines that Malaysia’s semiconductor industry is projected to grow, anticipating a compound annual growth rate (CAGR) of 7%. The goal is to achieve an output of US$46 billion or RM212.52 billion by 2028.

Remarkably, more than 50 years since the establishment of the first Free Trade Zone in 1972, the semiconductor industry remains a vibrant sector in Malaysia, solidifying the nation’s standing as a global powerhouse in Electrical and Electronics (E&E). This status continues to attract significant investors such as Tesla, further cementing Malaysia’s position on the global industrial map.

References:

[1] The Malaysian Semiconductor Cluster by Microeconomics of Competitiveness

[2] https://investpenang.gov.my/how-malaysia-fostered-a-semiconductors-industry-that-brought-in-investors-like-tesla-intel/