Introduction:

In the realm of technology and innovation, few names resonate as profoundly as Intel—a behemoth in the semiconductor industry renowned for its groundbreaking advancements and technological prowess. For decades, Intel stood at the pinnacle of innovation, pioneering microprocessor technologies that powered the digital age. However, as history has shown, even giants like Intel can stumble, and their fall can be as dramatic as their rise.

In this exploration, we delve into the trajectory of Intel, once a symbol of cutting-edge semiconductor technology, and unravel the story of its decline—a decline that many attribute to the short-term thinking of its CEO, armed with an MBA and driven by immediate gains. This narrative endeavors to dissect the pivotal moments, strategic decisions, and leadership approaches that ultimately contributed to Intel’s fall from grace, an unraveling that has left a significant mark on the technology landscape and serves as a cautionary tale for industries driven by innovation and long-term vision.

Read More: What is the Progress of Semiconductor Ecosystem in India in Last 2 years?

The PC Era’s Rise and Dominance of Intel

The personal computer (PC) era began in the early 1970s, with the release of the Altair 8800 kit computer. However, it wasn’t until the early 1980s that PCs began to become popular for home and business use. This was due in large part to the introduction of the IBM PC in 1981, which used Intel’s x86 microprocessor.

Intel’s x86 architecture quickly became the standard for PCs, and Intel remained the dominant player in the PC microprocessor market for decades. This was due to a number of factors, including:

- Performance: Intel’s x86 microprocessors were consistently faster than those from competing companies.

- Compatibility: Intel’s x86 microprocessors were compatible with a wide range of software and hardware, making them a good choice for both businesses and consumers.

- Aggressive marketing: Intel was very aggressive in marketing its x86 microprocessors, and it built strong relationships with PC manufacturers.

As the PC market grew rapidly in the 1980s and 1990s, Intel’s profits soared. The company also expanded into other markets, such as servers and networking equipment.

Read More: Intel Lost Decade: 5 Reasons Why Chip Giant Did Fall Behind

The Rise of Disruptive Innovation at Intel

The emergence of smartphones and tablets in the late 2000s marked the beginning of a new era, the era of disruptive innovation. These devices demanded lower power consumption, which the existing x86 chips struggled to provide.

ARM, a British company, introduced a chip architecture designed from the ground up for low-power mobile use. Despite initially being less powerful than Intel’s high-end chips, ARM’s focus on power efficiency gave them a significant edge in the mobile market.

Read More : Follow us on Linkedin for everything around Semiconductors & AI

The fall of Intel

iPhone Opportunity: It missed a significant opportunity to provide the processor for Apple’s iPhone. Underestimating the potential demand for smartphones, it turned down the chance to supply chips for the revolutionary device.

XScale ARM: Another missed opportunity was Its ownership of XScale, an ARM-based chipmaker. It’s decision to sell XScale in 2006 in favor of doubling down on its x86 architecture limited their prospects in the mobile chip market.

The fall and fall of Intel

In the aftermath of the iPhone announcement and the subsequent emergence of the mobile device era, lntel has found itself at a crossroads.

Despite reporting solid profits, the company’s growth trajectory had begun to plateau, triggering concerns among investors and on Wall Street about its ability to navigate the evolving tech landscape.

The rise of ARM chips, specifically designed for power efficiency and optimal performance in mobile devices, marked a significant turning point that further eroded it’s dominance.

Stagnation Amid Mobile Revolution: While its profitability was evident, its growth was notably stagnant in comparison to its earlier successes.

The company’s core business in producing high-performance x86 processors for PCs continued to generate revenue, but the growth was relatively modest compared to the explosive expansion of the mobile market.

The absence of a substantial presence in the mobile chip sector began to weigh on its overall market position.

ARM’s Ascendancy: ARM Holdings, a British company that focused on designing energy-efficient chip architectures, capitalized on the demand for low-power processors in the burgeoning mobile landscape.

ARM’s chip architecture not only catered to the power constraints of smartphones and tablets but also enabled device manufacturers to create more compact and lightweight designs.

This architectural advantage allowed ARM chips to quickly gain traction, powering flagship devices such as iPhones, iPads, and a multitude of Android-based smartphones and tablets.

Read more: How the iPhone Changed the World: The Story of Project Purple

The CEO’s Role in Fall of Intel:

Steve Jobs approached Intel in 2005 to see if they would be interested in making the chips for the iPhone. However, Intel rejected the offer, believing that the iPhone was a niche product and that the mobile market was not worth pursuing.

This was a major mistake on Intel’s part, as the iPhone went on to become one of the most successful products in history. Intel eventually entered the mobile chip market, but it was too late to catch up to Apple.

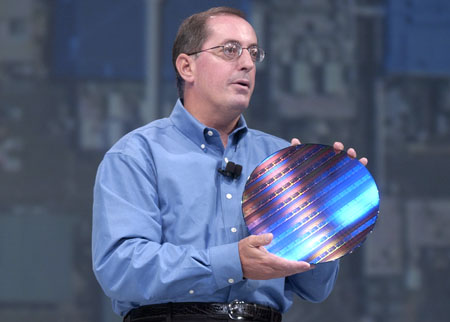

At the time of Apple’s announcement to transition, Paul Otellini was at the helm of the company as the CEO.

Otellini’s leadership was instrumental in cementing It’s position in the PC era. His focus on performance and expanding the reach of Intel’s x86 architecture contributed to the company’s growth during that period.

However, Otellini’s leadership faced challenges in adapting to disruptive innovation. Apple’s iPhone opportunity revealed a lack of foresight regarding the potential of the mobile market. Otellini’s emphasis on the existing profitable PC business may have influenced of it’s reluctance to fully embrace the mobile chip market.

We ended up not winning it or passing on it, depending on how you want to view it. And the world would have been a lot different if we’d done it. The thing you have to remember is that this was before the iPhone was introduced and no one knew what the iPhone would do. At the end of the day, there was a chip that they were interested in that they wanted to pay a certain price for and not a nickel more and that price was below our forecasted cost. I couldn’t see it. It wasn’t one of these things you can make up on volume. And in hindsight, the forecasted cost was wrong and the volume was 100x what anyone thought.

~ Paul S. Otellini

CEO, 2005-2013

Read More: Intel foundry is doomed to Fail: TSMC Director

The Profit-Oriented MBA Perspective & fall of Intel :

Intel’s dilemma highlights a broader issue prevalent in the business world: the focus on short-term profits rather than long-term innovation. The case of its underscores how this mindset can hinder companies from capitalizing on disruptive opportunities.

MBA programs often train graduates to prioritize profitability, efficiency, and established business models. While these skills are crucial for maintaining stability, they can sometimes impede an organization’s ability to pivot and innovate in response to disruptive technologies.

The company’s reluctance to invest in the nascent mobile market can be traced back to a profit-oriented mindset that underestimated the potential of smartphones.

The Missed Opportunity for Innovation:

Apple turned to ARM Holdings, a British semiconductor company, to design the chip for the iPhone. ARM designs chips that are used in a wide range of mobile devices, including smartphones, tablets, and wearables.

Apple’s A-series chips, which are designed by Apple and manufactured by TSMC, are now the most powerful mobile chips on the market. Intel’s mobile chips, on the other hand, have struggled to keep up with the competition.

It is failure to embrace disruptive innovation resulted in missed opportunities and a decline in its industry dominance.

While the PC business continued to generate substantial profits, the mobile market’s explosive growth surpassed expectations. ARM-based chips, with their focus on power efficiency, gradually took over the smartphone and tablet market.

The lessons from Its experience extend beyond the company itself. It serves as a cautionary tale about the importance of balancing short-term profitability with long-term innovation.

Businesses must be willing to invest resources in exploring new markets and technologies, even if the initial profit margins are smaller.

The Irony of Intel’s Fate:

Intel’s situation is ironic given its role in driving an earlier generation of computing innovators, like Digital Equipment Corporation (DEC), out of business.

DEC dismissed early PCs as toys and underestimated their potential, much like did with the mobile market.

The demise of DEC and its peers in the face of the PC revolution mirrors Its struggle in the mobile era.

Conclusion:

It is decline from a PC era powerhouse to struggling to compete in the mobile market underscores the significance of disruptive innovation and the role of leadership in navigating it.

The CEO’s influence, coupled with a profit-driven mindset, can determine a company’s fate in a rapidly evolving tech landscape.

As businesses face continuous disruption, the Intel case emphasizes the importance of adaptability, innovation, and a strategic approach that prioritizes long-term growth over short-term gains.