Introduction

Taiwan Semiconductor Manufacturing Company (TSMC) has been a major player in the semiconductor industry for several decades. In recent years, TSMC has made significant moves that have not only transformed its own operations but also had a ripple effect across the semiconductor supply chain including its foundry Rival Intel.

In this blog post, we’ll delve into some key observations about TSMC’s journey, including the rise in capital intensities, its spending compared to Intel, its global expansion, and the impact of AI on its wafer demand.

1. TSMC Vs Intel Rising Capital Intensities and the Impact on the Semicap Industry

One of the most noticeable trends in TSMC’s recent history is the rising capital intensities, particularly post-2018.

Capital intensity refers to the amount of capital investment required for a company to generate a unit of revenue.

In TSMC’s case, this capital-intensive nature has had a profound impact on the semiconductor capital equipment industry.

Companies like ASML, which produce cutting-edge lithography machines, have benefited from TSMC’s insatiable demand for advanced manufacturing equipment.

Image Credits: Techfund on X

The reason for this surge in capital intensities is multifaceted. TSMC has been at the forefront of developing advanced process technologies, like 7nm and 5nm, which require increasingly complex and expensive equipment.

As a result, the company has been investing heavily in the latest technologies to maintain its competitive edge.

Read More: 5 Major Updates on TSMC Global Expansion Plan

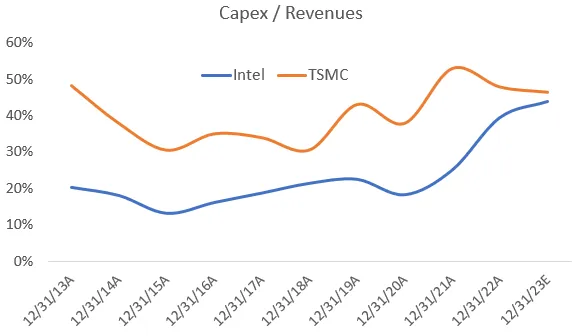

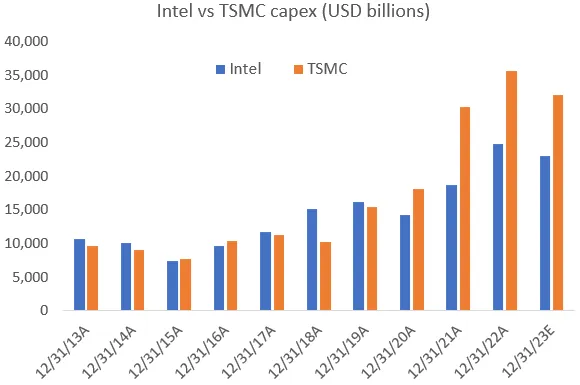

2. TSMC Outspending Intel on Capex

Another noteworthy observation is TSMC’s significant increase in capital expenditures (capex) compared to Intel (INTC) over the last three years.

Historically, Intel had been a leader in semiconductor manufacturing, but TSMC’s aggressive investments in advanced technologies have allowed it to surpass Intel in terms of capital spending.

Image Credits: Techfund on X

This shift in capital allocation highlights TSMC’s commitment to maintaining its leadership in the semiconductor industry and underscores the fierce competition in the market.

Read More: Intel Signs 2 More Customers for 18A, Boosting Foundry Ambitions

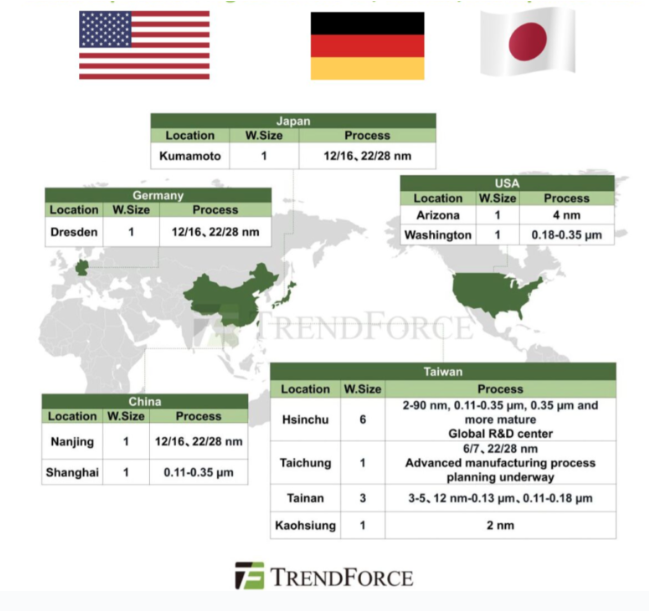

3. Global Expansion and Overseas Fabs

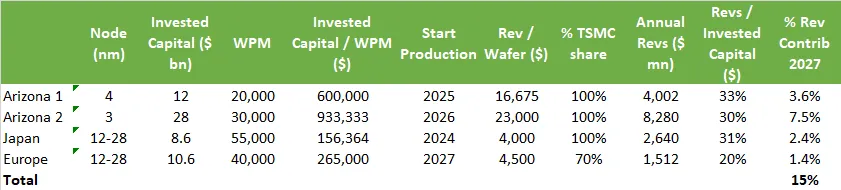

TSMC’s global expansion has been a strategic move to mitigate geopolitical risks and enhance its presence in key markets.

The company’s decision to establish new overseas fabs, particularly in the United States, has garnered attention. These fabs are expected to contribute significantly to TSMC’s revenues in the coming years, with estimates suggesting around a 15% contribution in four years’ time.

Image Credits: TrendForce

This move not only secures TSMC’s position as a critical player in the global semiconductor supply chain but also aligns with efforts to diversify semiconductor manufacturing locations.

Image Credits: Techfund on X

Read More: TSMC N3P To Outperform Intel 18A, Derailing Intel’s Foundry Leadership Plan by 2025:

4. AI and Larger Dies’ Impact on Wafer Demand

The semiconductor industry is on the cusp of a new era with the integration of AI components into various applications.

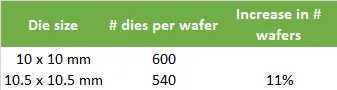

Larger dies, which can accommodate more complex AI functionalities, will have a leveraged effect on the number of wafers that TSMC sells.

Image Credits: Techfund on X

For instance, a 5% increase in the die length can result in an 11% increase in the number of wafers needed, indicating a growing demand for advanced semiconductor manufacturing capabilities.

As AI becomes increasingly integral to various sectors, from autonomous vehicles to data centers, TSMC’s prowess in manufacturing advanced semiconductor nodes will be critical in meeting the demand for these larger, more powerful chips.

Read more: 5 reasons Why American Chip Dream is dying

Conclusion

TSMC’s remarkable rise in the semiconductor industry is driven by a combination of factors, including its rising capital intensities, increased capital expenditures compared to Intel, global expansion efforts, and the evolving landscape of AI components driving wafer demand.

These observations underscore TSMC’s commitment to staying at the forefront of semiconductor technology and its pivotal role in shaping the industry’s future.

As TSMC continues to invest in advanced manufacturing capabilities, its influence on the global technology landscape is set to grow, solidifying its position as a semiconductor manufacturing powerhouse.

Reference: Techfund on X