Introduction:

The future is now, and it’s driven by artificial intelligence (AI). With the AI industry projected to skyrocket at a staggering Compound Annual Growth Rate (CAGR) of approximately 72%, soaring from $83 billion in 2024 to a monumental $420 billion by 2027, investors and tech enthusiasts alike are eagerly eyeing the top players set to capitalize on this explosive growth.

Let’s delve into the intricate landscape of the AI industry and unveil the titans leading the charge in various crucial sectors.

Follow us on Linkedin for everything around Semiconductors & AI

1. Hardware Companies (3):

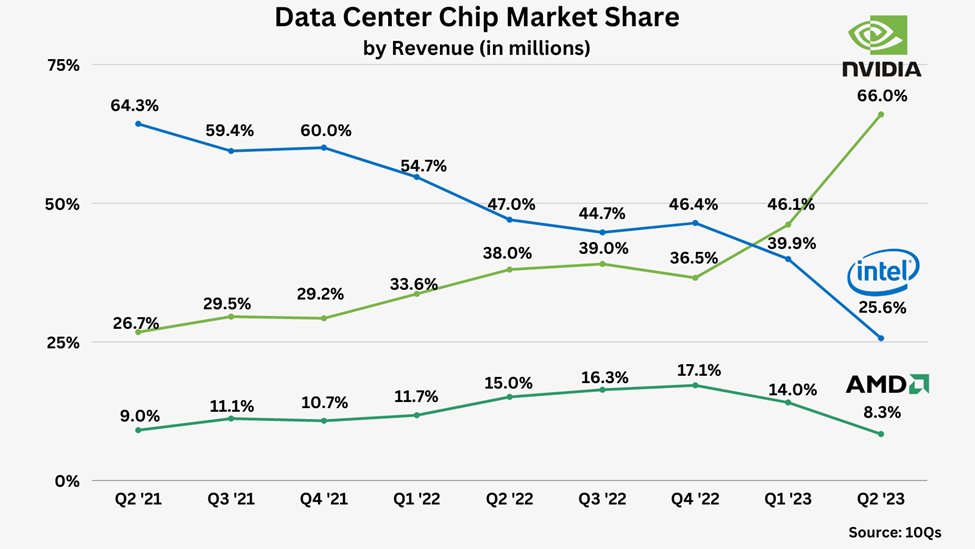

At the forefront of AI hardware, NVIDIA ($NVDA) reigns supreme with its cutting-edge AI chips, poised to revolutionize industries ranging from autonomous vehicles to healthcare.

However, the competition is fierce, with Advanced Micro Devices ($AMD) and Intel ($INTC) challenging NVIDIA’s dominance, vying for a piece of the lucrative AI hardware market.

Read More: China Bans Intel and AMD From Government Computers

2. Chip Innovation (4):

Fueling the AI revolution are companies like ASML ($ASML) and Applied Materials ($AMAT), specializing in chip making technology. ASML makes Lithography tools while AMAT does process tools such as Deposition and Implantation- key steps to make chips.

Supported by Taiwan Semiconductor Manufacturing Company ($TSM) and Lam Research Corporation ($LRCX), these innovators are paving the way for the next generation of AI-driven devices and systems.

TSMC is a foundry that makes these chips while Lam is a key player in Etching tools.

Read More: 8 Major Steps of Semiconductor Fabrication

3. AI Infrastructure (3):

Key to the seamless operation of AI systems is robust infrastructure, and companies like KLA Corporation ($KLAC), Broadcom Inc. ($AVGO), and Marvell Technology Group ($MRVL) are at the forefront of providing the necessary backbone for AI implementation.

KLA makes meterology tools, while broadcom designs AI chips. Their contributions ensure that AI algorithms can run efficiently and effectively, powering the innovations of tomorrow.

Read More: China Bans Intel and AMD From Government Computers

4. Design Efficiency (2):

In the quest for optimal AI performance, design efficiency is crucial. ARM Holdings ($ARM) and Analog Devices Inc. ($ADI) are at the forefront of this endeavor.

They prioritize creating efficient and scalable AI architectures. Their efforts are instrumental in pushing the boundaries of what’s achievable in artificial intelligence.

Read More: UK’s First 300mm Wafer Fab: Giant Chip Factory for Ultra-Thin Flex ICs – techovedas

5. Memory (3):

No AI system is complete without reliable memory solutions, and Micron Technology ($MU) stands out as a key player in this critical sector. Samsung and SK Hynix are the other leaders in this area.

Their innovative memory technologies provide the necessary storage and processing capabilities to handle the immense data requirements of AI applications.

Read More: HBM3e: AI’s Memory Marvel or Hype? Truth Behind SK hynix’s Game-Changer

Conclusion

The AI revolution is upon us, with key players leading the charge. These players span various sectors, each contributing uniquely to the advancement of AI technology.

From hardware innovation to infrastructure development and design efficiency, their roles are pivotal. Investors seeking growth opportunities should closely monitor these AI titans.

They are continuously pushing boundaries and reshaping the landscape of artificial intelligence.

As they innovate, they redefine what’s achievable in AI, presenting lucrative investment prospects. Keeping a keen eye on these leaders is essential for capitalizing on the unfolding AI revolution.