Introduction

Taiwan Semiconductor Manufacturing Company (TSMC) recently held its earnings call for the first quarter of 2024, revealing critical insights into its expansion plans and the associated costs, particularly in the United States. Amidst a global semiconductor shortage and increasing demand for advanced chips, TSMC’s strategic moves have significant implications for the industry and its customers, including tech giants like Apple, Intel, Nvidia, and AMD.

TSMC (Taiwan Semiconductor Manufacturing Company) plans to charge more for chips produced outside of Taiwan, including their new factories in the United States. There are a couple reasons for this:

- Higher Costs: Setting up and running factories outside of Taiwan is more expensive. This can be due to factors like labor costs, materials, and even things like power prices.

- Sharing the Burden: TSMC wants to maintain its profit margins, so they are passing on these extra expenses to their customers.

The exact price increase is still being negotiated, but estimates suggest it could be between 20% and 30% more for the most advanced chips produced in the US compared to those from Taiwan. This could potentially lead to higher prices for consumers of electronics that rely on these chips.

Follow us on Linkedin for everything around Semiconductors & AI

The Shift Towards Global Expansion

TSMC is actually expected to receive a total of $11.6 billion in funding from the CHIPS and Science Act according to news reports . This breaks down into two parts:

Grants: Up to $6.6 billion in grants to help offset the costs of building and operating their new chip factories in the United States.

Direct Funding: An additional $5 billion in direct funding, though the exact details of how this will be used are likely still under negotiation.

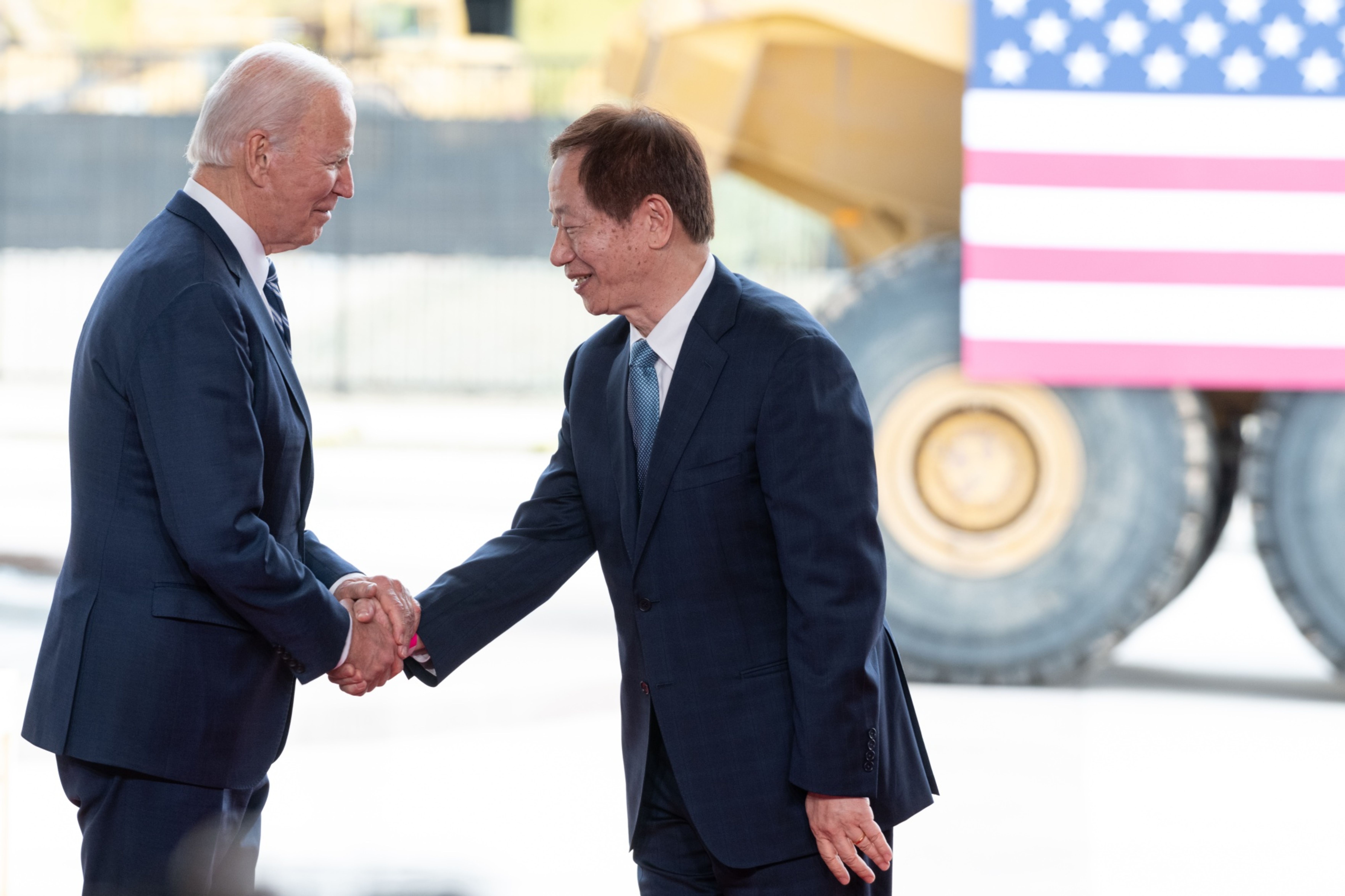

During the earnings call, CEO C.C. Wei emphasized the necessity of a global presence for TSMC to meet the increasing demands of its US clientele, particularly as they delve deeper into AI technologies. Notable clients such as Intel, Nvidia, AMD, and Apple underscore the significance of this expansion.

However, Wei acknowledged the significant costs associated with establishing overseas fabrication facilities, citing challenges such as rising electricity expenses and inflation. When pressed about potential price adjustments for US-made chips, Wei refrained from disclosing specifics, citing confidentiality, but expressed an expectation for customers to bear additional costs.

Read More: 7 Startup Ideas in Semiconductor Industry – techovedas

TSMC Cost Implications and Customers Collaboration

Reasons for Higher Costs:

Startup Costs: Building chip fabrication plants (fabs) from scratch is expensive. Setting up a new supply chain, training workers, and ensuring quality control all add up in a new location compared to their established Taiwanese facilities.

Material and Labor: Manufacturing costs can vary depending on location. Labor costs might be higher in the US compared to Taiwan, and factors like import/export logistics can affect material prices.

Efficiency: TSMC’s current facilities in Taiwan have years of refinement and optimization. New fabs in the US may not be quite as efficient yet, leading to higher production costs per chip.

The Big Deal:

Geopolitical Concerns: There’s a global push to diversify chip production away from Taiwan due to political tensions. The US and other countries want to reduce their reliance on a single source for such critical components. TSMC’s US expansion helps with this goal, but it comes at a price increase.

Potential Price Increase for Consumers: Since these chips are used in various electronics (phones, computers, etc.), the additional cost for US-made chips could trickle down to consumers in the form of higher product prices.

Impact on Tech Industry: This price hike could affect how companies design and manufacture electronics. They might have to find ways to absorb the cost or pass it on to consumers. It could also influence future decisions about chip production locations.

Overall, it’s a complex situation. While increasing chip production outside Taiwan is strategically important, it comes with economic challenges.

Read More: SK Hynix and TSMC Forge Ahead with 6th Gen HBM (HBM4) by 2026 – techovedas

Balancing Cost and Value Proposition for TSMC Customers

As TSMC navigates the complexities of global expansion and cost escalations, the company aims to strike a delicate balance between cost-effectiveness and value proposition.

The concept of sharing the incremental cost with customers underscores the symbiotic relationship between semiconductor manufacturers and their clients.

However, the extent to which customers are willing to absorb these additional expenses remains uncertain.

Read More: 4 Reasons Why Blackhole by Tenstorrent is a RISC-V Marvel for AI Applications – techovedas

The Future of Semiconductor Manufacturing in the US

Despite the challenges posed by escalating costs, TSMC remains committed to its US expansion plans.

The company has started producing 4nm chips at its Arizona facility. Volume production is set to begin in 2025. Wei plans to start 3nm production in Arizona by 2028. TSMC aims to establish 2nm production by 2030. This signals the company’s long-term commitment to US-based manufacturing capabilities.

Read More: Apple to Employ 5 lakh in Next 3 Years: Set to Scale up Production in India – techovedas

Conclusion

TSMC’s earnings call for Q1 2024 sheds light on the intricacies of semiconductor manufacturing in an era marked by technological innovation and supply chain resilience.

The company’s expansion into the United States reflects a strategic response to evolving market dynamics and customer demands, albeit with associated cost implications.

As TSMC navigates this transformative journey, collaboration with customers and the pursuit of technological excellence will remain paramount in shaping the future of the semiconductor industry.